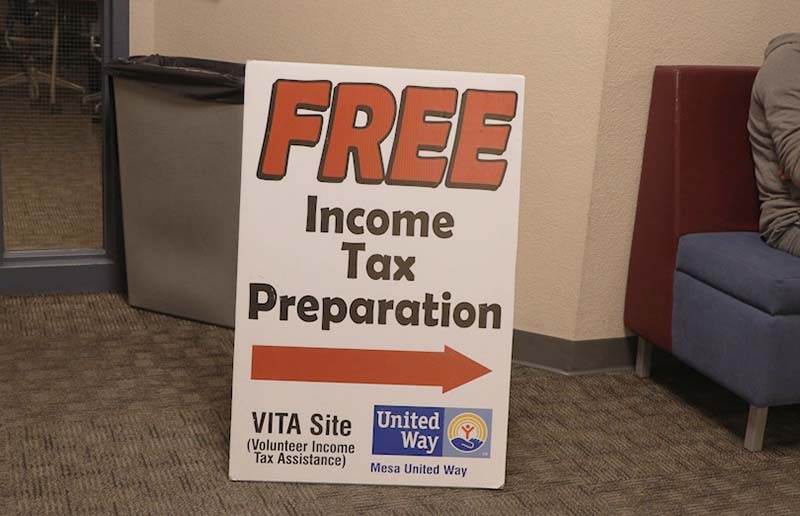

Volunteers from the Income Tax Association help people prepare and file their taxes for free on the main campus of Mesa Community College. (Photo by Mitchell Zimmerman/Cronkite News)

–

By Sarah Edwards | Cronkite News Special

March 3, 2022

MESA – Tax season is going to look a little different this year, from normal deadlines to IRS staffing shortages that could delay refunds. But help is available for the tax-phobic, and it’s free for those who qualify.

Unlike the previous two fiscal years, when the filing deadline was pushed back due to COVID-19, the deadline for federal and state tax returns is mid-April.

The tax filing deadline is normally April 15, a Friday. But because the District of Columbia will observe Emancipation Day on that day, 2021 taxes are due on April 18, said Rory Wilson, senior tax policy adviser at the Arizona Department of Revenue.

“The (2020) due date was pushed back to July 15, and then the following year the due date was pushed back to May 17, so we finally went back to what we call ‘normal due day,'” said.

The IRS expects to receive about 3.4 million individual income tax returns in Arizona, and estimates that 300,000 Arizonans will apply for a six-month extension.

“The IRS strongly encourages taxpayers to prepare accordingly this tax filing season,” said IRS spokeswoman Yvi Serbones Hernández. “They should also file their return electronically and choose direct deposit for a faster refund and visit Where’s My Refund on IRS.gov to check the status of their refund after they apply.”

As of Feb. 18, Hernandez said, the IRS has issued more than 22 million refunds worth more than $78 million, with an average refund of $3,536. He also said that 9 out of 10 taxpayers can expect to receive their refund within 21 days if they file electronically and have direct deposit.

Wilson said there are many factors that make this filing season different, from a backlog of cases to staffing shortages, that could lead to delays in the dispersal of tax returns.

The Government Executive business group said the staffing shortage is so great that in the “first half of 2021, the IRS had one employee for every 16,000 calls that came in.”

“Arizona doesn’t have the same backlog, but to that extent, you can e-file because it’s definitely a lot quicker to get your refund that way,” Wilson said. “What we found from looking at the data is that if you’re expecting a tax refund, if you e-file, you’ll get your refund six times faster.”

Child tax credit, stimulus checks add wrinkles

The American Rescue Plan added some temporary changes to the child tax credit, such as increasing the amount of money taxpayers can receive and making the credit available to qualified children who turn 17 in 2021. The plan also makes the credit fully refundable for most taxpayers and allows multiple taxpayers to receive half of the estimated credit for 2021 in advance, according to the IRS.

Before 2021, the tax credit was worth up to $2,000 per child with a refundable limit of $1,400. The IRS said the new law increases the credit up to $3,000 per child ages 6 to 17 and $3,600 per child age 5 and younger.

Taxpayers who received an advance child tax credit should have received a letter from the IRS in January with “the total amount of 2021 Child Tax Credit advance payments issued and the number of qualifying children used to calculate your advance payment,” according to the Tax Season Guide. The same goes for stimulus checks.

People eligible for stimulus checks who already received the third party should not include information about it when they file 2021 taxes, but others may be eligible for the 2021 Refund Recovery Credit, which could reduce taxes due for 2021.

Taxpayers can find the full amount of their third stimulus check through their online IRS account or wait until they receive an official letter.

Changes involve small businesses, military pensions

State level taxes have some changes for some taxpayers. One of the biggest changes, Wilson said, concerns the small business income tax.

According to the state Department of Revenue, this “allows individual taxpayers to elect to have their ‘Arizona small business adjusted gross income’ removed from their regular individual income tax return and assessed on an ‘Arizona small business tax return’. Arizona Small Business Income’ separately.

Wilson said this is also the first year that all military pensions for Arizona veterans are fully tax-exempt.

“Historically, military taxpayers received a $2,500 subtraction,” Wilson said. “In more recent years, it’s increased to $3,500, and for the first time, this starts with tax year 2021 to file in 2022 with a 100% exclusion, so that’s a huge benefit.”

Other changes are related to AZ529 Education Plans and the American Rescue PlanWilson said.

AZ529 plans are “state-sponsored savings plans designed to provide parents, grandparents, or prospective students the opportunity to save for tax-deferred educational expenses,” according to the Arizona Department of Benefits Administration. In previous years, these plans would allow taxpayers to contribute $2,000 for single filers and $4,000 for married filing jointly. Now, Wilson said, those limits apply per beneficiary.

Under the American Rescue Plan, passed by Congress last year, the federal government excluded unemployment income of up to $10,200 for those earning less than $150,000. Wilson said Arizona’s 2020 returns can still be modified if taxpayers were unemployed in 2020, to account for the exclusion of up to $10,200 for that year as well.

“Thousands of taxpayers may not be aware that they should have amended their 2020 Arizona return, so they should bring it up when they meet with their tax preparer to file their 2021 taxes due in 2022,” Wilson said.

“If you don’t have all of your information yet, file an extension. Arizona honors the federal extension, and the federal extension is deferred this year until October 17.”

Wilson also recommended checking with a voluntary tax aid group, such as the Voluntary Income Tax Association (VITA by its acronym in English) or AARPto assist in the submission process for those who qualify.

How to get free tax help

VITA is a free IRS service for taxpayers who earn $58,000 a year or less, have a disability, or have limited English language skills. Taxpayers can go to their local VITA location with all tax forms, where a volunteer will file their taxes and process their return.

Alan Floth, the VITA site coordinator at Mesa Community College’s main campus, has been helping people file their taxes for 12 years. He said most professional preparation services will do federal taxes for free, but will charge for filing state taxes. But through VITA, everything is free.

“A lot of people who come to us are math phobic, tax phobic, but (taxes) really aren’t that hard,” he said. Floth said people think filing taxes is difficult because of different filing statuses and life situations, such as whether a filer is head of household or a qualifying widower.

Taxpayers who want to file through VITA complete a form that lists all statuses, life events, income, and expenses for the prior year and, along with tax information on forms such as W-2s, 1099s, or 1098s, a volunteer will go online with them to verify all information. If all information is correct, the volunteer will take the taxes to a volunteer accountant, who will electronically file state and federal taxes and await IRS processing.

“You give us the documents and we do the taxes from there,” Floth said.

Taxpayers going through VITA must bring all relevant paperwork and tax documents, a Social Security card or personal taxpayer identification number, and a photo ID.

Luis Martinez has been filing his taxes through VITA since he started doing his own taxes three years ago. He said it’s better than trying to file on his own because the volunteers make the process so much easier for him.

“I really like how the volunteers help you through the process,” he said. “They are very good at helping you and telling you where to put what on the forms.”

This report was originally written and edited in English by Cronkite News.

–