Bitcoin (BTC) and pretty much the complete market are fast turning to the downside. It really is genuinely just the beginning, but individually I am of the similar belief as numerous many others. That is, which is a continuation in just the main bearish trend. As I have prolonged pointed out, the turnaround can be rather fast. Thus, it was fantastic to be geared up for this chance.

If not, I produced one more just one yesterday brief instructional material in the type of a movie. This time the topic was the RSI indicator, so go for it.

Full hazard out

The greenback index closed past week in the reverse vary of Bitcoin. In just 1 week, the index acquired 2.4% and we also have a better weekly near. Many thanks to this, we have an impulsive form of a candle in the chart, which confirms an intense uptrend. And an intense uptrend in the greenback index implies total to hazard market surroundings. I warned of the threat out two weeks in the past and it definitely arrived. It was enough to start from the potent pattern that awaited us.

The elimination of hazard is now manifesting totally in all places. ON shares, bonds, BTC and also on important metals. The desire for the dollar is definitely robust. Which, by the way, is a normal symptom in pre-crisis intervals. No person needs to keep assets that are not instantly liquid.

When there is a crisis, everybody Hard cash in a major way mainly because it protects them from likely failures. Devoid of enough liquid property no small business or relatives can functionality. As a end result, there is not a great deal fascination in belongings like stocks and cryptocurrencies. At least not now.

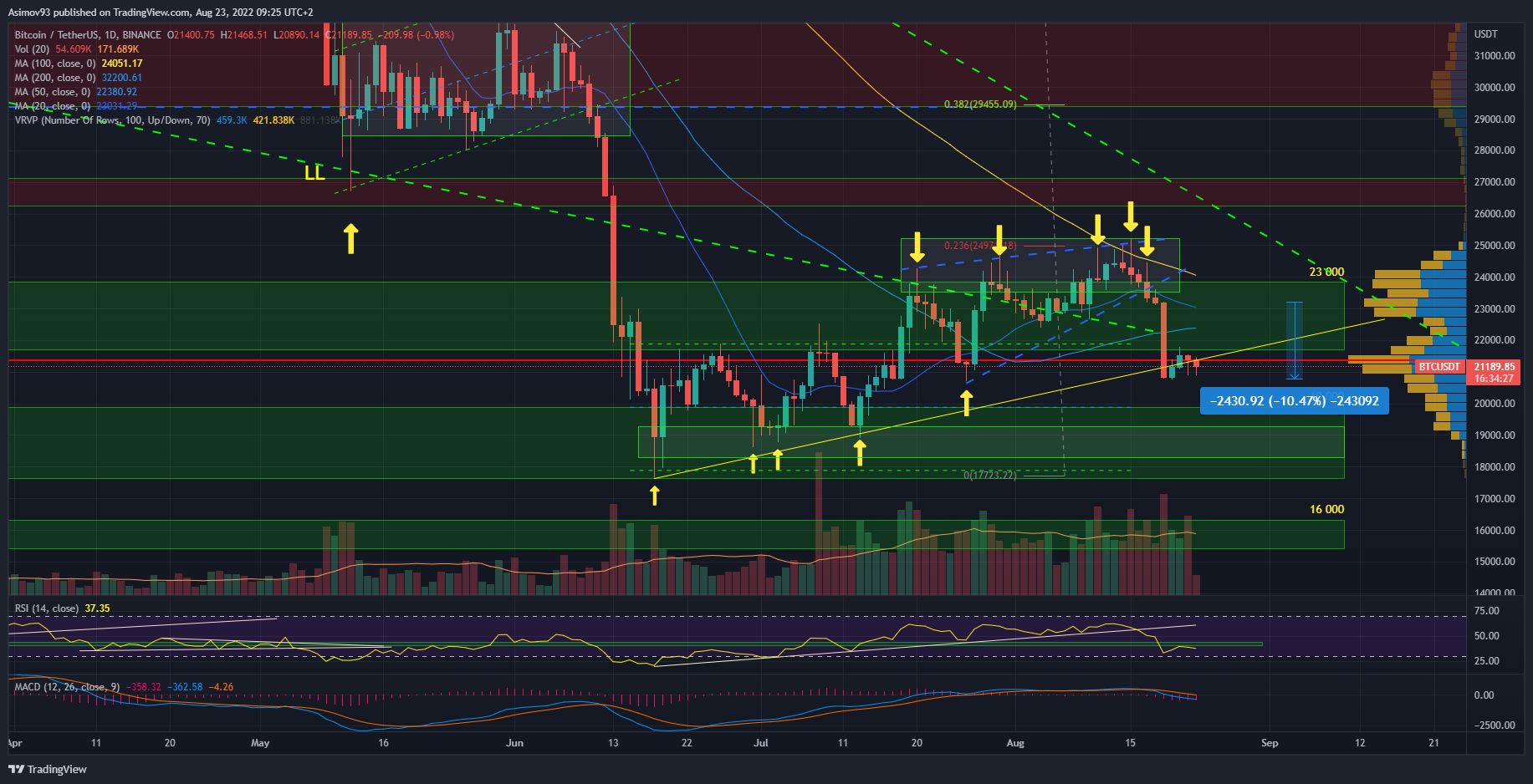

Present predicament on 1D BTC / USD

We have confronted the everyday chart with BTC numerous occasions, as there was a gradual textbook reversal on Friday which led to the significant fall of more than 10%. We have not had these a significant drop in the chart for a whilst now. And the critical factor is that the volumes are also significantly over the expectations. Or one particular of the biggest. Thus, it is vital to acquire the slide from the increasing wedge critically.

As talked about yesterday, the BTC price has stopped at command position volumetric profile. We have been consolidating considering the fact that then and it’s not 100% distinct if Bitcoin blew up that diagonal pattern. This generally defines the modest composition of the uptrend. But not fully, as the market hit a marketplace low for the 1st time since mid-June. Bitcoin broke the minimal of July 26.

Now, the largest impediment for bears is the highlighted concern location. Here I assume a sturdy defense, the place we can choose the medium-expression trend of the training course.

In shorter

Bitcoin has held up very very well since Friday’s drop, to the position of astonishing me. The inventory industry carries on to decrease, though the dollar index continues to bolster. Having said that, Bitcoin is not heading down. So we’ll see what the rest of the 7 days delivers.

I am new and ahead Linkedin, where by I share some of my insights and best posts. Really feel free of charge to stick to me there.

If you have any concerns about cryptocurrencies, don’t hesitate to join us dialogue teams on Fb. Don’t forget about to join ours too official discord server KRYPTOMAGAZIN CZ. We also have Youtube channelwherever you can sign upso you will not miss any movies or streams.

Attention: None of the information in the report is investment information. The analysis does not endeavor to forecast future rate developments. It serves entirely as an educational written content on how to feel about the industry. Do your investigate and evaluation ahead of creating any investments, always trade at your very own chance. The kryptomagazin.cz workforce strongly endorses particular person chance consideration

–