Bank of Thailand Gathered Measures to assist all debtors affected by the new wave of COVID 19 are organized to all banks. For people who have credit card debt, home loan, car loan, see here.

January 25, 2021 Bank of Thailand Revealed a new wave of COVID-19 remedial measures from all banks, including people with credit card debt, home borrowers, car borrowers, personal loans and others as follows

Good to know

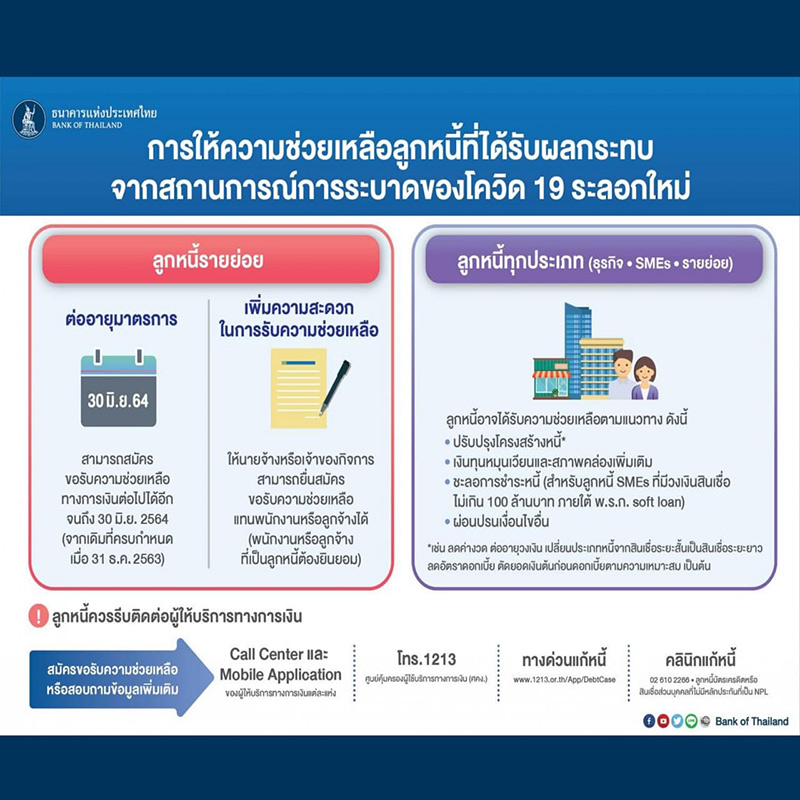

– You can apply for financial assistance until June 30, 2021.

– Allowing employers or business owners to apply for assistance on behalf of employees or employees With consent

–

–

Credit card receivable

Banks that set a minimum credit card installment rate of 5%

– Government Savings Bank credit card

– Bangkok Bank credit card

– SCB credit card

– credit cardKasikorn

–

– ICBC credit card

– KTC credit card

– Citibank credit card

– credit cardKrungsri

– credit cardUOB

– TMB / Thanachart credit card

Bank that cuts interest and extends the term 12% for 48 months.

– Kasikorn credit card

– TMB / Thanachart credit card

– SCB credit card

– Citibank credit card

– KTC credit card

Banks that reduce interest and extend the period of 48 months according to the bank conditions

– UOB credit card

Bank that reduces interest and extends the term of 99 months according to the bank conditions

– Krungsri Credit Card

Banks that reduce interest and extend the period according to the bank conditions

– ICBC credit card

– Bangkok Bank credit card

– Government Savings Bank credit card

– AEON Credit Card

Accommodation bank repayment of principal and / or interest

– Kasikorn credit card: 6 months stay on principal

– UOB Credit Card: 3 months stay on principal and interest

–

–

––

– Personal Loans: Switch to Long-Term Loans, 48 Installments

– The interest rate is not more than 22% or the minimum rate of interest is reduced.

– Personal loan with installments Or car registration loan At least 30% reduction in annuities

Bank / Financial Institution Accommodation to settle (Principal + interest) 3 months

– Krungsri Bank

– Kiatnakin Bank

– Government Savings Bank

– Thanachart Bank

– Islamic Bank

– Friend Sips Make Money

– Asia Sermkit

– AAM Finance

– generous personal loans

Financial institutions to settle debt (Principal + interest) 4 months

– Srisawat

Bank / Financial Institution Accommodation to settle (Principal + interest) 6 months

– BAAC

– g capital

Bank / Financial Institution Accommodation to settle (Principal + interest) 12 months

– BAAC

– SG Capital

Bank / Financial Institution That gives additional credit

– Government Savings Bank

– BAAC

– Promis (2 times the limit

Bank / Financial Institution Principal payment accommodation

– Krungsri Bank: 3 months

– Kasikorn Credit Card: 6 months

– Silver Turbo: 6 months

– Government Savings Bank: 3-6 months

– Islamic banks: 6-12 months

– SG Capital: 6-12 months

– Generous personal loans: 6-12 months

Bank, financial institution That extend the term / switch to long term loan

– Bangkok Bank

– Krungsri Bank

– Kiatnakin Bank

– Government Savings Bank

– BAAC

– Krung Thai Bank

– Kasikorn Bank

– Islamic Bank

– Citibank Bank

– CIMB Bank

– generous personal loans

– Friend Sips Make Money

– Asia Sermkit

– Turbo money

– SG Capital

– G Capital

– Mit Sin Express

Bank, financial institution That reduce the payment rate / installment

– Siam Commercial Bank

– Krung Thai Bank

– Bangkok Bank

– Kiatnakin Bank

– Krungsri Bank

– Kasikorn Bank

– Thanachart Bank / TMB

– CIMB Bank

– TISCO Bank

– Citibank Bank

– Islamic Bank

– AAM Finance

-Fulfill money, can order

– Turbo money

– Asia Sermkit

– Chai Rit Leasing

– Mit Sin Express

– Srisawat

– Heng Leasing

– SG Capital

– Star Money

Bank, financial institution Lowering interest

– Bangkok Bank: 22%

– Siam Commercial Bank: 22%

– TISCO Bank: 22%

– UOB: 22%

– Citibank Bank: 22%

– Thanachart Bank: 22%

– TMB Bank: 22%

– Kasikorn Bank: 22%

– CIMB Bank

– Krungsri Bank

– BAAC

– Government Savings Bank

– Asia Sermkit

– Mit Sin Express

– Chai Rit Leasing

– Promise loan: 25%

–

Hire Purchase (The person who borrowed the car from the bank)

– Postponed payment of installments (Principal + interest 3 months or reduce the installment by extending the repayment period

A suspension for repayment (principal + interest) 3 months

– Kasikorn Bank

– Siam Commercial Bank

– Krungsri Bank

– Thanachart Bank / TMB

– CIMB Bank (Cars and Motorcycles)

– Kiatnakin Bank

– TISCO Bank

– Islamic Bank

Reduce payment

– Kasikorn Bank

– Siam Commercial Bank

– Krungsri Bank

– Thanachart Bank / TMB

– CIMB Bank

– Kiatnakin Bank

– ICBC Bank

– TISCO Bank

Reduce interest / penalty

– Thai Credit Bank: 1 year according to bank conditions

Extended period

– Kasikorn Bank

– Siam Commercial Bank

– Thanachart Bank / TMB

– CIMB Bank

– TISCO Bank

– Kiatnakin Bank

– ICBC Bank

– Islamic Bank

–

Hire Purchase (People who recovered cars with Non-bank)

– Postponed payment of installments (Principal + interest) 3 months or reduce the installment by extending the repayment period

A suspension for repayment (principal + interest) 3 months

– Muangthai Capital: 3 months

– Honda Leasing: 3 months

– Krungsri Auto: 3 months

– Somwang money can order: 3 months

– World Lease: 3 months

– SG Capital: 12 months

– Srisawat: 4 months

– Ratchathani Leasing: 3 months

Suspend principal or interest payment

– ECL Auto Cash: 3-6 months

– Srisawat: 7 months

– SG Capital: 12 months

Refinance

– Ratchathani Leasing

Reduce payment

– Honda Leasing

– Heng Leasing

-Fulfill money, can order

– Asia Sermkit

– Amanah Leasing

– Star Money

– ECL Auto Cash

– SG Capital

– SANY

– Krungsri Auto

– Ratchathani Leasing

Extended period

– Honda Leasing

– Heng Leasing

-Fulfill money, can order

– Asia Sermkit

– Amanah Leasing

– Star Money

– ECL Auto Cash

– SG Capital

– SANY

– Ratchathani Leasing

–

–

–Home loan

– Postponed payment of installments Principal + interest 3 months

– Postpone the principal payment for 3 months and consider reducing the interest.

– Reduce installment by extending the repayment period

Suspend on principal + interest

– Siam Commercial Bank: 3 months

– Kasikorn Bank: 3 months

– Krungsri Bank: 3 months

– Thanachart Bank / TMB: 3 months

– UOB Bank: 3 months

– Kiatnakin Bank: 3 months

– ICBC Bank: 3 months

– Islamic Bank: 3 months

– Bangkok Bank: 3 months

– Land and Houses Bank: 3 months

– TISCO Bank: 3 months

– CIMB Bank: 3 months

– BAAC: 1 year

Reduce interest

– Siam Commercial Bank: 3 months

– Kasikorn Bank: 3 months

– Bangkok Bank: 3 months

– Land and Houses Bank: 3 months

– TISCO Bank: 3 months

– ICBC Bank: 3 months

– Government Savings Bank: 3-12 months

– BAAC: according to conditions

– CIMB Bank: according to the conditions

Stay on principal payment Pay only interest

– Siam Commercial Bank: 3 months

– Krung Thai Bank: 3 months

– Kasikorn Bank: 3 months

– Krungsri Bank: 3 months

– TISCO Bank: 3 months

– ICBC Bank: 3 months

– Bangkok Bank: 3 months

– Land and Houses Bank: 3 months

– Government Savings Bank: 3-12 months

– Thanachart Bank / TMB: 6 months

– Islamic Bank: 6 months

– UOB Bank: 1 year

– BAAC: 1 year

– Cash Back

– BAAC: 20% of paid interest

Not thinking of a default penalty

– Islamic Bank

Reduce payment

– Kasikorn Bank: 50% 3 months

– Thor: 25% -50% -75% 6 months

– Thanachart Bank / TMB: 70% 6 months

– BAAC: according to conditions

– Bangkok Bank: according to the conditions

– Siam Commercial Bank: according to the conditions

– Krung Thai Bank: According to the conditions

– Kiatnakin Bank: According to the conditions

– ICBC Bank: according to the conditions

– TISCO Bank: according to the conditions

– Land and Houses Bank: according to the conditions

– CIMB Bank: according to the conditions

Extended period

– BAAC

– Islamic Bank

– Bangkok Bank

– Siam Commercial Bank

– Krung Thai Bank

– Kiatnakin Bank

– Land and Houses Bank

– TISCO Bank

– ICBC Bank

– Thai Credit Bank

–

–

–

–