Input 2021.03.03 06:00

MLCC, camera module, communication, etc.

Continued decline in dependence on affiliates… “Positive to sales soundness”–

–

According to F&Guide, a financial information company on the 3rd, the stock price forecast for this year’s Samsung Electro-Mechanics’ operating profit is around 1.15 trillion won. This is an increase of nearly 40% compared to the previous year, and if this prospect is correct, it means that Samsung Electro-Mechanics will return to the 1 trillion won club in operating profit in three years. In addition, it is also considered as the key to setting a record exceeding 1,149.9 billion won, the highest performance since the company was founded in 2018.

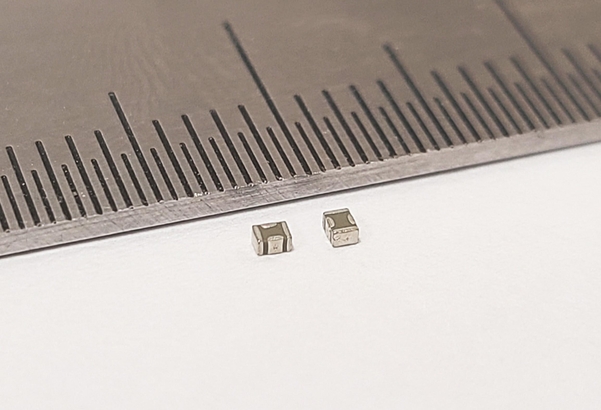

The part that predicts Samsung Electro-Mechanics’ good performance is the expansion of 5G smartphones. This is because a large number of multilayer ceramic capacitors (MLCC), which Samsung Electro-Mechanics is using as its main focus, are being installed in 5G smartphones. MLCC, called rice in the electronics industry, is a stack of capacitors. Capacitors (capacitors) store electricity by placing a material that induces electricity between metal plates and send electricity to the circuit when needed. It is recognized as an essential component for many electronic devices that require stable current flow.

5G smartphones use 20 to 30% more MLCC than the existing 4G mobile communication (4G). According to market research firm Counterpoint Research, smartphones are expected to form a market of 1.52 billion units this year, of which 5G smartphones are expected to have a market of about 600 million units. This is more than doubled from 2722.6 million units last year. Accordingly, the stock price forecast is that Samsung Electro-Mechanics is expected to benefit sufficiently.

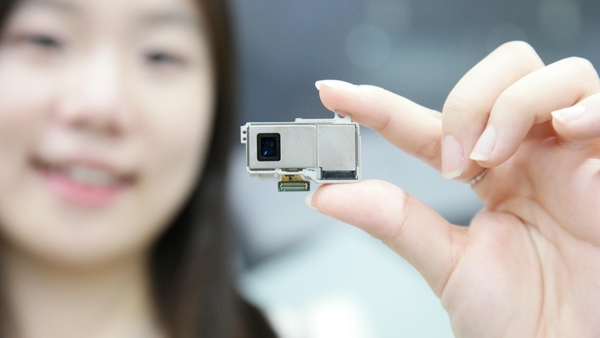

Samsung Electro-Mechanics is also producing camera modules for Samsung Electronics’ Galaxy series. On the 1st, it announced that it has developed a folded camera module that implements 10x optical zoom. It has doubled the performance of the optical 5x zoom folded camera module implemented in 2019. It is expected to supply to 5G smartphones of global customers in the future.

–

–

Along with the recovery of the global automobile market, MLCC sales for automotive electronics are also predicted to increase. In particular, electric vehicle sales are expected to increase significantly this year, which is expected to have a positive effect on SEC.

The global market recovery is inevitable as the number of MLCCs for automotive electronics is several times higher than that of smartphones. If the amount of MLCC in one smartphone is usually around 1000, then 3,000 to 8000 are used in automobiles. For electric cars, this number jumps from 10,000 to 15,000.

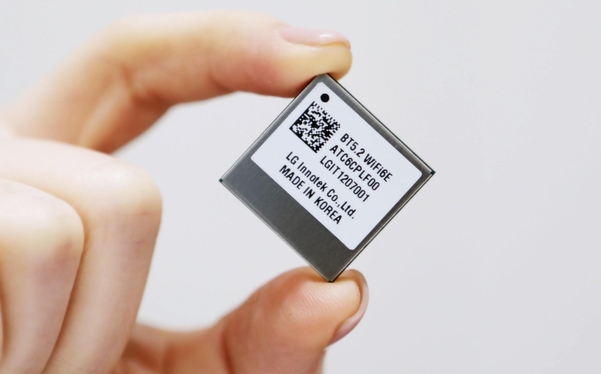

LG Innotek, which surpassed 68 billion won in operating profit last year, is expected to break the record again this year. This is also due to the expansion of 5G smartphones, and stock prices predict this year’s operating profit at 818 billion won.

–

–

In order to expand the supply of parts, LG Innotek also announced last month that it will invest 548.8 billion won in the optical solution division that makes smartphone cameras. This investment is expected to increase the production of camera modules and 3D sensing modules. The industry believes that the number of sensor shift adoption models for overseas customers such as Apple is expected to increase from one to three or more last year, so it is time to respond. The business area of the front 3D sensing module is also expected to expand.

Researcher Kwon said, “Generally, new investments in optical solutions at the beginning of each year will lead to a significant increase in performance in the second half of the year.” However, this becomes a natural barrier to entry and an opportunity to widen the gap with competitors.”

LG Innotek’s electronics division, which had been in the red for 11 consecutive quarters from the first quarter of 2018 to the fourth quarter of 2020, is expected to turn to the black in the second half of this year. This is due to the recent increase in market interest in electric vehicles and autonomous vehicles.

LG Innotek currently produces cameras for battery control management systems (BMS), advanced driver assistance systems (ADAS), and vehicle-to-object (V2X) sensors. Park Sung-soon, a researcher at Cape Investment & Securities, said, “ADAS cameras and V2X sensors are key parts of autonomous vehicles and are expected to serve as a factor for expanding the company’s value in the future.” Unlike LED lighting, the V2X sensor requires a rather long-term breathing.”

–

–

Samsung Electro-Mechanics and LG Innotek have recently found that the proportion of internal transactions is also decreasing. This is due to a decrease in sales of group affiliates while overall sales increase. The industry sees this as a positive situation that could lead to a decrease in reliance on the group between Samsung Electro-Mechanics and LG Innotek, resulting in higher sales soundness.

Samsung Electro-Mechanics posted sales of 3,275.5 billion won last year through transactions between internal affiliates such as Samsung Electronics. This is a decrease of 7197 billion won, 18% from the previous year, 3,995.3 billion won in 2019. On the other hand, the company’s total sales amounted to 8,2087 billion won, an increase of 4904 billion won (6.4%) from the previous year’s 7.7183 trillion won. Accordingly, the share of internal transactions in total sales also decreased by 11.9 percentage points from 51.8% in 2019 to 39.9% last year.

For LG Innotek, the transaction between affiliates, including LG Electronics, decreased by about 70 billion won from 9231 billion won in 2019 to about 85 billion won. During the same period, total sales increased 14.9% (1,239.7 billion won) from 8,302.1 billion won to 9,541.8 billion won, and the proportion of internal transactions decreased by 9 percentage points from 11.1%.

–

– .