After a dose horribilis linked to the pandemic, nearly half of the country’s businesses said they were unable to take out new loans, according to the results of a survey relayed in the analysis of the government agency.

Despite low interest rates, many businesses can no longer afford to borrow.

Photo : Radio-Canada / Camile Gauthier

—

This figure suggests that there could be an increase in insolvency cases in the coming quarters as the financial situation of companies deteriorates.

Significantly fewer cases filed in 2020

This forecast is set against what was observed in 2020.

Despite a decline in GDP estimated at 5.7% by the Desjardins Group, few Canadian companies filed for insolvency that year compared to 2019.

An insolvency application allows insolvent companies to take shelter from their creditors in order to restructure by maintaining their activities, through repayment installments, for example.

For 2020 as a whole, Statistics Canada observed a 29.3% decrease in these requests compared to the previous year, including 474 in each of the second and third quarters.

View larger image (New window)

View larger image (New window)

A credit file allows companies to free up time to examine their options and in particular to reorganize.

Photo : Radio-Canada / Camile Gauthier

—

This data may seem surprising at first glance (the organization even spoke surprise

) given the financial difficulties exacerbated by the COVID-19 pandemic.

Yes, we were surprised like many observers

, said the Canadian Federation of Independent Business (CFIB).

In previous recessions or economic crises, we saw that it increased very significantly. Once again, we will have to conclude that COVID is truly an unprecedented situation.

Low borrowing rates and federal aid keep businesses on drip

Statistics Canada has mentioned two potential explanations:

Businesses are waiting to see if the government will give more help and if they can manage their debt levels before they file for insolvency.

The low borrowing costs for businesses could also partly explain this drop in insolvency filing.

Since March 30, it is indeed much cheaper to borrow. The Central Bank of Canada set the key rate at 0.25%, a much lower level than in 2019, when the rate stood at 1.75%.

There is a certain limit to the debt capacity, however, said Gaudreault. The financing terms may be good, but at the end of the day, there is only a certain debt you can take with a small business.

Companies that file for bankruptcy or go bankrupt are a consequence of the crisis that is not addressed in the study, noted Simon Gaudreault. According to a provisional report from Statistics Canada, nearly 58,000 companies were no longer active last September compared to before the pandemic.

Photo: Radio-Canada

—

According to him, the government will have to continue to adjust its aid between now and the end of the pandemic to save what it is possible to save.

You know, you are in the marathon, there, you are 5 km from the finish, then you are offered gels, a little water. It might help you get to the finish light a bit, but it’s still very, very difficult when you’re emptied.

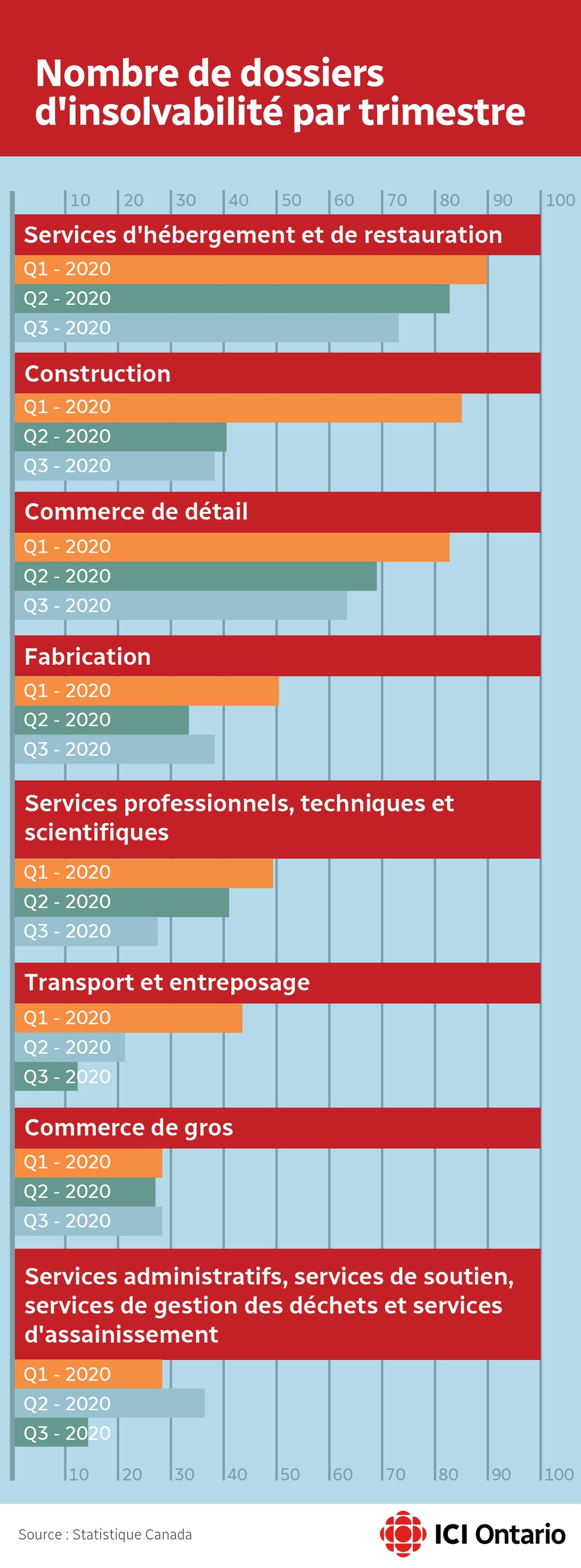

Among the sectors that have used insolvency filings the most are hotels, restaurants, construction and manufacturing.

View larger image (New window)

View larger image (New window)

Companies filed fewer solvency applications in the 2nd and 3rd quarters of 2020.

Photo : Radio-Canada / Camile Gauthier

—

The study also highlighted the fact that large companies, unlike small companies, had to file twice as many such requests in the second quarter of 2020 (21 requests, a historic summit

) compared to the first trimester.

Statistics Canada did not provide the names of the companies concerned, under the Statistics Act.

–