So we are at the very end of the month and the end of the weekend will end the next business week. In today’s analysis, we will look at the Bitcoin (BTC) market, where we will analyze the monthly, weekly, three-day and daily charts. Compared to the past In addition, we have just a monthly time frame for the analyzes.

The market is definitely quite nervous, which can be well observed on altcoin market. Somewhere to know more, on other markets, on the other hand, less. Anyway, on Bitcoin it’s probably the most interesting since the last bull run. If you don’t understand, just look at the monthly chart. The October candle is something (from a technical point of view) unusual.

Personally, however, I do not perceive it as anything confirming. As I mentioned in previous analyzes, so for confirmation we would have to close the price much higher. It’s a feast for the eyes, of course, but it’s not convincing. But I have to admit one thing – the chances are slowly shifting in favor of those different moonboys. Maybe they hit the bull run once out of twenty attempts. But as I mentioned, it has not yet been confirmed.

Current situation at 1M TF BTC / USD

So now we have before us a monthly graph in a linear design. As you can see, the October moon candle not only looks solid, but will most likely have a close of near $ 14,000. And if it closes above $ 13,880, this moon candle will have the highest close in the history of this market. That $ 13,880 is just the closing price of the December candle.

Given that the current price is about $ 13,750, the market is very close to creating an important milestone. In any case, it would be quite a bizarre for someone to drop the price below $ 12,000 today. But it doesn’t seem very likely to me, because those opportunities were plenty this week and they remained untapped.

That’s why I’m not expecting any shit today, but that doesn’t mean that the next two weeks may not be corrective. But now to the criticisms I have of the whole situation. Many of you may have noticed that we are currently close to the fibbo level of 61.8% and, in addition, almost exactly to the so-called golden ratio of 65%. These levels play a role in strong resistance. But I see the biggest problem in volumes. The current moonlight has, in my opinion, completely disproportionate volumes to the size of that growth (in relative numbers).

I have marked candles with a similar growth (again in relative numbers) in the graph and you have to admit that our (soon) closed bull volume candle has a significantly smaller one. Notice how the volumes gradually increased between March 2019 and May 2019. Then there was a slight decline in June, but it was still ok. However, from March this year to today, volumes have been steadily declining. A little weird for a confirmed bull run, don’t you think?

Indicators

I’m quite serious about RSI, because a lot of analysts have come to the conclusion that there is a bearish divergence. However, when you look at the peaks, there is no anomaly. The joke is just in the close-up of candles. The close of the June candle last year is much lower, so according to this it is on the RSI divergence. But I must admit that there is no consensus here. As for the MACD, a positive momentum is slowly gaining ground here.

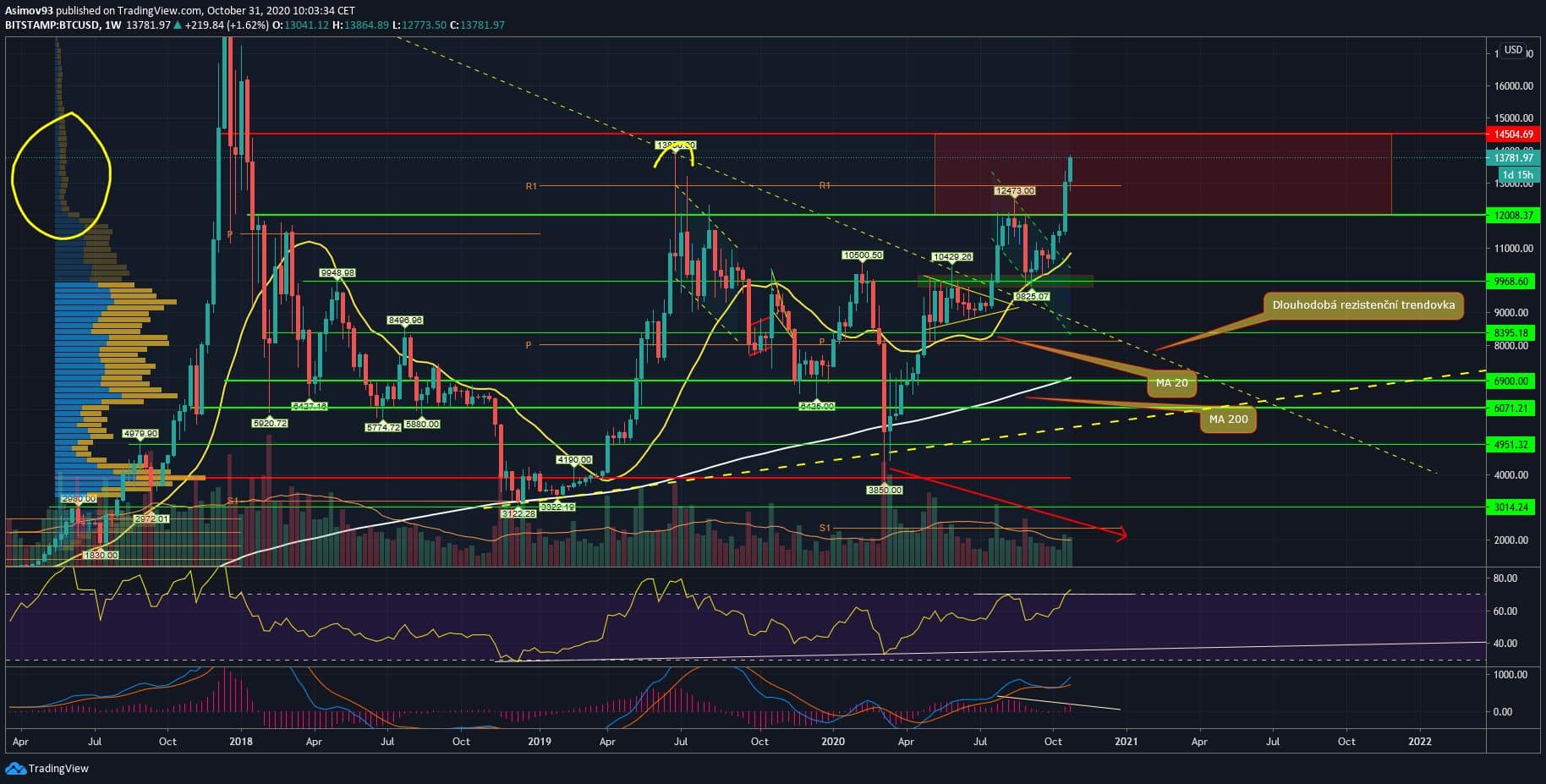

Current situation at 1W TF BTC / USD

According to the weekly chart, we continue to penetrate the resistance band of USD 12,000 – USD 14,500. So we are already very close to the upper limit of the band. In any case, the annual pivot of R1 is clearly broken, which was not successful last year. Weekly volumes are not marginal and quite possibly there is an attempt to reverse the declining trend.

However, we need many more candles to confirm. As for the volume profile, don’t forget that we are in price levels where not much has historically been traded. As I said before, these areas function as resistance, but when the price passes, they are the result of a long impulse candle (poor liquidity).

Indicators

The current RSI values are almost 73 points, so the bearish divergence is probably passé. However, on the MACD histogram, the second divergence constantly haunts us, but it is not valid without confirmation.

Current situation on 3D TF BTC / USD

On the three-day chart, I just want to show that behind the current candle, the bull volume fell a lot again. The initiative is clearly weaker, but very little is enough to create the highest monthly close in the history of the Bitcoin market.

Indicators

Even at the three-day RSI, divergence is probably a thing of the past. The same is true for the MACD histogram, so that several divergences at high time frames remain completely unused.

Current situation at 1D TF BTC / USD

On the daily chart, I would like to show how the market fractal from the turn of July / August is extremely similar to the fractal from the last three weeks. This is not to say that the development will be exactly the same, but it is remarkably quite similar and it would respect the context of the fact that we are within the drawn broadening wedge.

Indicators

We have been on the daily RSI for ten days in the overbought zone of the indicator. This is without debate bullish, but we are generating potential bearish divergence here. In addition, the market will never last too long without purification. When we go to the MACD histogram, another bearish divergence is observable on the histogram.

Conclusion

If I were to take Bitcoin in the context of the global financial market, a lot has changed with the new macroeconomic data for Q3. Gross domestic product grew by 33.1% in the third quarter. So I didn’t expect such a positive result and a lot of things just change the markets.

The data for Q4 will certainly not be so promising, but it will be a long time. As a result, investor sentiment may improve again. So he is still bizarrely good, but it can lead to an even greater ethusiamus – and then up to a new paradigm.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, you always trade only at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–