The New York Stock Exchange closed slightly lower Thursday shortly before details of Joe Biden’s stimulus package were announced and after statements by Fed Chairman Jerome Powell.

• Read also: Wall Street: the Dow Jones close to equilibrium, the Nasdaq up slightly

According to final results, after a session in positive territory, the Dow Jones finally finished down 0.22% to 30.991.52 points.

The Nasdaq, with strong technological coloring, dropped 0.12% to 13,112.64 points while the S&P 500 lost 0.38% to 3,795.54 points.

The Russell 2000 index, which includes small caps, had a good day, concluding up 1.94% to 2152.62 points.

“The markets were awaiting the stimulus package” from future president Joe Biden, which he was to announce shortly after the markets closed, said Karl Haeling of LBBW.

To get out of the crisis caused by the pandemic, the president-elect has promised a new stimulus package, which will be counted in “trillions of dollars”. He must present the basics on Thursday evening.

Investors have made “a rotation positioning themselves in banking, cyclical or energy stocks as well as in small caps to the detriment of technology,” added the expert.

The market also reacted to statements by the boss of the Central Bank (Fed), Jerome Powell, at an economic conference.

“He reiterated that the Fed was not going to raise rates soon even if it was possible to see a rise in prices,” said Peter Cardillo of Spartan Capital Securities. Mr. Powell said the Fed “had other tools to use”, namely asset purchases, “without changing monetary policy,” Cardillo noted.

In the bond market, the yield on 10-year Treasuries, which moves in the opposite direction of their price, climbed to 1.1275% from 1.0832% the day before.

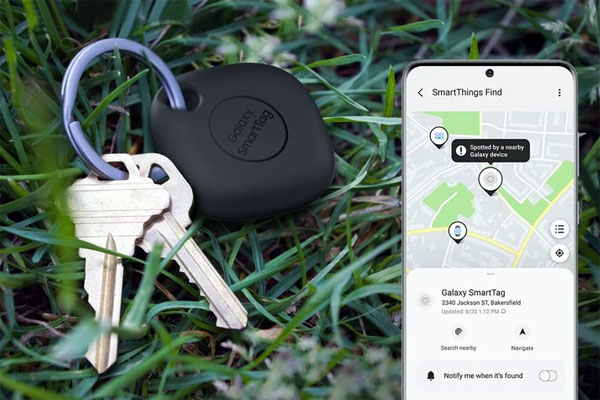

The big names in the technology sector drove the decline in particular Apple (-1.51%) while its competitor Samsung announced a new range of high-end 5G smartphones, the Galaxy S21, at lower selling prices. Facebook (-2.38%), Tesla (-1.10%) and Amazon (-1.21%) were also the object of profit taking.

Investors have notably repositioned themselves in the energy sector (+ 3.01%) while the prices of black gold are on the rise. Chevron finished at + 2.40%. Bank stocks also performed well (+ 0.51%), with Wells Fargo gaining 2.81%.

The US pet store chain Petco got off to a good start on its first day on the stock market. Introduced at $ 18, the title finished at $ 29.40 (+ 63%).

– .