Jakarta, CNBC Indonesia – The strong pace of the Turkish lira against the United States (US) dollar throughout last week ended this week. In the last two days, the lira has fallen by almost 10%. The “incantations” issued by the Turkish President, Recep Tayyip Erdogan, on Monday (20/12) last week began to fade, sending the lira down again.

According to data from Refintiv, Tuesday’s lira fell 1.05% to TRY 11.79/US$, after falling 8.8% the day before.

|

– – |

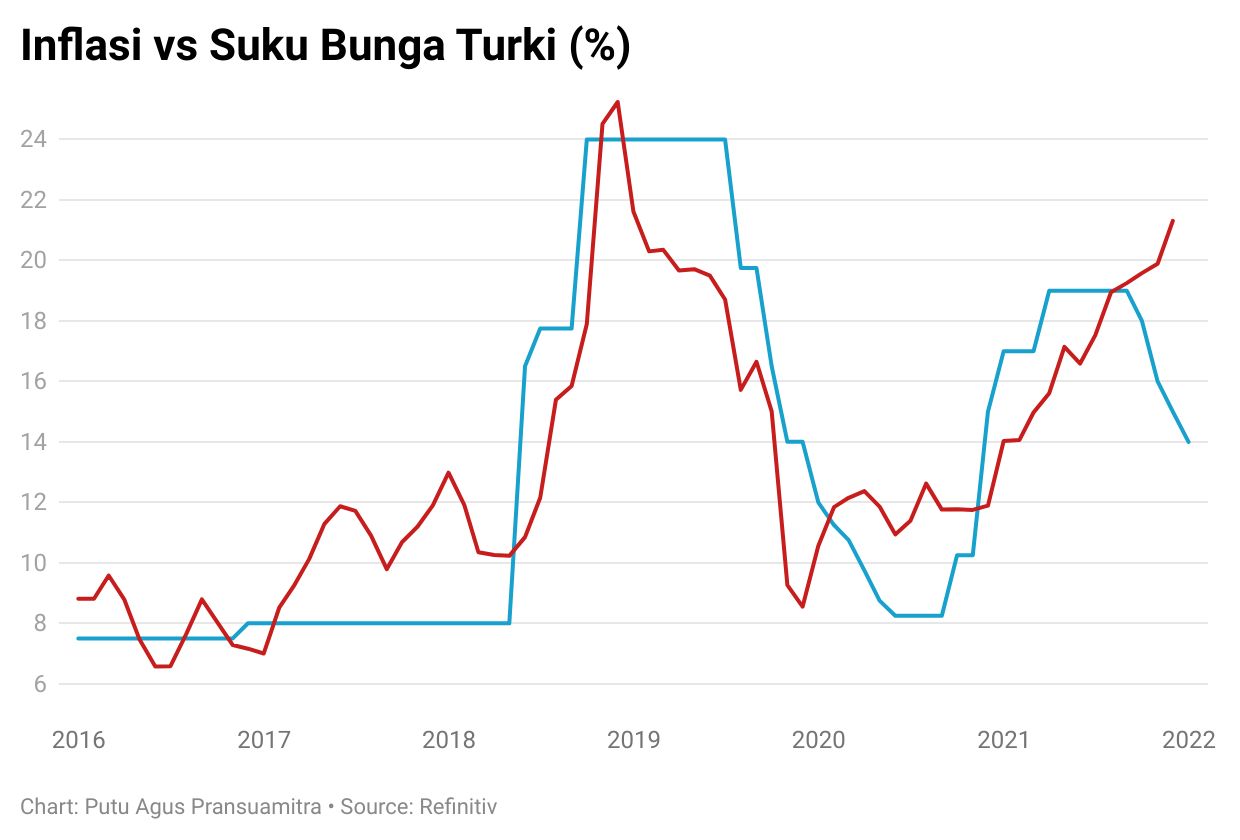

The movement of the lira the last few months is like roller coaster. So far this year until Monday last week the lira fell more than 55%. The reason is the Turkish central bank (TCMB) which cut interest rates for the fourth month in a row by a total of 500 basis points to 14%. In fact, inflation is at a high level, currently at more than 21%.

As a result, interest rates were lower than inflation, the Turkish lira experienced a massive sell-off.

Not without reason TCMB aggressively cut interest rates. The policy stems from President Recep Tayyip Erdogan’s view that high interest rates are “the culprit of the devil”. Erdoan believes that high interest rates will worsen inflation.

TCMB also “as long as you are happy” and cut interest rates aggressively. Because, if the TCMB’s policy differs from Erdogan’s view, the governor will be fired.

In other words, Erdogan is the cause of the drop in the lira. But it was also Erdogan who saw the lira soar up to 54% over the past week.

Foto: Refinitiv Foto: Refinitivtry- – |

Erdoan issued a policy that the Turkish government would provide incentives for its citizens to convert their foreign exchange savings into lira deposits.

“If a Turkish citizen has deposits or deposits in foreign exchange such as US dollars, euros or pounds until December 20, and converts them into lira deposits/participation funds, they will be eligible for incentives,” the central bank of Turkey (TCMB) said. ).

“The deposits in question have maturities of three, six, and twelve months,” added TCMB.

The incentive given is that TCMB will cover if there is a foreign exchange difference when opening a deposit until maturity. In other words, Turkish citizens will not experience foreign exchange losses if the lira slumps again.

In addition, the deposit is also not subject to tax.

Erdoan claimed that after the so-called anti-dollarization announcement, Turkish citizens’ confidence level in the lira increased, and deposits in the local currency rose by 23.8 billion lira.

But in fact, data from the banking supervisory agency BDDK shows no change in the value of foreign currency deposits in Turkey. The week before the announcement of Erdogan’s latest policy, the value of deposits in foreign currency was US$ 163.7 billion, while on Friday last week it was US$ 163.8 billion, in fact there was a slight increase.

Indeed, Erdogan’s latest policy is one of the triggers for the strengthening of the lira. Just as Erdogan announced the policy on Snein (20/12) bankers told Reuters they were converting US$1.5 billion worth of foreign exchange.

However, data from BDDK which shows no change in the value of deposits in foreign currency is an indication that Turkish citizens are taking advantage of the strengthening of the lira which is up to 50% more to collect foreign currency again.

CNBC INDONESIA RESEARCH TEAM

(pap / pap)

– .