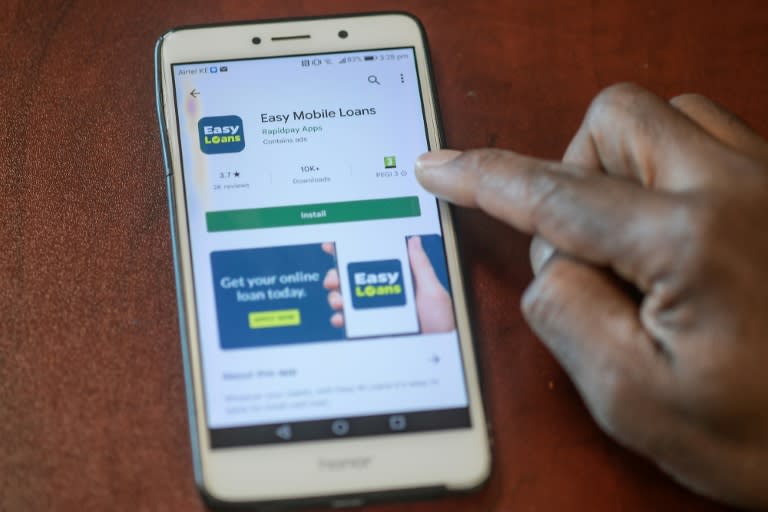

A few clicks, no collateral required: it only took a few seconds for Ambrose Kilonzo, a Kenyan security officer, to get a loan on a mobile application. But when he couldn’t repay, his donors contacted his boss, threatening his job.

This is not uncommon in Kenya, where the digital lending boom has seen thousands of people take on debt at high interest rates.

These apps offer money quickly and discreetly to people who don’t have a bank account. But non-repayment often turns into public humiliation: Debt collectors call friends, family and even employers of the borrower to force him to pay.

Ambrose Kilonzo, who earns 23,000 Kenyan shillings a month (around 178 euros), did not expect his job to be threatened for a loan of less than $ 30.

“It was like a little extra ” , tells AFP the 38-year-old man: “The way it was presented, it was so easy to get money. It was not something important.”

In this East African country where only 41% of the population has access to a bank account, according to 2019 data from the Central Bank of Kenya and the non-profit financial organization FSD Kenya, digital loans have seen great success.

The country had only five digital lenders in 2015. Today there are more than 100, including the Tala companies. , Okash and Opesa, whose loans total up to $ 60 million per month.

– Private data –

But these apps are increasingly monitored for certain predatory practices, such as interest rates reaching up to 400%.

They are also notorious for using data from their borrowers’ phones to humiliate those who do not repay.

When Patricia Kamene fell behind on her payments, her friends suffered a deluge of calls from a debt collector.

Desperately in need of money after losing her job in a supermarket during the coronavirus pandemic, the 24-year-old single mother did not read the fine print in the contract.

Like most users, she was unaware that she had given her consent for the developers to access her phone book, her call and SMS log, her Facebook friends list …

“When you are hungry, when you have nothing and these applications give you money, you take it without reading the conditions,” she told AFP.

A man who couldn’t pay his debts committed suicide in November 2019, after a lender called his mother, grandmother and aunt. His wife said he couldn’t stand the humiliation.

– “Rogue lenders” –

The director of the Kenya Digital Lenders Federation (DLAK), Kevin Mutiso, assures us that such practices are limited to a few “rogue lenders”.

“Our sector has grown very quickly,” he told AFP, stressing that the explosion in demand had forced many of these lending organizations to outsource debt collection to third parties, sometimes with behavior. irresponsible.

“The DLAK has a code of conduct that states that none of our members should humiliate their clients with their debts,” he said, adding that he had campaigned against dishonest lenders and offered compensation to victims of harassment.

The government on Tuesday passed a new law allowing the central bank to monitor all lenders, leaving open the possibility of a cap on interest rates offered by apps.

The governor of the central bank Patrick Njoroge had warned Parliament in July on the frenzy of credit and the risks posed to the whole economy.

“There’s a certain chaos in the borrowing and lending patterns, where people will sometimes go to three or four lenders, borrow from one to pay off the other. And when they have problems, everything the process collapses, ”he explained.

For Ambrose Kilonzo, the price of harassment and humiliation is not worth it: “I have returned to my banks and I am trying to live within my means”.

ho/amu/sva/md/jhd

–