–

And Wednesday analysis at Bitcoin (BTC), I announced that the Federal Reserve was to issue a statement on interest rates and quantitative easing in the evening. Of course, this has a great influence on the markets, which was reflected in the stock markets right before the press, which began to grow again. But what about Bitcoin?

Bitcoin a Fed

If the stock market response was in the form of growth, it could easily be taken as a good signal for Bitcoin. However, it is good to say that if the stock markets are too strong, they crypto vacuumly speak. However, the volatility on many stocks is currently much higher than on BTC. In any case, I am very curious what will happen now.

As for the Fed’s policy, everything remains the same. It will keep the key interest rate at almost zero and the purchase of assets (THAT) of USD 120 billion will continue. However, it has been suggested that it may begin to tighten in the near future.

Which shouldn’t surprise us too much, as some Fed chiefs have heard that rates should begin to rise soon. Respectively, they expressed their own opinion. What is actually voted on is something else.

However, if some are of the opinion that current policy should ease, it has some weight. I have a lot more on this topic, but we’ll keep it on tonight’s stream.

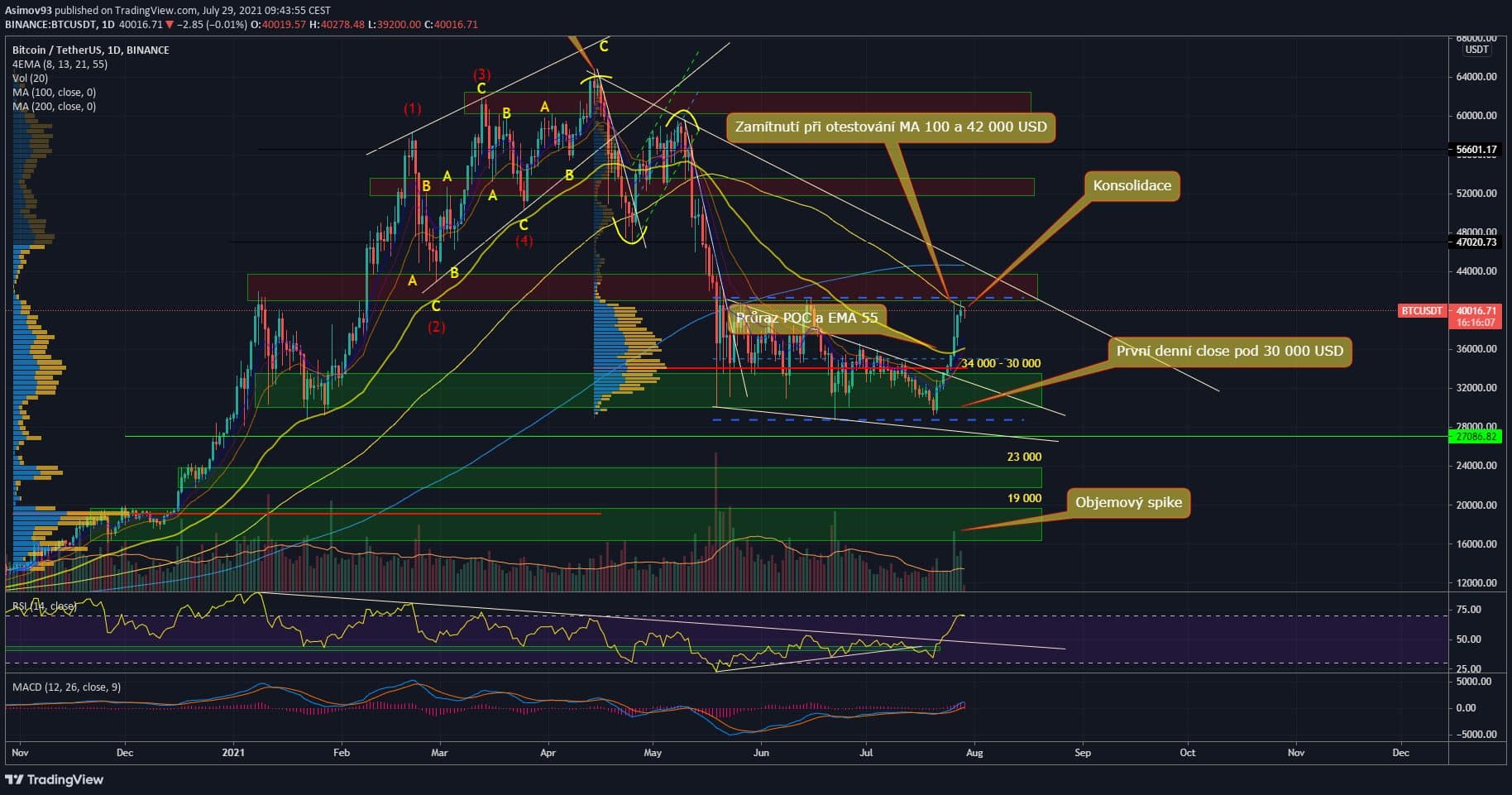

Current situation at 1D TF BTC / USD

Bitcoin for a second test MA 100, Low Volume Node and Key Resistances still consolidating in close proximity. Although there was no breakthrough, even the effort to stay in close proximity naturally counts. It is certainly very important that the volumes remain above average. So at least we know there’s something going on in the market.

Respectively, there are enough shoppers under resistance who are not afraid to push the price up. Of course, there are naturally enough sellers who still calculate that resistance confluence the onslaught of bulls will withstand. However, they are not so aggressive with those shorts, when the price still stays in place.

But it is good to mention that another strong obstacle is MA 200 and plotted resistance diagonal, which starts at an all time high from April this year. Even if the shopper manages to break through the first three obstacles, he can easily turn everything around again in a few moments.

That is why it is very important not to be trapped. Even if Bitcoin breaks $ 42,000, there is no guarantee that the price will actually stay there. Unfortunately, the situation is very complicated and setting the right entry into the market is not easy at all. Those who risked $ 30,000 and no longer sold may not be able to deal with it. But others must now minimize the potential risk.

Indicators

The daily RSI is still at 70 points. So far, there is not enough momentum to continue higher. The momentum on the MACD is growing stronger, but there has been a slight slowdown.

In conclusion

Unfortunately, there are enough potential obstacles for BTC to stop moving forward. On the positive side, we have tested some of these obstacles, allowing us to see the real strength of both sides of the barricades in the graph.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, always trading only at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–