Bitcoin (BTC) and in fact the entire financial market is facing many diverse reports, which are quite often opposing. That’s why we can watch the markets live constellation of emotions. The catalyst for this is the diverse news. Moreover, of course, the market is unable to estimate the impact of these reports in such a short time. A typical example is the disconnection of Russia from SWIFT. No one can fully confirm how fundamental a problem this can be.

Russia’s central bank raises rates to 20%

Russia’s central bank was expected to raise rates. Which they eventually did, from 9.5% to 20%. Such an increase is absolutely unthinkable in the West due to high indebtedness. However, the Russians have public debt at historic lows. That’s why they can afford it, and probably more big ones are waiting for us “Hiky”. I would not be surprised to increase to 50%. But Russia is facing a severe recession. That is already certain.

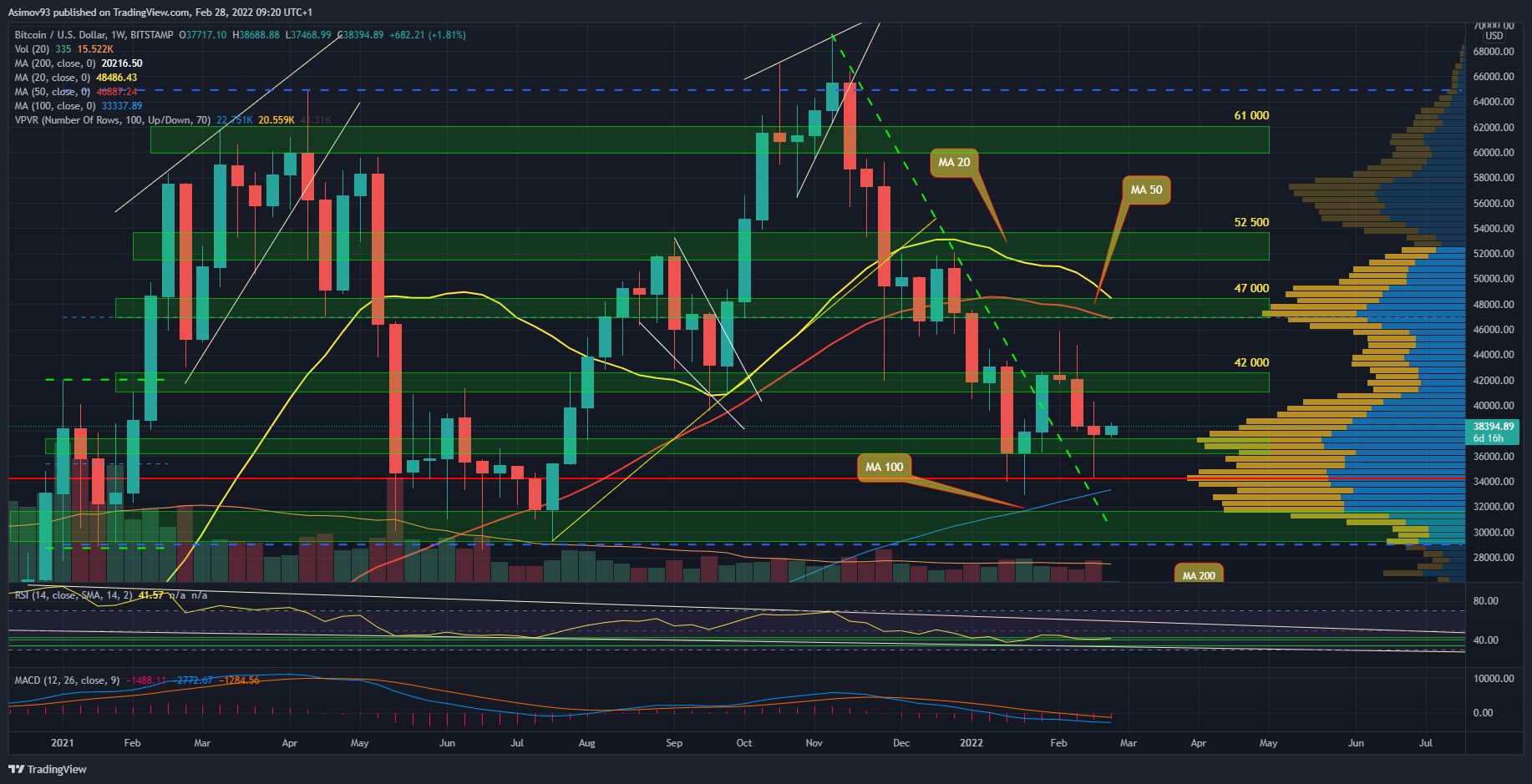

Current situation at 1W BTC / USD

At the end of yesterday, something really interesting happened. On Sunday night, the market started to be enough volatile and for a few moments we seemed to lose S/R level $ 37,000. In yesterday’s video analysis, which I filmed between 17:00 and 18:00, I just said that nothing interesting is waiting for us until the end of the week. However, I was wrong because the situation is starting to be different from last year.

But from a technical point of view, I would venture to say that not so much has happened. Thanks to yesterday’s slump, the weekly candle closed like Doji. At least I would identify her that way. Generally speaking, these are neutral candles, but in context they are more bull. Appearing at the end of a short declining trend, it has a close above $ 37,000 and the lower wick is much longer than the upper with a red body. So the bulls come out of the fight like winners.

That’s why I think the market is more bullish. As in January, we have nice reactions below $ 37,000, where there are obviously enough shoppers ready. Which I just perceive positively. In addition, we have a wick of a weekly candle exactly on point of control volume profile.

But please note that we must not forget the bearish development of the rest of February. We know that it is obviously a terrible problem for bitcoin to continue to grow as the exchange rate approaches $ 47,000. In addition, there are both moving averages – 20 weeks a 50 weeks.

In conclusion

Ta stock market psychology it is now very turbulent. In fact, according to the books, it reminds me of the last century, when geopolitics was often very tense. Like now. In any case, the global financial market is facing a lot of negative consequences. The recession is not just for Russia, they will be the first.

ATTENTION: No data in the video is an investment board. The analysis does not try to predict future price developments. It serves exclusively as educational content on how to approach the market. Before you invest, do your own research and analysis, you always trade at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–