Original title: What signal!The valuation of multiple indexes is comparable to 2015. A-shares recorded the biggest decline in the first year, but Baotuan is more focused on the leader… Firewire interpretation

The phenomenon of institutional “grouping” that had been controversial for a while was loosened on Monday.

On January 11, with the significant adjustments in the A-share sector and individual stocks, A-shares also ushered in their first “scale” decline since the beginning of 2021. More than 600 stocks in the two cities fell by more than 5%. As of the close,Shanghai IndexDown 1.08%,Shenzhen Component IndexFell 1.33%,Growth Enterprise Market IndexThe number fell 1.84%.

However, after a closer look, it can be found that the organization’s “grouping” has not completely collapsed, and there is even a tendency to further concentrate.

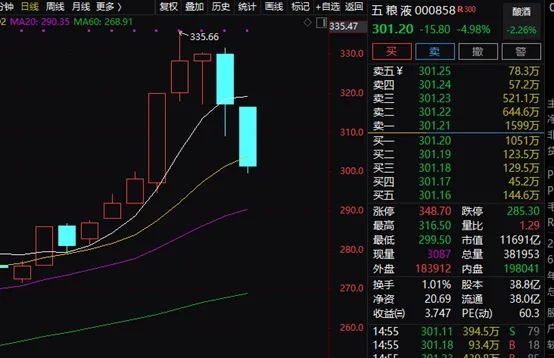

For example, liquor stocks, which have traditionally been regarded as institutional groups, have faintly divided into two camps, Moutai and “non-Moutai”.Leading stockKweichow MoutaiThe stock price rose another 0.47%, while liquor stocks other than Moutai generally fell sharply. Among them,WuliangyeFell 4.98%,Yanghe shares、Shanxi FenjiuSuch declines all exceeded 5%.

What’s more noteworthy is that A shares includeCSI 300、SSE 50The valuation level of other important indexes has approached or even exceeded the 2015 level.

Is “holding group” loose or “holding tighter”? A-shares welcome the biggest adjustment in 2021 on Monday!

January 11, A sharesmarketSeveral major indexes usher in the biggest adjustment since 2021!

The market data of the day showed thatThe Shanghai Composite IndexAt one point, it fell sharply by more than 50 points, and closed down 1.08%.The Shenzhen Component Index fell more than 200 points, or 1.33%, and the small and medium board indexStart a businessThe board index fell by 0.44% and 1.84%, both of which set the most since the beginning of 2021.Big orderDaily decline.

The sudden increase in market volatility stems from the sharp decline of many popular leading stocks in the early period, and these are mostly stocks with strong positions in institutions.

ArowanaThe closing plunged 11.30%, and the intraday plunged more than 14%. The stock has risen all the way before, less than three months after its listing, and it has increased by nearly five times the issue price at most. After the stock price plummeted,ArowanaMarket valueStill close to 700 billion yuan.

Leading pig farming with a market value of more than 300 billion yuanMuyuan sharesIt also suffered a sudden drop, closing down 7.93%.

Photovoltaic faucetLongji sharesOn the basis of last Friday’s decline, the decline was further expanded. On Monday, it fell 3.85%. Another photovoltaic leaderTongwei sharesIt plunged 6.60%.Longji shareswithTongwei sharesTop tenshareholderZhongjun is an institutionGathered, Has recently won the favor of Hillhouse Capital.

The liquor sector stocks, which were previously regarded as a concentrated group of institutions, plummeted on a large scale.

Leading stockWuliangyeTumbled 4.98%, and the intraday drop once exceeded 5%.

Among the other liquor stocks,Yanghe sharesIt plummeted by 5.87%, and the intraday drop once exceeded 8%.Luzhou LaojiaoIt fell by 3.35%, and fell nearly 7% during the session.Shanxi FenjiuTumbled 5.63%.

However, there are exceptions in liquor stocks.

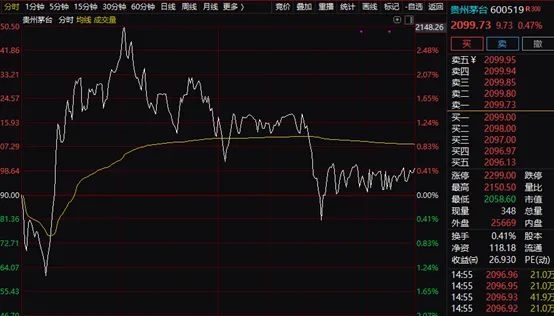

“One brother” in liquor stocksKweichow MoutaiThe performance was stable, even rising against the trend most of the day, closing up 0.47%.

Kweichow MoutaiThe performance is not alone. Leading stocks in many other industries continued to surge, and some continued to hit new highs.

BYDSoared 3.23% and continued to hit a record high.

Mindray Medical、Hikvision、Sany Heavy Industry、Weir shares、WuXi AppTec、SAIC、Great Wall MotorThe same goes for leading stocks in other industries, and their stock prices continue to rise sharply.

Judging from the performance of the above-mentioned stocks, Baotuan seems to be concentrating on the leading players.

CSI 300 and SSE 50 quietly hit a new high in the past 13 years

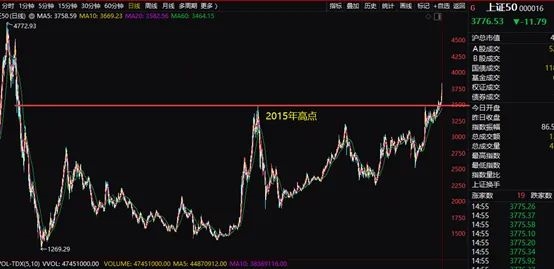

For the A-share market, 2015 is a very important year. The A-share market created a wave of bull markets with the shortest time and the largest level since then. The highs created by multiple indexes became the highs of the following years. .

Under the recent continuous rise of institutional stocks, a number of important indexes in the A-share market have quietly broken through the highs of the leveraged bull market in 2015, setting new highs in the past 13 years since 2008.

The most prominent of these are the Shanghai and Shenzhen 300 Index and the Shanghai Stock Exchange 50 Index.

Market data shows that the Shanghai and Shenzhen 300 Index has continued to rise recently and has quietly broken through the 2015 highs in the bull market. On June 9, 2015, the Shanghai and Shenzhen 300 Index once reached 5380.43 points, which has become the “ceiling” of the index for more than five years, until it quietly broke through recently. On Monday, the index continued to attack, reaching a high of 5555.69 points during the session.

The Shanghai Stock Exchange 50 Index recently broke through the 2015 high, setting a new high in nearly 13 years.

CSI 300 Index and Shanghai Stock Exchange 50 IndexConstituent stocksThe selected stocks in the Shanghai and Shenzhen stock markets with large market capitalization and good liquidity are mostly leading stocks in some industries. The recent rise in the group of leading stocks has pushed the two major indexes to break the 2015 highs first.

While the above two major indexes have reached new highs in the past 13 years, the Shanghai Composite Index, Shenzhen Component Index, Small and Medium-sized Board Index, and ChiNext Index are still far away from their 2015 highs. The high of the Shanghai Composite Index on Monday is still more than 30% lower than the high in 2015.

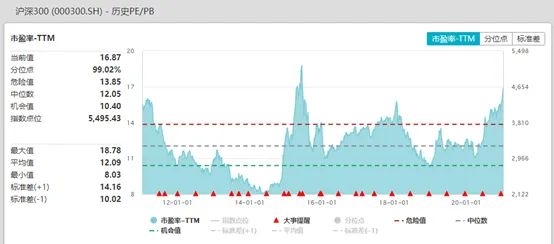

Multiple index valuations approach or even exceed 2015

After the market continues to rise, especially after the continuous rise of leading stocks in some industries, there is still considerable controversy in the market as to whether A shares have become “expensive.”

From the data, part ofMarket indexThe valuation has significantly exceeded the average in recent years, showing an “overheated” state.

The data shows that the CSI 300, which represents the big blue chip, is currentlyP/E ratio16.87 times, exceeding the average level of 12.09 times and 12.05 times of the last 10 yearsMedianThe level is at a high “water level” in the past 10 years, which is close to the peak of the bull market in 2015.

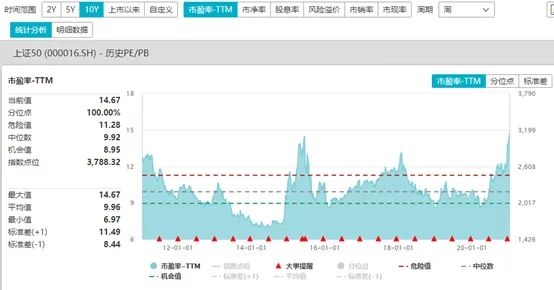

Similarly, the current P/E ratio of the SSE 50 Index is 14.67 times, which has also greatly exceeded the average level of 9.96 times and the median level of 9.92 times in the last 10 years, and has exceeded the peak valuation of the bull market in 2015.

Recently, regarding the phenomenon of institutional groups, market institutions and expertsopinionAlso more divided.

In an exclusive interview with the Securities Times, Chen Jiahe, chief investment officer of Jiuyu Qingquan Technology, said that the A-share market is much more mature than before. Unlike the past few groupings in history, most of the hot speculation this time is high-qualityenterprise. However, the positive cycle formed by institutional investor groups will surely evolve into a reverse cycle in the future.

The signed article by Chen Jiahe published by the Securities Timesmotivation“In “, Chen Jiahe pointed out, “Just as there is no perpetual motion machine in the real physical world, there is noReal economyA real perpetual motion machine other than value creation. Those market phenomena that seem to be perpetual motion machines often prove to be nothing more than a stage of the cycle. However, in the hearts of investors, they are often so yearning for the “perpetual motion machine” capital market story, and in the end they are often lost in the false perpetual motion machine.

Everbright SecuritiesAccording to the research point of view, the possibility of substantial loosening or disintegration of capital groups in the short term is relatively small. For large market value stocks, the short-term uncertainty of the epidemic has made the ability of large market value stocks to resist risks, and the reform of the registration system and delisting system will promote the accumulation of funds to industry leaders in the long term.For consumption, new energy and other self-contained sectors, the obviousPerformanceThe advantage of growth rate and the continuous influx of funds make the grouping of funds in the above-mentioned sectors expected to continue, but investors need to pay attention to changes in the capital and performance of the above-mentioned sectors.Net inflowIf the performance of the sector is reduced or the performance of the sector is not as good as expected, the group of funds in the above-mentioned sectors may loosen. Prior to this, the possibility of a significant loosening of the group of funds is low.

(Source: Securities Times Net)

(Editor in charge: DF537)

–

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.