2.4% of economic growth this year

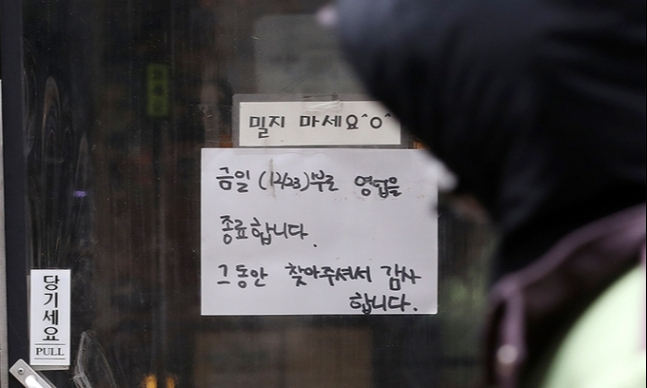

At a restaurant located in a street near Jonggak Station in Jongno-gu, Seoul, there is a word indicating the end of business. News 1

Domestic economists diagnosed that the economic shock caused by the novel coronavirus infection (Corona 19) crisis was similar to the IMF financial crisis in the 1990s and far greater than the global financial crisis in 2008. This year, the domestic economic growth rate is expected to gradually recover to 2.4%.

On the 10th, the Korea Employers Federation announced the results of the ‘2021 economic outlook and expert opinion survey on major economic issues’ conducted with 214 professors of economics and business administration at four-year universities nationwide.

Respondents showed that this year’s economic growth rate was an average of 2.4%, more conservatively than major domestic and foreign institutions.

This is lower than the forecast of domestic and foreign institutions such as the Bank of Korea (3.0%), Korea Development Institute (3.1%), and the Organization for Economic Cooperation and Development (2.8%).

Regarding the future Korean economy, 55.1% of the respondents answered’Nike-type recovery’ (the economy recovers at a gentle pace). In addition, 17.8%, 13.6%, and 10.7% responded that’L-shaped recession’ (long-term recession),’V-shaped rebound’ (recovered quickly after a temporary shock), and’W-shaped double dip’ (recovered economy contracted again), respectively. Occupied.

Respondents answered that the economic shock experience caused by the Corona 19 crisis was 101.7, similar to that of the International Monetary Fund (IMF) currency crisis. In addition, compared to the global financial crisis, the shock feeling was 133.5, which was found to be about 30% greater. The shock feeling is a value evaluated by comparing the Corona 19 crisis, assuming that the impact of the IMF foreign exchange crisis and the global financial crisis on the Korean economy was 100 respectively.

As for the government’s fiscal management policy this year, 48.1% of the respondents answered,’Financial expansion is necessary, but minimal.’ This was followed by’there is a need to maintain balanced fiscals’ (22.4%),’must expand more than the recent trend’ (21.5%), and’a tighter fiscal is necessary’ (7.9%).

Regarding the direction of industrial restructuring, 49.3% of respondents answered that’the government should minimize intervention and leave it to the market.’

“Experts are presumed to recognize that private-led restructuring is necessary rather than government-led in order to improve the fundamental constitution of the industry beyond corporate rehabilitation,” Gyeong-Chung explained.

In addition, 36.6% of the respondents said that the government should proactively support restructuring only for companies or industries that are in a limited situation, as in the recent aviation industry case.

Regarding the highest rate of inheritance tax, 55.9% of respondents said,’A reduction is necessary to ensure business continuity’.

Lastly, about the impact of the launch of the US Biden administration on the Korean economy, 59.3% said,’There will be no significant difference in the overall economic impact.’ In addition, 36.0% of the positive effects and 4.7% of the negative were counted. The reasons for answering positive were’global export increase’ (67.5%),’export increase to the US’ (24.7%), and’expand new business opportunities’ (6.5%).

Reporter Nam Hye-jung [email protected]

[ⓒ 세계일보 & Segye.com, 무단전재 및 재배포 금지]

– .

![[Monster Hunter Rise]Official strategy guide will be released!Capcom Official Monster Hunter Rise Hunting Data[MH-RISE]– Strategy Encyclopedia [Monster Hunter Rise]Official strategy guide will be released!Capcom Official Monster Hunter Rise Hunting Data[MH-RISE]– Strategy Encyclopedia](https://i2.wp.com/s3.ap-northeast-1.amazonaws.com/media.gamepedia/wp-content/uploads/sites/98/2020/12/08184250/51gfGjGx0JL.jpg?fit=500,351&ssl=1)