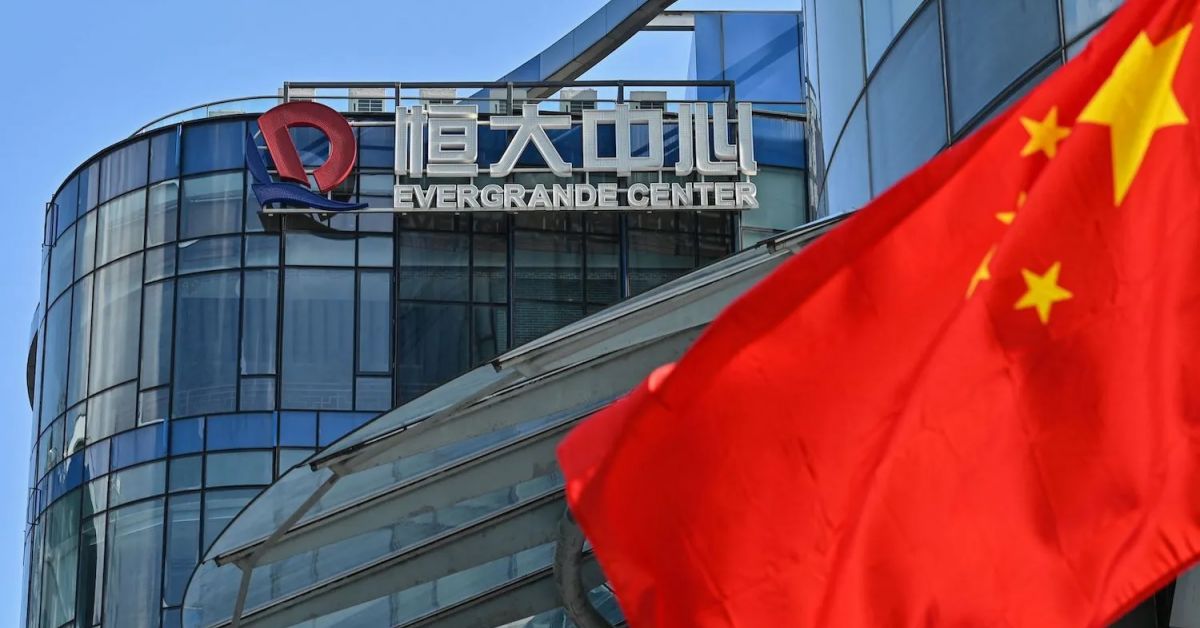

One of the largest Chinese companies is facing bankruptcy

Globally, China’s growth slowdown could have a variety of effects

The group’s suppliers are also at risk

An event has recently taken place that could be key to the short-term development of the Chinese economy, and therefore to a more global level. One of the companies from the Evergrande Group – one of the largest in the field of real estate in the country, failed to fully meet its obligations to issue bonds with a nominal value of 260 million dollars, due on October 3. There is no grace period for the issue, but a possible delay due to administrative or technical reasons of up to 5 working days is allowed. After this period, the lack of full payment at face value will mean actual default or bankruptcy. This comes amid the group’s total debt, which exceeds $ 300 billion, which means that a possible bankruptcy could be one of the largest in China’s history.

Which is Evergrande

The Evergrande Group owns more than 1,300 construction sites in more than 280 cities in China. It was founded in 1996 and today ranks second in terms of sales among real estate corporations. Of course, its activity is not limited to real estate – another important element is asset management. The group also has its own football club.

However, bankruptcies of other companies in the sector (Fantasia Holdings Group Co.) suggest that the problem is not only with Evergrande. In fact, this may be a sign of funding difficulties, which Goldman Sachs has already warned about. The group itself has upcoming payments on its existing liabilities of $ 7.4 billion in 2022. However, the current situation will seriously hamper the practice of obtaining new debt to repay existing debt.

The market price of the issue due in 2022 is only 23.5 cents per dollar, which shows market perceptions of a low probability of full repayment of this obligation. For comparison, in the middle of 2021 this price was close to the face value and in about 4 months it lost more than three quarters of its value.

Data for the second quarter of 2021 show a decline of 16.5% on an annual basis of net income, while net income increased by 120% and the profit margin reached 6.46% compared to 2.45% a year earlier.

Meanwhile, CST Group, one of the major shareholders, sold more than 32 million shares in one of the Evergrande Group companies. The share price of the whole group, in turn, marked a significant decline – on October 8, 2020 it was $ 20.25, while the quotations on October 6, 2021 are already $ 2.95.

Macroeconomic implications

The situation with Evergrande remains unclear. Following payments made at the end of September, the above-mentioned payments are still due from the beginning of October. The Chinese authorities are expected to intervene and try to restructure the group by selling viable parts of the business to competitors, while other liabilities are guaranteed by state-owned enterprises with support from the People’s Bank of China. Proceeds from the sale of ancillary activities will be used to pay off debts to creditors and it must also be decided how to distribute the company’s remaining assets and liabilities.

According to some analysts, the authorities are reluctant to save the most indebted company in the real estate business. Given the expected impacts on other companies in the sector, on the financial system, credit and stock markets, as well as on the Chinese economy as a whole, they are unlikely to refrain from interfering.

China’s economic growth has been heavily dependent on construction since the 1990s, with some estimates accounting for about a quarter of gross domestic product. However, indebtedness in the sector is causing concern among authorities, who imposed severe restrictions last year. They try to control both construction and rising real estate prices by setting minimum values at the regional level.

Current events are likely to reduce market optimism and slow down home purchases and investment in the sector. This will put pressure on construction and related industries. Increasing bond issues by local governments to maintain growth may take time for money to reach the real economy.

In the meantime, however, there is a slight decline in forecasts for the development of the Chinese economy in 2021 (over 8% real growth), which is mainly due to the deterioration of the epidemic. However, the risks of lower growth are high. The real estate sector is not expected to slow growth this year, but is likely to do so next.

Due to government restrictions on loans to the real estate sector, liquidity has fallen sharply. The current situation is likely to exacerbate the problem of non-performing loans to the sector. According to some estimates, almost 1/3 of the publicly traded companies in the sector have a ratio between cash and short-term liabilities below 1 (this is one of the indicators set by the authorities).

At Evergrande, about 60% of the 800 existing projects (which include 1.25 million homes) at various stages of completion have been suspended indefinitely. About half of the projects are in relatively smaller cities, where cases of emergency sales would mean a significant drop in prices.

The group’s suppliers are also at risk, as almost half of the liabilities are to subcontractors, who are already feeling the effects of the government’s actions towards the construction sector. Another major sector that would be affected is the financial sector. The group’s total liabilities are about $ 300 billion, with a small number of medium-sized banks appearing to have the largest exposures to Evergrande. For some of them, they will probably have to increase their capital to meet possible losses. Larger Chinese banks are less exposed to risks to the group, which means that no concrete action will be required on their part. The situation is similar with foreign banks.

However, the People’s Bank of China has increased liquidity in the banking system by the equivalent of more than $ 130 billion to protect it from a crisis. Chinese banks themselves have real estate loans of about 22.5 trillion. dollars, more than 2/3 of which are mortgaged. After a period of rapid growth, the regulatory ceilings on loans introduced last year give little room for banks to lend more.

Risk premiums on Chinese high-risk bonds have risen in recent weeks. With a yield of 20%, refinancing seems problematic for some of the corporations for which US dollar-denominated bonds are due soon. In fact, the bond market is inaccessible to many such companies. The development of restructuring programs has partially restored bond prices (reduced yields), but further development depends on Evergrande’s ability to meet its overseas obligations on time. In addition, the way the plans will be implemented will be important, and investors must be prepared for significant discounts. Low-risk loans maintain their positions, with investors showing clear preferences for quality and for state-owned enterprises.

US dollar-denominated high-risk bonds are causing tensions in Asian markets as a whole, as opposed to investment-grade assets. There are currently no significant changes in the second type of markets in India and Indonesia. The Chinese capital market is more affected, and the Hong Kong economy, which relies heavily on orders from China, has serious exposures. The market could cope with the lack of revenue growth in the real estate sector next year, but the situation would change significantly with a strong negative impact on it at the moment. The risk of a systemic crisis still seems relatively small, but it should not be ignored.

The possible infection should be analyzed in detail. The 20% yield on corporate bonds in China’s real estate sector seems too high to be sustainable and will cause serious difficulties in refinancing existing liabilities, necessitating government intervention. The development of the interbank market will show how much credit institutions have confidence in each other.

At the moment, a more serious decline in real estate prices does not seem likely, but if it happens, it could cause a sharp slowdown in the entire Chinese economy. As I have pointed out, the risk of infection is not very high, but this could lead to an untimely reaction on the part of the authorities in complying with their real estate policy. They are likely to wait and intervene only in the face of an imminent threat to macroeconomic stability. For investors, this is a signal of possible difficulties in restructuring Evergrande. There is still a lack of information to assess the impact of these events in the longer term.

Globally, the slowdown in the Chinese economy (no expected downturn) may have different effects. This could mean a weaker increase in demand for raw materials and energy resources in the short term. It would help reduce the pressure on the prices of these products globally. That is, it means more favorable conditions for production prices.

On the other hand, the impact on the production of consumer goods should not be so significant. The growth of global supply may also slow down, which will have an impact on consumer prices, but this will not contribute to a significant increase compared to the current situation.

After all, initial fears that this episode could provoke a large-scale crisis are not yet justified.

– .