–

From Wednesday analysis on Bitcoin (BTC) some price action took place, but it’s quite a mess and the market doesn’t seem to know where he wants to go. In any case, we are entering the second half of July, and given the volumes and volatility, I dare say that a sharper price movement should come by the end of the month. This is unsustainable, it doesn’t make sense for the course to pay for the whole summer vacation like this.

I know that I repeat myself, but that is the intention – I would like readers to realize that there is a relatively high prospect of the coming of opportunity over the next two weeks. Even if nothing happens, have a plan in place for what to do when the $ 30,000 breakthrough occurs. Of course, have a plan for the opposite scenario.

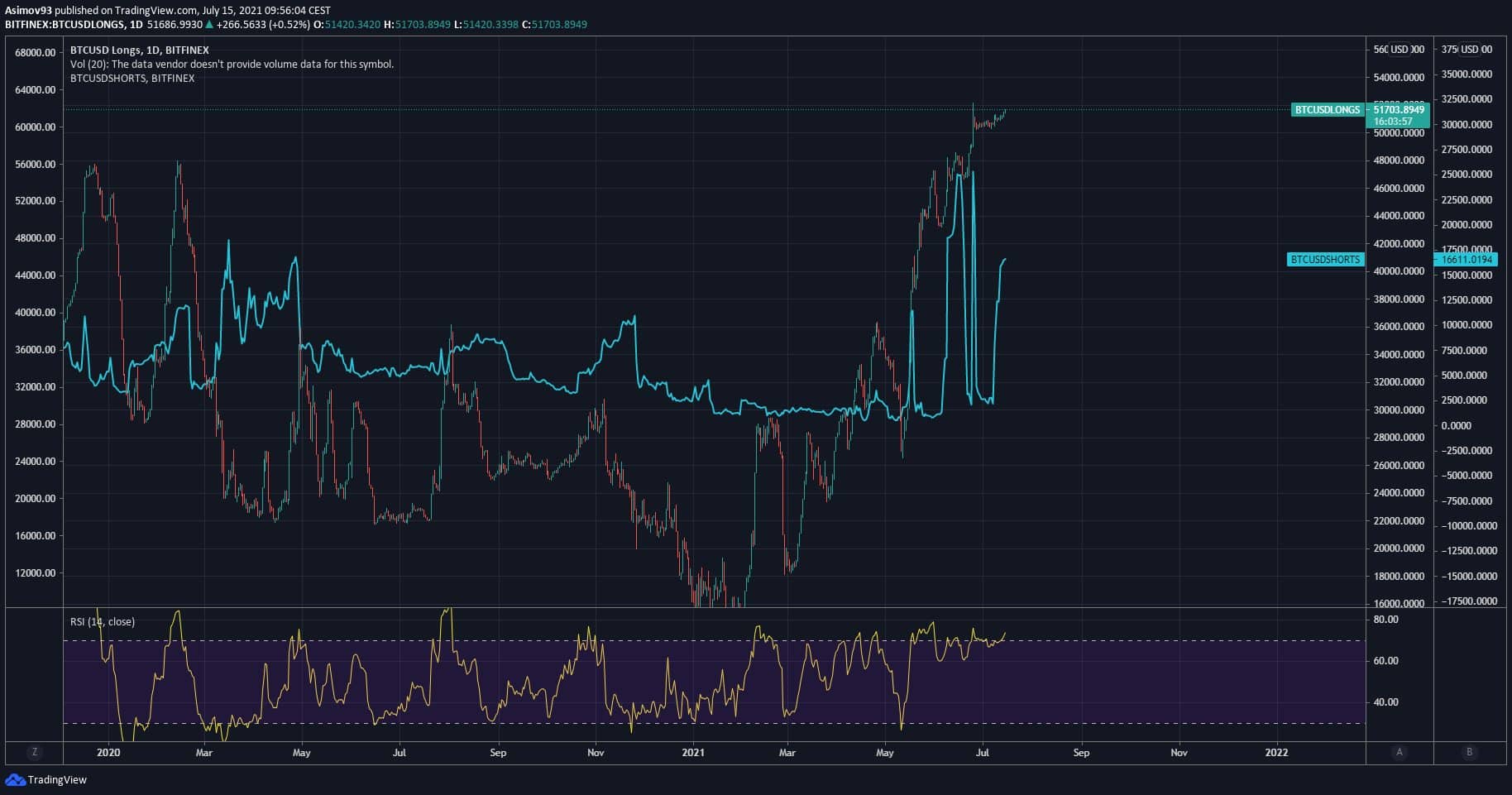

BTC long / short positions

As for long and short positions, right from the beginning of the summer holidays, long positions began to stagnate, which basically lasts until now. On Bitfinex, Bitcoin is on the margin almost does not buy. That is in the order of hundreds, but of course it does not move with prices more visibly. In short, the cucumber season, and I would venture to say that the situation is similar on other stock exchanges in this regard.

Otherwise, of course, the longs are on Bitfinex at all time high. Traders hold 51,600 BTCs in long positions. It must be under terrible psychological pressure, because the market has not moved anywhere for weeks and is still balancing over the abyss. Respectively, we have been standing on key support for too long.

Short positions are growing rapidly, for the third time in a row. Last time, shorts in the amount of about 23 thousand BTC were opened, but within a moment the positions were closed, but the price did not work. Described convinced me that it is probably claim and I honestly admit that I don’t understand these steps on the part of the big players. However, if you have a theory as to why they are doing this, feel free to write in a comment or chat in tonight’s stream.

Current situation at 1D TF BTC / USD

Bitcoin stays within the support band. Do you see the contrast with June? Whenever the price reached the range of 30,000 – 34,000 USD, buyers aggressively bought with a slight vision of profit. They just believed that the level would definitely last. However, this one pattern, or the pattern of behavior of bulls, now clearly does not apply. There is some activity, but quite weak.

Previously, it was quite easy to push the price back above the support, which is currently not the case. Some resistance can be seen from the lower time frames, but the exchange rate is still falling steadily. And it gets to the point where long position holders lose patience and can start selling. Said may not even trigger a breakthrough of $ 30,000, sales may start sooner, because simply psychology.

Then we have so many inflected volumes – they are on their own minimech, and until there is a visible break, volatility will remain at freezing. However, as I keep saying, the current situation may end by the end of the month. Such low volatility and volumes have never lasted more than a few weeks.

Indicators

The breakthrough through the lower support diagonal is still in progress, but so far without a market reaction – it is quite possible that the response will not come at all. The positive momentum is red on the MACD, it is approaching a bearish cross.

In conclusion

We have to be patient, but at the same time stay vigilant – perhaps the dynamics will return to us within two weeks, and that is why we must be prepared. It doesn’t matter if you are a bear or a bull. Whichever way Bitcoin moves, it can be a good opportunity.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, you always trade only at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–