In times of pandemic, Europe has continued its era of low interest rates, largely driven by the policy of the region’s central bank. In addition, in some old European countries, there are more and more cases when commercial banks even transfer money to their customers when the loan rate is negative.

For example, The Wall Street Journal (WSJ) highlights a case in Portugal where a borrower has such a dream mortgage. It is pointed out that the specific loan taken at the Banco financial institution is in the amount of approximately 320 thousand euros, where the interest rate applied to it fluctuates, although at present it is negative at -0.25%. As a result, for example, this month it has happened that Banco has transferred approximately 40 euros to the account of the borrower, paying interest. The mortgagee himself, of course, continues to pay the principal amount of the loan.

“When I took out this loan in 2008, I could never imagine such a scenario. The bank did not think so either, ”says Paul Kristina Santos, a business consultant from Lisbon. The major economic challenges have meant that the European Central Bank (ECB) needs to pursue a very warm – even experimental monetary policy to prevent the economy from slipping into a ditch. This has meant both quantitative easing (liquidity printing) and lowering interest rates.

For example, the euro refinancing rate is currently at round zero, while the deposit rate for commercial banks is negative and stands at -0.5%. had reached 30 thousand. In turn, this year this number has more than doubled and exceeded the mark of 60 thousand.

The added rate is less than the disadvantages of the interbank rate

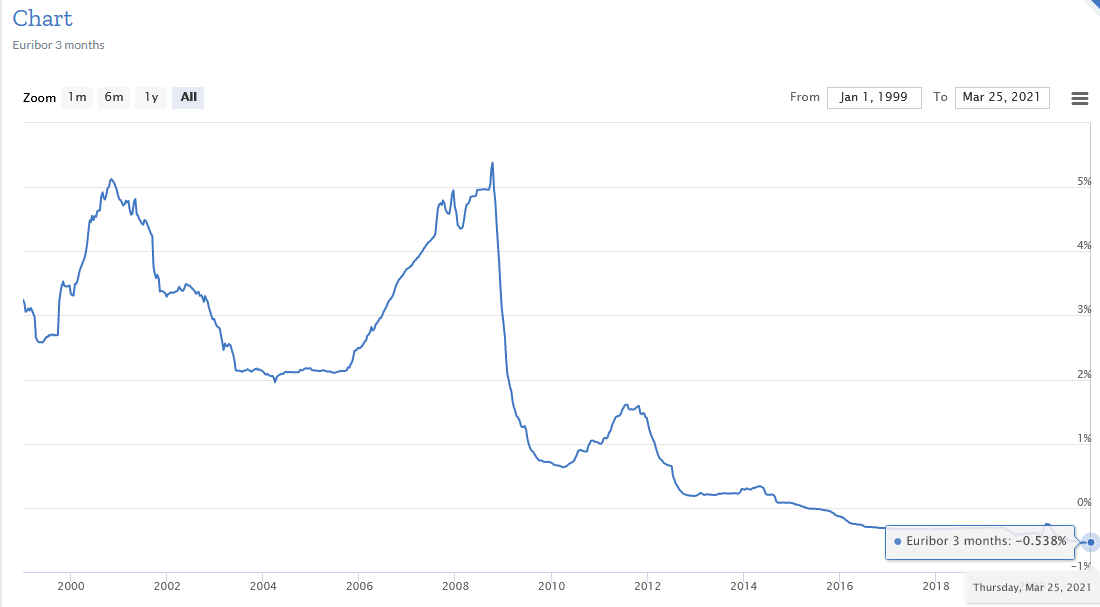

In fact, in all European countries, lending rates tend to “slide” and depend on both the bank’s added rate and the change in the value of the interbank Euribor rate. For example, in this particular case, PK Santosa reveals that its bank added rate is 0.29%. To this is added the three-month Euribor rate, which in 2008 was close to the 5% mark. The fact is that currently the three-month Euribor rate is negative and stands at -0.54%. In the case of Santos, it turns out that the bank’s added rate is less than the effect of the Euribor negative rate – accordingly, simple mathematics dictates that the total loan rate is also negative. The Portuguese government-controlled financial institution Caixa Geral de Depositos reveals that around 12% of its mortgage loans are currently at a negative rate.

Last year, the number of such cases has halved. Banco, on the other hand, states that it has so far paid its customers about one million euros for the privilege of lending them interest. The WSJ writes that a similar picture has begun to emerge in Spain. However, its government has stipulated by law that lending rates can be reduced to zero, but not further. “In this case, the customer will not pay interest. However, in no case will the bank pay them to the borrower, ”says the Spanish lender Banco Bilbao Vizcaya Argentaria. In this respect, Portugal has already taken a different path by adopting the relevant laws.

In the case of Latvia, too, it seems that borrowers can only dream of such a situation, when banks transfer interest payments on loans. Our borrowing conditions are different than in the old European countries. First of all, in our case, the added rates of banks tend to be significantly higher. Latvian laws also limit the sliding of loan rates below zero. In addition, the new agreements with banks essentially stipulate that the effects of negative interbank rates (for example, negative three- or six-month Euribor rates, which were not a conceivable phenomenon 10 years ago) stop at zero. In general, however, this is nothing unique, because banks are trying to protect their profits in many other places as the situation changes.

Also negative deposits

It should be noted that by setting very low or even negative rates, central banks expect that commercial banks will be forced to go in search of profitability and will start lending more actively. Similarly, very low interest rates should mean that cheaper financing is available and that many previous borrowers find it easier to breathe. A cheaper side effect of negative rates also tends to be a cheaper local currency. Such a situation has also been one of the pillars of stock market growth – against the background of low rates, money has flowed in their direction, hoping for a more attractive return.

At such times, however, there is a risk that banks’ profits, which are traditionally the difference between deposit and borrowing rates, will shrink. One option, of course, is to start applying negative rates on deposits or money in the account to customers, which has often been the case recently. It can also be an additional factor for businesses and households to spend if they do not want to see their money in their account slowly dwindle.

In any case, the “taboo” of earlier banks on collecting money from deposits or cash account is quite fast. Understandably, in times of negative rates, commercial banks are still afraid to pass on these costs to customers in some cases, because then they will simply be better off holding money in socks (or safes). Huge cash withdrawals from banks, for example due to the same negative rates, would also mean that their ability to lend would deteriorate. This would also run counter to the current meaning of central bank monetary policy. In many places, however, large-scale cash withdrawals are becoming quite difficult and associated with additional costs. In any case, if such an alternative is taken away and cash is eliminated, then nowhere does it say that the funds in the account are not subject to the negative rate they need.

For example, since last year, the large German banks Deutsche Bank and Commerzbank have been applying an annual rate of 0.5% to their new customers who want to hold large amounts in these financial institutions. That’s a whole lot. Banks point out that it is difficult for them to absorb the ECB’s negative interest rate policy: the more deposits they attract, the more money they have to pack at the ECB at the already -0.5% rate. The WSJ adds that this even leads to a very atypical situation where banks try to avoid attracting deposits.

The pandemic also played a role in this, which basically meant that the savings of the population of Western countries, with limited opportunities to spend, but the revenues often remained unchanged against the background of government stimulus. As a result, platforms that allow consumers in Europe to compare deposit rates and switch to banks that do not charge customers excessive amounts or even pay low interest on their deposits are gaining popularity. It should be noted that the Germans are big savers. Germany is responsible for about a third of all household deposits in the euro area. Last year, the country’s deposits increased by 6% to 2.55 trillion euros. In 10 years, it has increased by 60%.

–