Bitcoin (BTC) had a very interesting price action at the end of yesterday. But even more interesting price action was markets such as stock indices, the gold market or oil. I must definitely mention the dollar index. It was an extremely turbulent development, evoked by yesterday’s market psychology.

Indeed, stock market psychology can change radically on the same day. It is enough for someone powerful to say something. Or the market report just comes to mind and then it is stated that nothing much is really happening. I am currently addressing this phenomenon in the series on psychological market analysis.

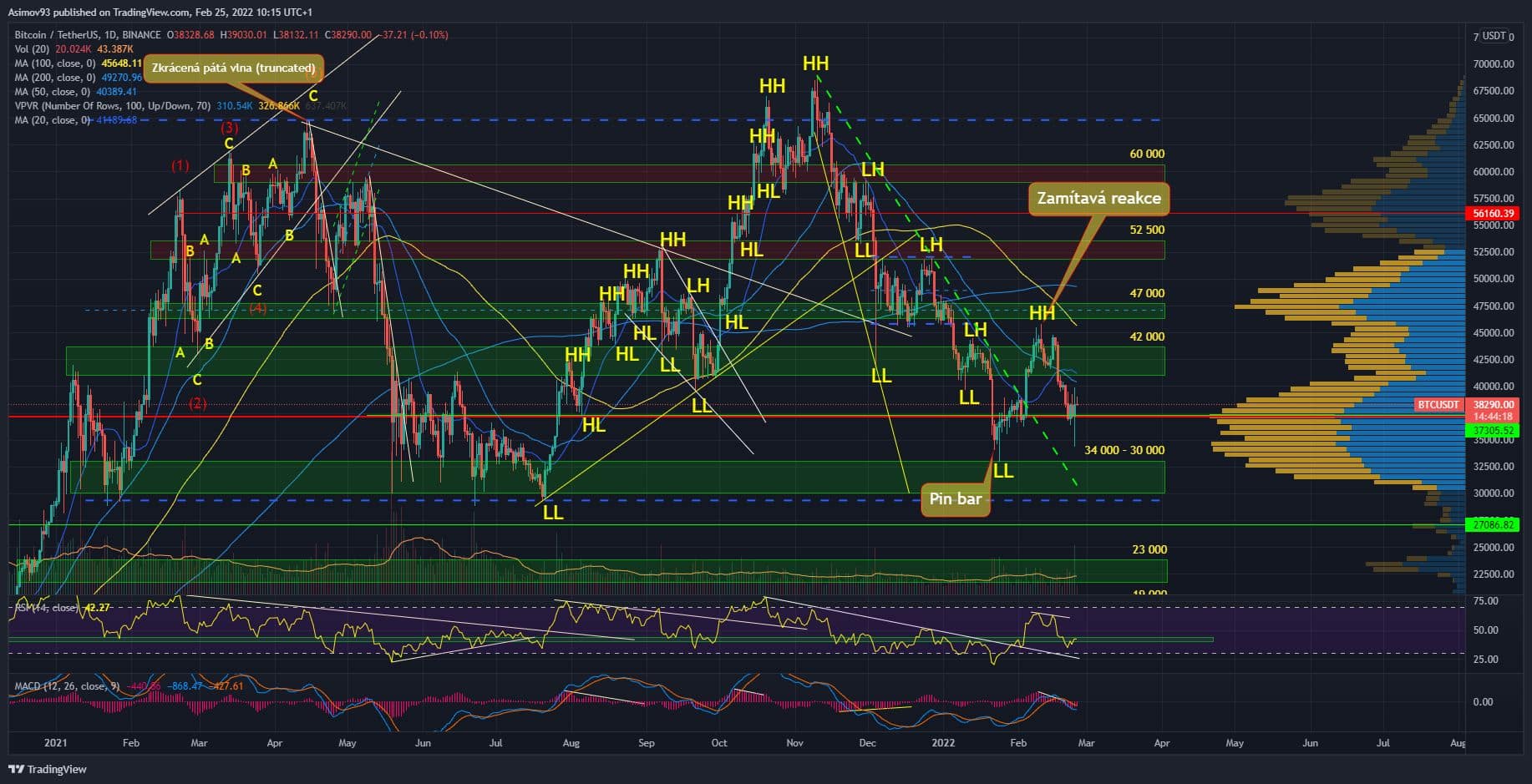

Current situation at 1D BTC / USD

Bitcoin eventually rebounded more or less in the same area as on January 24. Personally, I considered a similar scenario to be an option, but I rather assumed that we would test the $ 30,000 this time. But the exchange rate at the end of Thursday was not much wanted. So we have yesterday’s market low of $ 34,300.

I must point out that we are on volume profile probably shifted point of control. From about $ 34,000 to almost $ 37,000. Which I see as a positive factor. As if the defense from shoppers had moved a little higher from the $ 30,000.

However, I would be careful because there is still a high probability that we will test the $ 30,000. Maybe when we least expect it. In fact, the risk of falling to $ 30,000 persists at least until we are below S / R level 42 000 USD.

As for Thursday’s close, the shape of the candle is close to New Pin. Even given those massive volumes I consider this candle to be bull signal. For that reason alone, I think that the market is very close to the market bottom and there should be a recovery that will hopefully last at least a few weeks.

In conclusion

Emotions pulsed from the market during yesterday. No one knew what would happen, which is normal in geopolitical problems. In the end, however, the markets probably take it quite neutrally. But that can change again – no one sees the future. Market psychology is very fickle.

ATTENTION: No data in the video is an investment board. The analysis does not try to predict future price developments. It serves exclusively as educational content on how to approach the market. Before you invest, do your own research and analysis, you always trade at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–

Binance Referral Code R277WOFC , Binance Referral Code By signing up using this Binance referral code, R277WOFC, new Binance users get a lifetime fee rebate of 20 when they trade cryptocurrencies on the platform. Getting started is simple and easy. You’ll be required to verify your account and identity, but it doesn’t take too long.