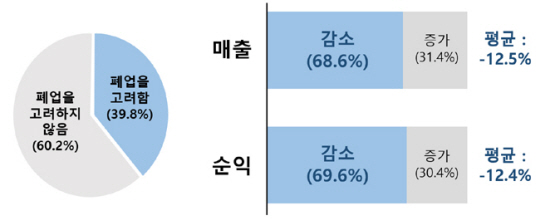

| If you consider closing your business within 3 years (left), survey results for this year’s sales and net income versus last year |

FKI, self-employed survey results

Sales decreased by 68.6% compared to last year

It found that 4 out of 10 self-employed entrepreneurs are considering closing their business within the next three years due to deteriorating business performance or an uncertain economic outlook. As for the economic recovery period, more than half of the respondents predicted next year, 2024 or later.

On the 12th, the Federation of Korean Industries (FKI) conducted a survey of the 2022 performance and 2023 outlook of the self-employed, commissioned by Mono Research, a market research institute, of 500 self-employed workers in restaurants, accommodation, wholesale/ retail and other service industries.

In the survey, 39.8% of the self-employed said they plan to close their business within the next three years. 12.0% responded that they could close their business within 1 year to 1 year and 6 months. Followed by close of business within 2~3 years (10.6%), followed by close of business within 6 months~1 year (8.0%), close of business within 1 year 6 months~2 years (4.8%) and closure of business within 6 months (4.4%) appeared as Reasons for considering closure include continued deterioration in business performance (26.4%), uncertain prospects for recovery economic situation (16.1%), the worsening of the financial situation and the burden of repayment of the loan (15.1%).

68.6% of the self-employed saw their sales decrease this year compared to last year. While social distancing has been lifted, self-employment is not recovering. The answer that net income decreased was 69.6%, reaching 7 out of 10 respondents. The average decrease from last year was 12.5% in sales and 12.4% in net income.

Prospects for next year are also not good. 53.2% of respondents expected a decrease in sales and 54% expected a decrease in net income. Next year’s sales and net income are expected to decline 3.1% and 3.8% respectively from this year. The cost increase factors that have the greatest impact on company performance are △cost of raw materials and materials (22.8%) △cost of labor (21.5%) △rent (20.0%) △capital and interest on loan repayments (14.0%).

The financial situation worsened as the burden of repaying loans increased due to rising interest rates. The average interest rate for the self-employed is currently 5.9%, up about 2 percentage points from last year. The average loan amount is about 99.7 million won. 15.8% of respondents said their loans exceeded 150 million won.

Many self-employed have predicted that the recent economic downturn will continue into the coming year. When asked when the economy will recover, 59.2% of respondents said it will be after 2024, next year. The self-employed said they need government support policies such as expanding financial support such as low-interest loans (20.9%), promoting consumption support to recover consumer sentiment (17.8 %) and the suppression of increases in bills for public services such as electricity and gas (13.3%).

Yoo Hwan-ik, head of FKI’s industrial branch, said, “The proportion of self-employed workers in Korea is about 25%, which is the highest level among OECD countries.

Journalist Cho Seong-jin