When local highs of around $ 42,400 appeared on July 31, market prospects began to flip back to the bull side and to the “supercycle” bullish. Bitcoinu.

The bulls are about to end year 2021

Bitcoin has been busy correcting the impact of the suspension since mid-May Chinese mining, but last week’s price development was more favorable than expected.

price BTC and place further deeper decline maintained its previous profits, which last week was over 20% yesterday.

What seemed almost impossible seven days ago is now the honor of an entire month across an ever-growing part of the analytical community.

“After a worrying three months of news and price developments Bitcoin continued to create five green moon candles in a row and increased approximately 10 times in the second half of 2013, “said Jeff Ross, founder and CEO of Vailshire Capital, commenting on Saturday:

“I still say that 2021 will behave in a similar way. “

BTC/USD 1-month annotated candlestick chart, source: Jeff Ross / Twitter

During its last growth BTC/USD meanwhile, it broke through its 21-week exponential moving average, which analyst Rekt Capital described as “time test bull market indicator ’.

The shock from the menu returns

While Ross added that such a prediction is “just guessing,” he has an increasing number of on-chain indicators to support his claim.

After rebounding from the bottom to 83 exahashes per second (EH / s), the hash rate is now back above 100 EH / s, with mining difficulty recording the first positive readjustment since Saturday’s price crash in May.

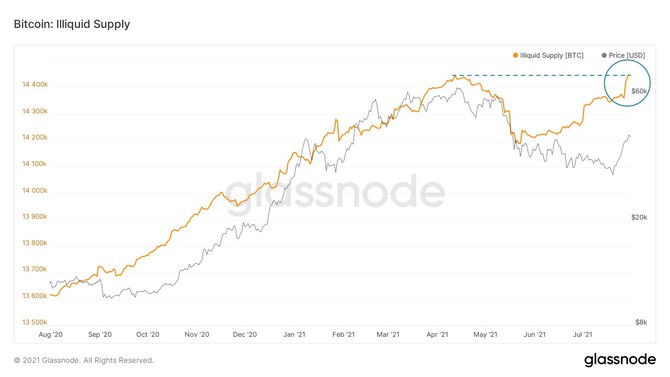

Investor behavior further reflects the change in sentiment. Strong watchers with little or no sales history of theirs BTC They have now regained control at levels that reached their current historical high Bitcoinu The $ 64,500 in April has never been recorded before.

“That’s a lot of bullish,” said Lex Moskovski, investment director at Moskovski Capital. view to the accompanying graph from Glassnode. His opinion points to Hodler’s belief in the growing amount of supply BTCwhich becomes illiquid – is withdrawn from the market.

Annotated graph of the growing supply of illiquid Bitcoinu, source: Lex Moskovski / Twitter

Annotated graph of the growing supply of illiquid Bitcoinu, source: Lex Moskovski / Twitter

„Bitcoin The ‘menu shock’ is now at the levels it had Bitcoin previously priced at 53K, ”commented fellow analyst William Clemente on the same data.

“Consolidation after 10 consecutive green days is very reasonable, but I still stay in the coming weeks.”

However, we must not forget that it can still be a “bull trap”, ie the trend can be easily reversed downwards. However, the similarity in the development of the price with 2013 is obvious.

–