Estonia has paid out tens of thousands of people who have decided to leave the 2nd pillar pension this month. On average, they are several thousand euros each.

IN SHORT:

- The reform of the pension system entered into force in Estonia this year.

- Reform of membership 2. voluntary level in Estonia.

- Its purpose is to allow people to decide for themselves how to handle this money.

- However, there are warnings that this could mean a significantly lower pension in old age.

- The majority of the Estonian population continues to participate 2. pension level.

In Estonia, the Pension Center has started transferring money to accounts for those who decided to withdraw from the 2nd pillar of pensions and withdraw their savings by the end of March this year – after the entry into force of the pension reform. They are almost 150 thousand people or about a fifth of the participants of the 2nd pillar pension funds.

Among them is Jāne, a resident of Tallinn: “I take out this money because I will invest in shares myself. My daughter is studying economics and helping. ”

“I have not yet made a decision. I think it’s a choice for everyone. [..] If I needed money, I would probably apply for a payout. But for now, I’m leaving as it is, “said Jeanne, a resident of Tallinn.

“I left the money [2. līmenī]. But I also understand those who do not leave. Maybe they have some difficulties in life or want to invest this money in another way. Everyone does what they want, ”said Thomas, a resident of Tallinn.

Of the withdrawn funds, income tax must be paid – 20% for those under 60 years of age, and 10% for residents over 60 years of age.

Aivars Voogs, Kantar Emor survey manager

Photo: LTV / Gints Amoliņš

–

–

Surveys show that the reasons for leaving the 2nd pillar of pensions are different.

“Most of those who apply for a payout have below-average incomes.

They may have financial problems and they use this money to solve them to repay their debts. Others will use it for daily spending. A small part of it will be used for investments or as a payment for real estate, ”said Aivars Voogs, a sociologist and head of surveys at Kantar Emor.

According to the Estonian Ministry of Finance, a total of 1.34 billion euros will be deducted from the 2nd pillar of pensions in September. A further 20% personal income tax will be deducted from it. This will mean that, in practice, a total of EUR 1 billion will flow into the accounts of people who have decided to leave the 2nd pillar of pensions. This amount corresponds to 4% of Estonia’s gross domestic product.

It is expected that the inflows into the accounts of tens of thousands of people will affect consumption in one way or another. More accurate data is expected when the Estonian government publishes the current economic forecast this week.

Kertu Fedotova, Adviser to the Estonian Ministry of Finance

Photo: LTV / Gints Amoliņš

–

–

“People who are now leaving the system have saved a little under 9,000 euros. On average, a person who is currently leaving the 2nd pillar of pensions is 41 years old and earns slightly below the Estonian average salary, ”said Kertu Fedotova, Adviser to the Estonian Ministry of Finance.

In essence, the reform provides for three options:

- to remain at the 2nd pension level,

- withdraw the money accumulated in it,

- open your own pension investment account, transfer funds there and make investment decisions yourself. In this case, no income tax is payable.

Data from the Ministry of Finance show that the latter option is not very popular, at least for the time being.

–

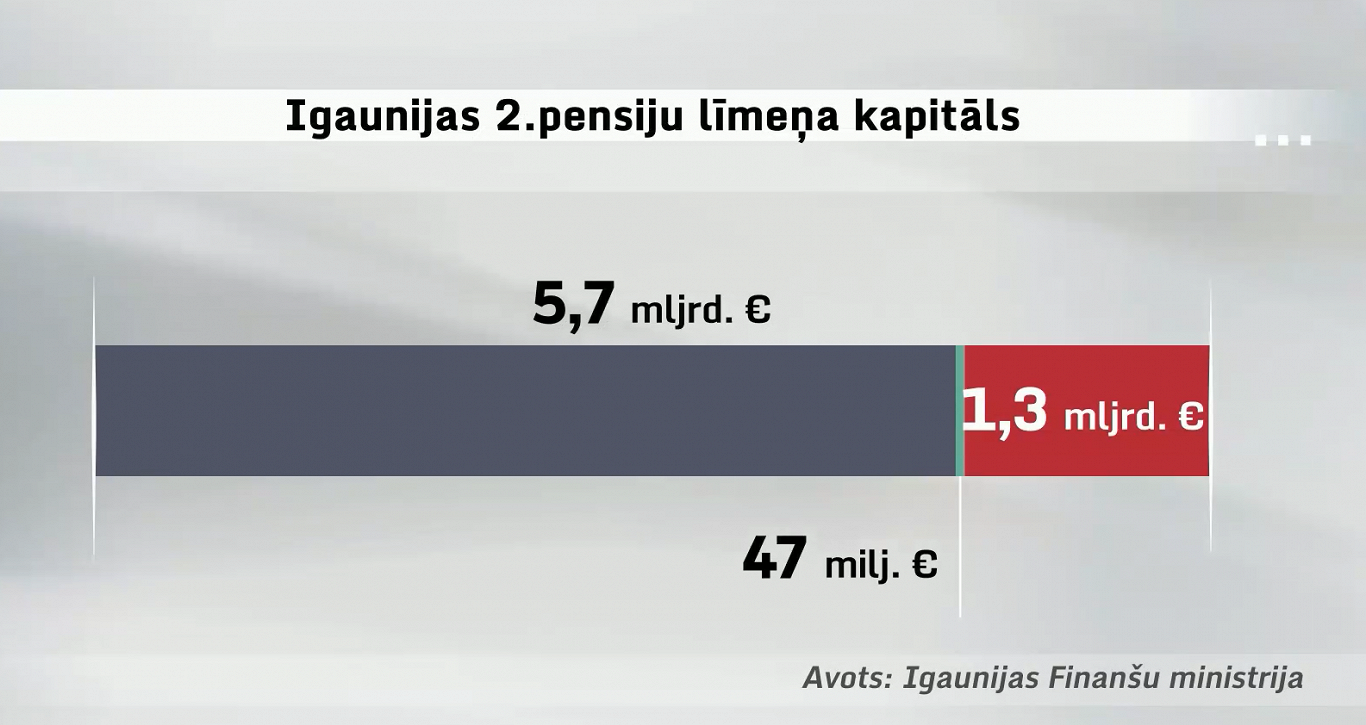

In total, 5.7 billion euros have been accumulated in Estonia’s 2nd pension level so far. In September, 1.3 billion euros were withdrawn, but only 47 million euros were transferred to personal pension investment accounts.

–

Highlight text and press Ctrl+Enterto send the text to be edited!

Highlight text and press Report a bug buttons to send the text to be edited!

–

–