Jakarta, CNBC Indonesia – A number of gold commodity analysts predict that the price of this precious metal in the global market could penetrate US $ 4,000-5,000 / troy ounce in line with investors’ interest to sink their funds to buy gold amid economic uncertainty.

First, the forecast came from Rob McEwen. Chairman McEwen Mining, a gold mining company in Canada, projects that the price of gold can reach US $ 5,000 / troy ounce due to its increasing popularity among retail investors.

In an interview with Kitco News he cited the movement of US technology stocks which were very popular and experienced very high price increases.

He also highlighted the issue of government debt that has become very swollen, so that gold is an attractive alternative for investment.

“The current debt burden is quite frightening in the US and many other countries around the world as a result of what is happening, related to Covid. There is a threshold when debt to GDP reaches 130%, there is a very real possibility of default,” he was quoted as saying by Kitco. , Friday (13/11/2020).

The next projection comes from Ole Hanson, Head of Commodities Strategy at Saxo Bank. The reason, according to him, was that although the corona virus could eventually be contained, the economic condition was not expected to recover immediately, because there had been massive damage.

“The virus can go away, but that doesn’t mean the economy will recover quickly. There’s been a lot of damage that can’t be repaired quickly,” said Ole Hanson.

The uncertainty caused by Covid-19, which is still high, triggers the forecast for gold prices to shoot up again. Hansen is an analyst who predicts the price of gold will soar to US $ 4,000 / troy ounce in the next few years.

Next, the analysis comes from one of the trading companies in Asia, WingCapital Investment. The amount of fiscal stimulus that is disbursed is considered to be the result of swelling US debt.

The large debt-to-GDP ratio of the US is one of the factors that can bring gold back to its feet.

“Historically we see that the debt-to-GDP ratio has a greater correlation than the balance sheet [neraca] bank sentral AS [terhadap harga emas]”wrote WingCapital analysts quoted by Kitco.

|

Photo: Global gold 12 November 2020 Emas global 12 November 2020- – |

Under current conditions, the price of gold is predicted to reach US $ 3,000 / troy ounce in the next 3 years.

One troy ounce, according to market regulations, is equivalent to 31.1 grams, so that the amount of US $ 5,000 / troy ounce means that it is converted by dividing that number by 31.1 grams, the result is US $ 161 per gram. Assuming an exchange rate of Rp. 14,000 / US $, the price of gold could reach Rp. 2.25 million / gram.

As for the price level of US $ 4,000 / troy ounce, in rupiah terms it can reach Rp. 1.8 million / gram, while the level of US $ 3,000 / troy ounce is equivalent to Rp. 1.35 million / gram.

Referring to Revinitif data, after a landslide of 4.6% in a day earlier this week due to positive news about the Pfizer vaccine, the price of gold has not returned to the psychological level of US $ 1,900 / troy ounce. The price of the yellow metal is moving in a narrow range throughout this week.

Last Thursday morning (12/11/2020), the price of gold in the spot market arena rose 0.34% compared to Wednesday’s closing position.

At 08.55 WIB last Thursday, prices bullion This is pegged at US $ 1,871.06 / troy ounce. For the period 9-11 November, gold prices moved in the range of US $ 1,861 – US $ 1,876.

As for Kitco data on Thursday night at 22.26 WIB, it was stated that the price of gold in the spot market was still low at US $ 1,878, down 0.73%.

Despite the sharp fall this week, analysts have yet to change their projections that gold prices will still soar up to break an all-time high. Some predict world gold will reach US $ 3,000 / troy ounce, to US $ 5,000 / troy ounce as previously explained.

Some of these analysts saw that in the previous period when gold hit an all-time high of US $ 1,920 / troy ounce in September 2011, the rally ended when the rate of increase in the US debt-to-GDP ratio began to decline.

Uncle Sam’s country will continue to pour out more fiscal stimulus, the discussion has stalled due to the November 3 presidential election.

The US President-elect, Joseph ‘Joe’ Biden of the Democratic Party is expected to provide more fiscal stimulus than Donald Trump.

Simply put, the bigger the stimulus means the more money circulating in the economy, in theory the US dollar will weaken. When the US dollar weakens, the price of gold will be cheaper for holders of other currencies, so that the demand has the potential to increase, the price will go up.

Photo: Antam’s Gold November 12, 2020 Photo: Antam’s Gold November 12, 2020Gold Antam 12 November 2020- – |

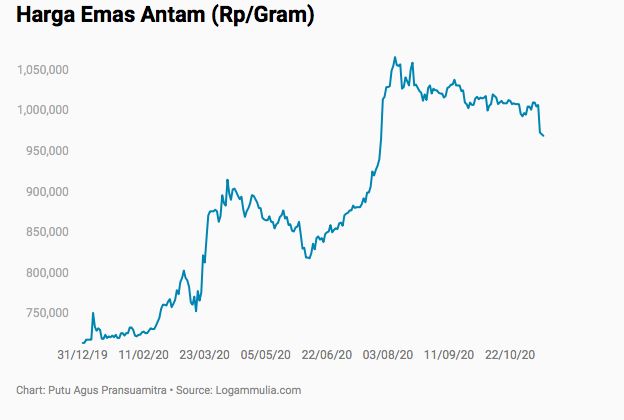

In Indonesia, the price of gold bullion produced by PT Aneka Tambang (Antam) Tbk. fell again in trading yesterday, stuck at the lowest level in nearly 4 months.

World gold prices, which weakened again on Wednesday’s trade, continued to drag down precious metal prices in the country.

Launching data from PT Antam’s official website, logammulia.com, Today’s 1 gram gold bullion is priced at IDR 968,0000 / stick, down 0.21% compared to Wednesday’s price.

Thus, in the last 3 days Antam gold unit 1 gram has collapsed 3.78%, and was at the lowest level since last July 21.

Meanwhile, the 100 gram unit which is usually used as a reference is valued at Rp. 91,012,000 / stick or Rp. 910,120 / gram, a decrease of 0.22%.

CNBC INDONESIA RESEARCH TEAM

(bag bag)

– .

:quality(80)/cdn-kiosk-api.telegraaf.nl/55568262-2495-11eb-a6c0-0217670beecd.jpg)

:quality(80)/cdn-kiosk-api.telegraaf.nl/3bd7e706-2524-11eb-901a-0255c322e81b.jpg)