HoonSmart.com >> “Morning Star Research” reveals a 63 billion baht outflow of mutual funds, poisoning COVID, debt flaring, Thai stocks fall, Big Cap equity funds for the first time in 15 rounds. The year is more than 21 billion baht, no money, LTF funds support the stock market after the tax rights are exhausted, the SSF is still not popular with investment funds outside of the eye. 100%

Ms. Chanyani Chuengmanon, Senior Analyst at Morning Star Research (Thailand), revealed that the mutual fund industry in 2020 had a net flow of 2.8 billion baht with net assets. At 5.0 trillion baht, down 6.5% from the end of 2019 by domestic investment funds This is the lifeblood of the industry, slow recovery. The COVID-19 epidemic is also a pressure on the Thai economy as a whole. While foreign investment may have a stronger support factor. In particular, investing in foreign stocks is interesting in terms of industry segments where the Thai stock market may still lack or the recovery of markets in each country in line with the COVID-19 situation. In that country

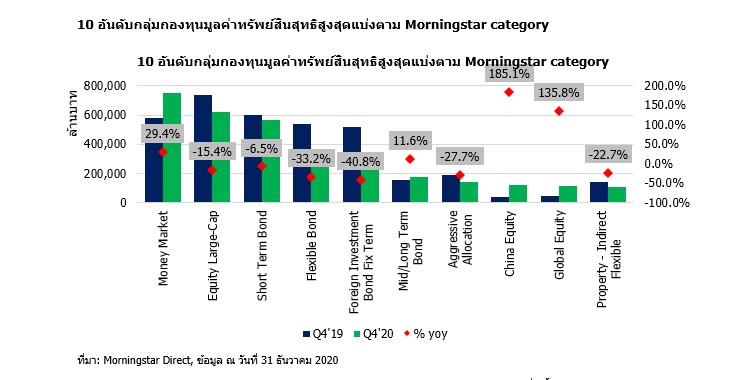

The Foreign Equity Fund has clearly grown. Especially Chinese equity funds or global stocks But with the asset ratio not too high when compared to the entire industry, it has not had much impact on the growth of equity funds. The stock fund grew slightly from 2019, or increased 1.8% to 1.3 trillion baht from net inflows of 7.7 billion baht.

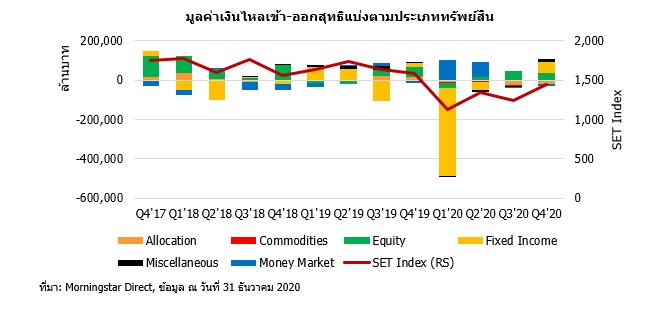

The Thai stock market in 4Q20 was adjusted to 1,400 points, with the 3-month SET TR at 17.4%, but overall, it was not much positive for the mutual fund. This can be seen from the Thai Equity Fund still having a continuous net flow out. Also, investors are more interested in foreign equity funds. And bond funds as a whole saw an impact from funds that closed earlier in the year. As a result, the asset value of the Fixed Income Fund has not returned to its original level or decreased 21.3% from 2019 to 1.6 trillion baht, with a total net flow of 4.4 billion baht in the past year. Bonds fell to 38% from 46% in 2019.

However, at the end of the year, there was clearly more money to invest in bond funds. From the net inflow of 5.7 billion baht

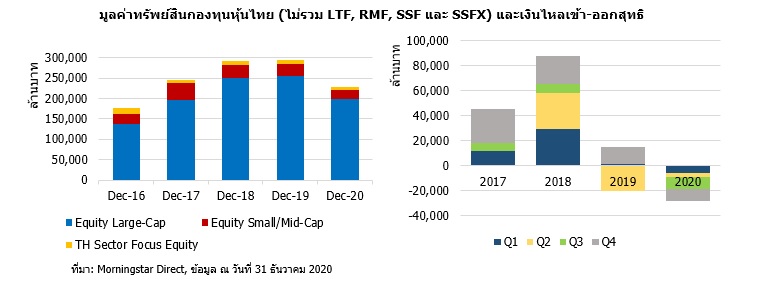

Ms. Chanee said that for Thai equity funds (excluding LTF, RMF, SSF, SSFX), although the 4Q2020 Thai stock index has risen. But does not make investors interested in Thai equity funds much Equity Large-Cap has a net cash outflow of 7.2 billion baht, including an annual net outflow of 2.1 billion baht, the first outflow in 15 years with a net asset value of 6.2 billion baht. However, the SET Index at the end of 2020 stood at 1,400 points, which is 1,500 points lower than the previous year, resulting in a contraction of 15.4% from the previous year.

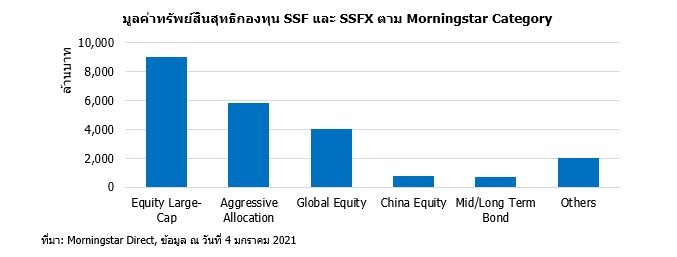

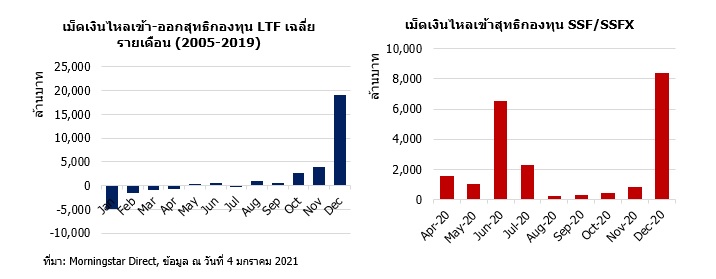

“The direction of capital funds, large groups of stocks in the past 10 years found that Regardless of whether the return of this fund group is positive or negative, there will be a net inflow of ten billion baht in the last quarter of every year. But the last quarter of 2020 marks the first year with net cash flows. This is due to the lack of LTF investment, while the replacement SSF has not received as much attention in the past. Plus, there are options for investing abroad while LTF focuses on investing in Thai stocks, ”said Ms. Chanee.

In addition, in the last quarter of 2020, the SET Index rose more than 17%, contributing to the sale of units to Thai equity funds. As a result, the net cash flow was 2.8 billion baht, unlike in the past that the last quarter was the period when the net inflow.

In the amount of net cash outflows of 28 billion baht, if 220 funds with full year 2020 cumulative return are divided into 10 groups (decile) according to the 2020 cumulative yield, the top decile group is a group with returns. The highest average and Bottom decile were the groups with the lowest mean yields. The top decile was the only group with a positive mean return, nearly 7%, and the bottom decile had -18.0% mean yield. How positive or negative will the return be? All groups have net money flows. They tend to have worse returns, more money to flow out.

If only for new open funds, it will find that Although most Thai equity funds have money flowing out. But new Thai equity funds still have high net inflows totaling more than 1.6 billion baht, in 2020 there are 3 new Thai equity funds from AIA Asset Management (AIAIM), total asset value 1.4 Ten billion baht

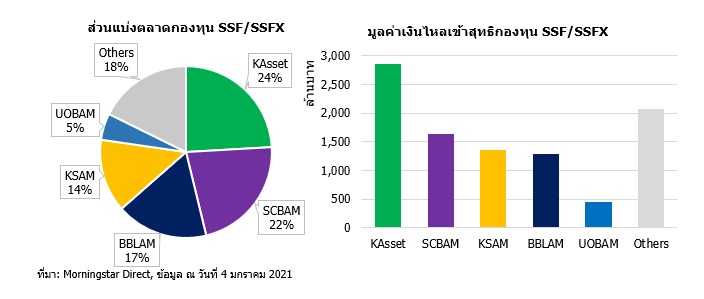

Savings Fund (SSF) and Special Savings Fund (SSFX) With total net asset value of 2.2 billion baht, SSFX fund’s net asset value as of July 1, 2020 totaling 1.1 billion baht), net inflow in the last quarter totaling 9.6 billion baht from the sale of SSF / In the first year, SSFX was found to have similar investment characteristics to LTFs, meaning that the inflow of capital was high at the end. There was a high inflow of SSFX funds in June and December for SSF.

LTF funds Net asset value of 350 billion baht, down 14.6% from the end of 2019, but increased 10.4% from the third quarter due to an increase in asset value according to the SET Index.However, in the last quarter of the year, there was still money flowing out of LTF. For a further 3.7 billion baht, total net outflows were nearly 15 billion baht.The average return on LTF last year was -8.0%, while the fifth year was 2.1%.

RMF The net asset value has returned to 300 billion baht once again after falling in the middle of the year, increasing 8.5% from 2019. In the direction of RMF funds this year, it is considered to have inflow in the quarter. Finally, that is higher than every year at 31 billion baht, including a net inflow of 36 billion baht, of which approximately 23 billion baht is an inflow of RMF – Equity funds. Most of them were new funds in the last quarter. Including mainly foreign funds such as Global Equity or China Equity, etc.

Average Return RMF has a group of gold funds. (Classified as RMF – Other) with the highest one-year average return of 15.9% followed by the equity fund (RMF – Equity) average at 4.3% which is the result of positive returns of foreign stocks but Thai Equity Fund has a negative average return. In the last three months, an average of 11% is due to the recovery of Thai equity investments.

Read news

Fund “foreign stocks” give out rich profits. Year ’20 through the COVID-19 crisis

Year 63, Thai medium-small shares won Big Cap “KTMSEQ” 23.92% champion

Number of audience

77

–