Chicago started the week with a mixed balance. Rosario started with a stable commercial dynamics and the blue dollar fell $ 1 after having reached the highest value of the year last Friday when it reached $ 185.

In the US grain market, soybeans and corn closed with gains underpinned by the dry weather in the main productive regions, while wheat ended with losses. The market was looking forward to a new report from the USDA on the condition of the crops.

While the local rosarina square operated without major changes in the values of the main grains traded compared to the last round of operations.

Y the dollar listed on the parallel market showed a decline after the progress it has made in recent weeks. Financial prices closed stable. The retailer held, but the wholesaler adjusted to the rise.

In Chicago

Soybean prices closed with increases of between US $ 2 and US $ 4 depending on positions supported by opportunity purchases of funds, by the rise of between US $ 16 and US $ 18 in oil and by the dry climate in producing areas. The price of the bean traded below US $ 500.

In this sense, from Granar they analyzed that the increases were due in part to “forecasts that maintain the lack of humidity for the western and northern portion of the soybean-corn belt in the official forecasts extended from 8 to 14 days ”.

On the other hand, I also add to the bullish trend the fact that “the soybean imports by China would be reduced considerably towards the end of 2021 after a first semester of record imports of the oilseed, which would have put pressure on prices and limited increases ”, added the BCR in its daily report.

Corn ended with improvements of between $ 1 and almost $ 2 and managed to reverse the downtrend that it exhibited during the day. As in the case of soybeans, the climate tipped the balance to end up with a positive balance. The cereal traded between US $ 215 and US $ 220.

“The forecasts maintain dry weather conditions for the main producing areas of the west and north of the Midwest, where crops will finish forming their yield potential with moisture restrictions,” Granar analysts said.

Along the same lines, the BCR technicians indicated that “no significant rains have occurred in the last two weeks, and although the humidity of the soils was adequate and prevented a deterioration in the crops, it has begun to decrease as a result of the high temperatures ».

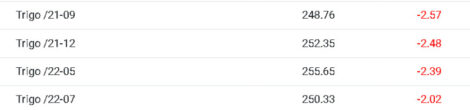

Y Wheat ended the day with falls of between US $ 2 and US $ 2.50 due to production complications in some key countries and was at a value of between US $ 250 and US $ 255.

“The poor condition of spring wheat, with areas that would have been abandoned, limited losses, while producer tours are expected to provide more certainty about the impact of lack of moisture on the northern Great Plains,” explained Granar. .

For its part, the BCR report added “global cereal production would reach a record in the new season, so the supply would remain abundant despite the production cut in some regions of the US and Russia, among others ”.

In Rosario

For soybeans with immediate delivery, contractual and for fixations, they were offered at the end of the business conference u $ s 330, unchanged from Friday. The offer in pesos was $ 31,790 the ton for both the contractual section and the fasteners segment.

For the oilseed to download in August, the offer was located at US $ 325, about US $ 5 less than on Friday. However, the intermediate position between August 15 and September 15 reached $ 330 respectively.

For corn with contractual delivery, the generalized offer remained at US $ 185. This same offer was extended for delivery in August.. Then, delivery in September reached US $ 190, with October at US $ 195 and November at US $ 198. In this sense, this last position was offered above Friday.

Regarding the segments of the next commercial campaign, unloaded corn in March was unchanged at $ 185, with deliveries in April and May also at the same value, but registering a rise of five dollars compared to the last trading round. As for late corn, the open offer increased by US $ 5, to US $ 170 for the cereal with delivery between June and July 2022.

Y for wheat with delivery in August, $ 200 was openly offered. While, for the cereal with delivery in the months of November, December and January, u $ s 190 were offered, without changes. For delivery in February of next year, the offer was located at US $ 192, with the offer for March at US $ 195.

Dollar

The blue dollar started the week with a decline in its value, after the rises of the last few days, the parallel quote registered a decrease of $ 1 to settle at $ 181 for the purchase and $ 184 for the sale. In this way, it slightly reduced the gap against the official wholesale dollar, which is now below 91%.

With this last variation, the ticket that operates in the informal plaza cut the streak of eight consecutive days upwards, in which it had accumulated an increase of $ 9. However, so far this month, it has registered an increase of $ 16 , which represents an advance of more than 9%.

According to analysts, After the increases that it registered in recent weeks, in the next few days the blue could show a little calmer, due to the possible interventions that could be given through “friendly hands”.

Meanwhile, financial dollars, returned to close stable after showing significant increases since the first operations of the day, with increases of up to 2.8%. Thus, the MEP and the cash settlement (CCL) closed with slight increases of 0.2%, at $ 166.8 and $ 167.5, respectively.

For its part, The official retail dollar remained at $ 95.50 for the purchase and $ 101.50 for the sale, while the wholesaler advanced $ 0.12 cents compared to Friday and closed at $ 96.34 for the purchase and $ 96, 54 for sale.

And the average reported by the Central Bank in financial entities was $ 101.77, so that the “solidarity” dollar stands at almost $ 168 on average, $ 16 below the blue.

–