Kasikorn Research Center Evaluate the trend of Thai stocks moving in the range of 1,500-1,530 points during the past week. Investors reduce their holdings before entering a long weekend. Domestic political concerns

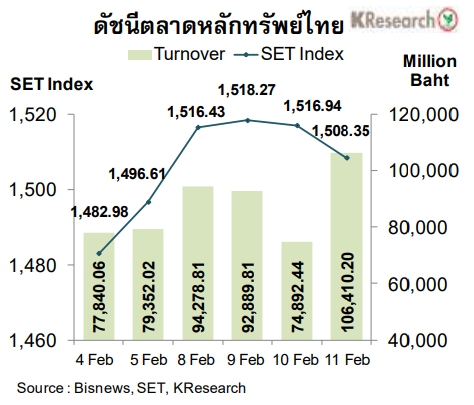

Kasikorn Research Center Revealed that last week (8-11 Feb. 64), the Thai stock market slipped down before the long holiday. The SET index closed at 1,508.35 points, an increase of 78% from the previous week. The average daily trading value was 92,117.82 million baht, an increase of 17.64% from the previous week. The mai stock market index rose 2.77% to close at 380.18 points.

Thai stocks jumped early in the week following the international market direction. It is driven by the hope of the US economic stimulus measures. This is expected to be approved by the Congress. However, Thai stocks have swung in a narrow range until midweek. Before falling at the end of the week Due to the lack of new factors To stimulate After the market has accepted such positive factors already. In addition, investors cut their investment positions before closing a long break and wait to monitor the political factors in the country over the next week.

For the next week trend (15-19 Feb.) data from Kasikorn Securities Company Limited Given that the Thai stock index has support levels at 1,500 and 1,485 points, respectively, while resistance levels are at 1,520 and 1,530 points, respectively. The Kasikorn Research Center estimates the key factors to be monitored are GDP figures for Q4 / 2020, earnings. Quarter 4/2020 of listed companies, Thai political factors, COVID-19 situation As well as progress on the issuance of US economic stimulus measures.

Other information To be monitored include the US release of Fed Minutes, retail sales, January industrial production, and the preliminary PMI index for February. These include GDP figures for 4Q20, as well as the preliminary PMI for February for Japan and the euro zone.

–