Lina Vargas Vega – [email protected]

–

A revolving credit is part of the category of consumer loans, some analysts compare it to a credit card because it works through a quota, which you can release as you pay your debt, but with several differences.

Like all credits, whoever requests it must meet certain requirements imposed by the financial institution. However, banks are usually more flexible with this type of loan, since they are free investment, and some institutions do not even require a co-debtor for this loan.

Once a certain amount has been tested for your revolving credit, it is deposited in a savings account and you can use it when and for what you want, it is paid month by month with the interest rate and your quota can increase if your income also grow.

Although it is a free investment loan, natural persons who acquire it are advised to use the money in investments that generate more income, but if the loan is requested in the name of a company or legal entity, the money must be used for working capital.

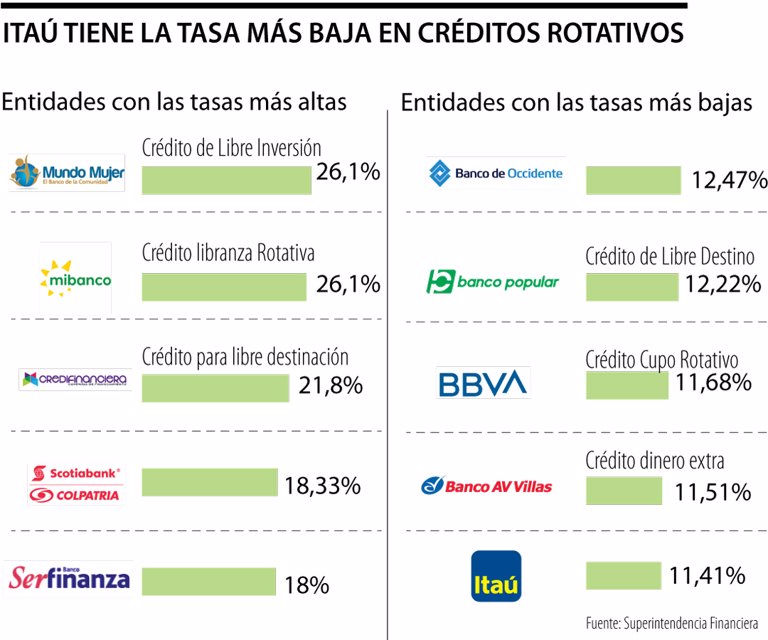

According to the latest report from the Financial Superintendency, at the end of December 2020, the banks with the highest interest rates for this type of credit are Banco Mundo Mujer (26.1%); Mibanco SA. (26.1%); Credifinanciera (21.8%); Colpatria (18.33%); Serfinansa (18%).

On the other hand, the banking entities with the lowest rates are Banco De Occidente (12.47%); Banco Popular (12.22%); Banco Bbva (11.68%); Banco Av Villas (11.51%) and Itaú with the lowest collection in the market (11.41%). It should be noted that the average interest rate for banking entities is 15.89%.

Banks are not the only ones that grant revolving loans. According to the Superfinanciera, these are the financial entities that handle the highest interest rates for this type of free investment loan: Tuya SA (23.92%); Let’s grow (22.09%); Coltefinanciera (21.52%); Money and Finance (20.7%); La Hipotecaria Compañía de Financiamiento SA (20.5%). While the lowest rates are handled by RCI Colombia (14.86%); Dann Regional (14.83%); Trust (14.49%); Cootrafa (13.82%) and National Savings Fund (12.67%).

Other institutions that also handle revolving loans are Cofiantioquia, Financiera Juriscoop, John F. Kennedy, Empresas Públicas de Medellín and Gmac. The average interest rate of non-bank financial entities is 17.55%.

The usury rate currently certified by the Superfinanciera is 25.98%.

One of the disadvantages of this type of credit is a high interest rate compared to housing loans or other modalities. Andrés Moreno financial and stock market analyst explained that “revolving loans are the most risky for banks, since they do not have many payment guarantees, so it is very common for them to stick to the usury rate without exceeding”.

Average interest rates fell 1.2%

The economic crisis as a result of the coronavirus pandemic made the interest rates of both the banking entities and the one established by the Banco de la República, the lowest in a long time, financial analysts predict that this trend will continue this year down to benefit different sectors of the economy. The average interest rate for revolving loans in December 2019 was 17.17%, while for the same month of 2020 the figure was 15.89%, which represents a contraction of 1.2%.

– .

![[이슈시개]’Burning Sun’ exposer Kim Sang-gyo this time… “You saw Hyoyeon-ah’s VVIP” [이슈시개]’Burning Sun’ exposer Kim Sang-gyo this time… “You saw Hyoyeon-ah’s VVIP”](https://file2.nocutnews.co.kr/newsroom/image/2021/01/14/202101141512358312_6.jpg)