- Mortgage mobility is the possibility of transferring your credit from one financial institution to another.

- The objective is to improve your payment option, interest rate, monthly payments and Total Annual Cost (CAT).

- Condusef designed a mortgage mobility simulator to help you make this decision and find the best option.

–

In the midst of the current economic situation, having a mortgage is complex, as it is one of the longest-term financial products. If you are looking for options to reduce the amount you pay, there is the option of mortgage mobility.

According to the National Commission for the Protection and Defense of Users of Financial Services (Condusef), mortgage mobility, also known as mortgage subrogation, is the possibility of transferring your credit from one financial institution to another; The objective is to improve your payment option, interest rate, monthly payments and Total Annual Cost (CAT).

Moving your mortgage to another bank can improve the current credit conditions, either in the amount of the monthly payment or in the term. The institution is the one that carries out the entire process.

Before deciding, compare requirements and features

The Condusef recommends that, before carrying out the procedure, you compare the requirements that they request, as well as the characteristics that your credit and current situation must meet.

These requirements depend on the institution you want to transfer to, but are generally the following:

• Have a loan age of 1 to 3 years at the original institution.

• That the amount of the credit to be transferred is not greater than 90% of the value of the property.

• Be up to date on payments with the initial institution.

• Good credit history.

• Work seniority of at least 3 years in the same activity.

Use the Condusef Mortgage Mobility Simulator

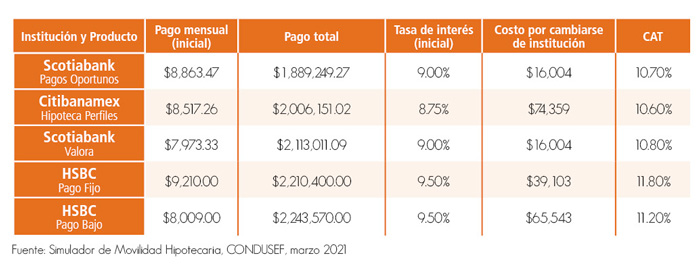

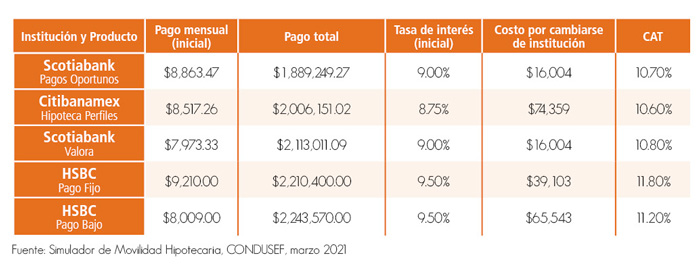

The Condusef carried out an exercise in which a person acquires a home for 1.2 million pesos and contracts a mortgage loan for 960,727 pesos (which is the value of the property less the down payment), with an interest rate of 11.9% for a term of 20 years.

After paying 5 years of credit, someone recommends you use the Condusef mortgage mobility simulator, before making any decision.

Upon accepting the proposal, the user entered the data requested by the simulator, these being the current data:

Look for lower monthly payments

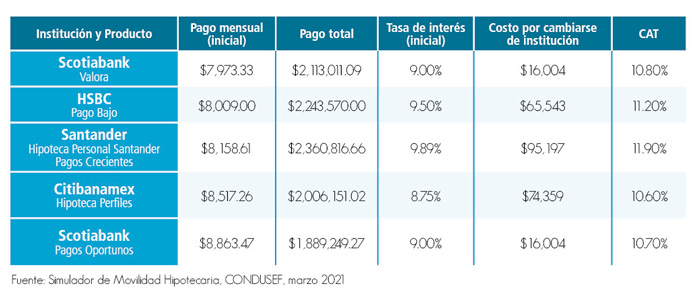

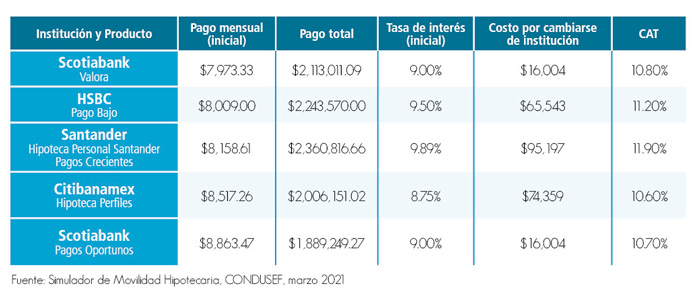

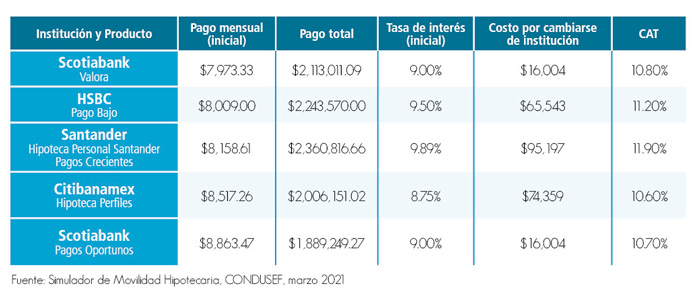

As mentioned, the person has 15 years left to pay off his debt, which is why he indicated that he requires that the payments be lower than those he currently makes. He also selected one of the institutions that offer lower monthly payments, although he decides that it is better to increase the term so that they are reduced even more. In the simulator, he selects the 20-year option, and shows him the available alternatives.

You can also pay less at the end of the credit life

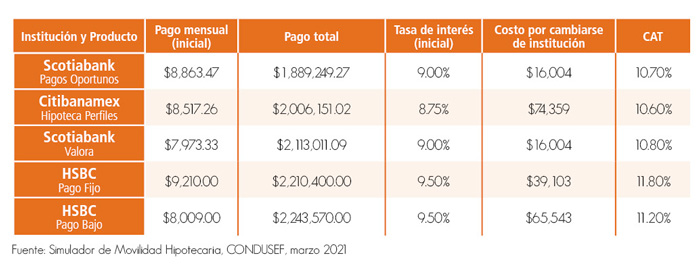

In the example, lower monthly payments are sought; However, these are not the only options you have, because if you want to pay less at the end of the credit life, you can also sort the institutions by total payment, thus showing a new order in the columns, where you can compare the total amounts at the end of credit.

This simulator offers you different alternatives depending on your needs, remember that you only have to compare and choose the one that suits you best and suits what you are looking for.

You can also compare:

• Which institution offers a lower interest rate.

• Which one offers you a lower cost for changing institutions.

• Which has a lower CAT.

NOW READ: I have no credit history because I have always bought everything in cash and now I want to buy a house. How can I access a mortgage loan?

ALSO READ: Dead the owner the house is lost? This is what happens if the owner of a mortgage loan dies – with or without a will

Discover more stories at Business Insider México

Follow us on Facebook, Instagram, LinkedIn and Twitter

–