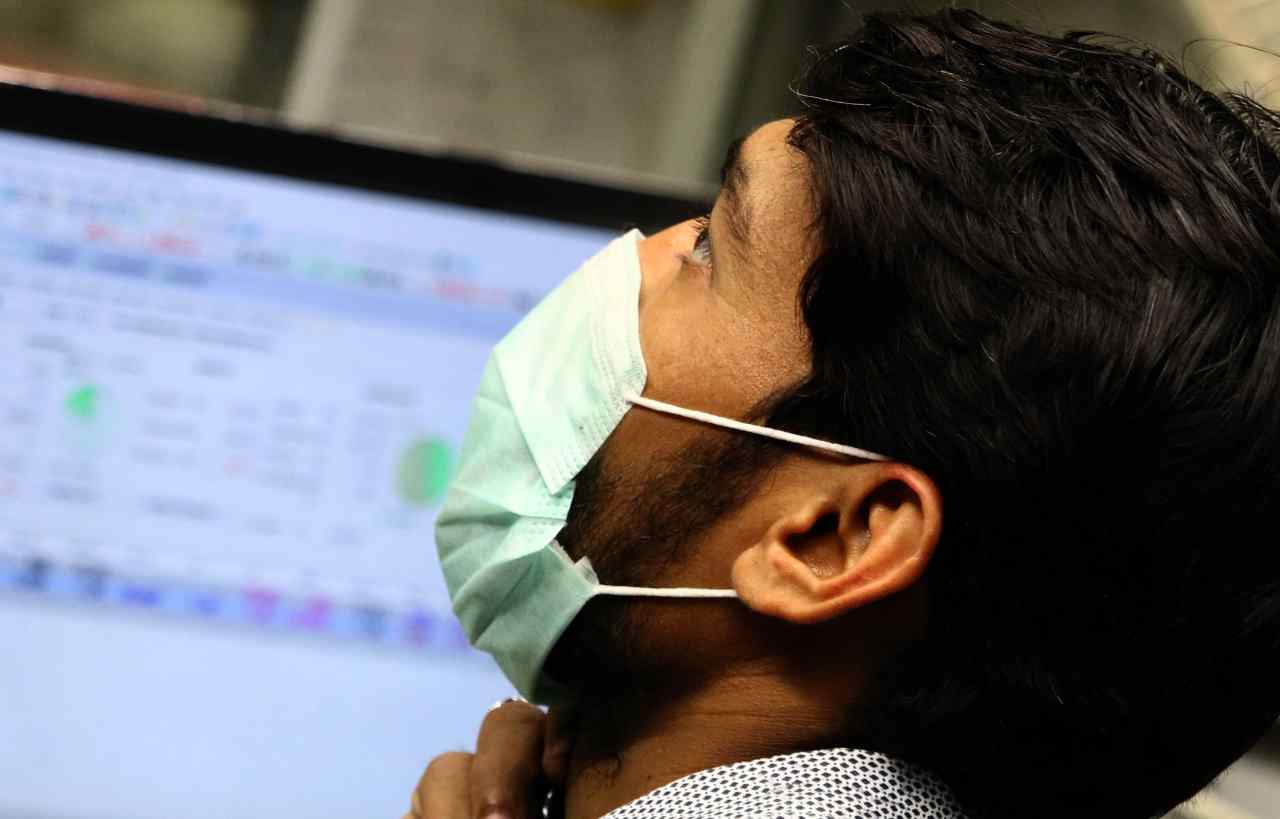

Sudden collapses are feared for stock exchanges around the world and the reasons are many.

Analysts are increasingly anxious looking at stock exchanges around the world why threats that can bring down the American stock market and also all the other lists become really important.

The biggest threat is surely the Federal Reserve’s rate hike.

Everything changes for the bags

Central banks have been accommodating to markets for many years.

When the covid pandemic broke out, they brought rates to zero and launched ultra-expansionary policies. But all of this has favored high inflation and now they are forced to switch to much more restrictive policies. Rising rates and restrictive policies are likely to blow up the dreaded bubble on the markets. In fact, many believe that the stock exchanges around the world but especially the American stock market are heavily inflated due to too many years of very low rates. If that is the case, the rate hike could lead to a real collapse on markets around the world. But in addition to rate hikes, there are other threats that make the stock market look with great concern.

Risk of collapses on the markets

A global recession appears increasingly probable e this clearly can only make its effects felt on the markets. But the crises on the horizon are really too many. The gravity of the global food crisis is underlined with increasing force. In too many countries it is now becoming difficult to obtain food and over 53 nations of the world they are at risk of hunger. Furthermore, the war in Ukraine represents an element of strong destabilization on international markets. In fact, the war in Ukraine pushes speculators to keep the costs of raw materials very high.

Global emergencies

In particular it is Europe to risk running out of gas and to enter a recession even before the United States. In short, the threats to the global economy are really too many and unfortunately the medicine that central banks will have to administer it is precisely what the markets like least. Since the war began but especially since when central banks they started their rate hike, the stock market lost markedly but this could unfortunately be just the beginning.

–