Jerome Powell’s eight-minute Jackson Gap speech cost globe marketplaces two trillion current market capitalization: the richest Us residents dropped $ 78 billion in prosperity in those people 8 minutes. So it was one particular of the most “costly” speeches in historical past, a single could say. If you component in Powell’s eight-moment speech in Jackson Gap and the ensuing international decline of two trillion dollars down to just one 2nd, the Fed chairman has a decline of $ 4.2 billion for every next!

Powell in Jackson Gap – prepared to take the discomfort

Fed chairman Powell made it very clear to the markets that the US central bank would not immediately adjust course in its interest level plan, but would in its place preserve curiosity prices higher for a more time time period of time, largely in get to reduced prices. inflation expectations. Jerome Powell stated former Fed Chairman Paul Volcker three periods in his speech, a obvious indicator that Powell preferred to signal to the markets his willpower to battle inflation.

Even if preventing inflation will lead to soreness, as Powell built distinct: “they will also bring suffering to families and corporations” (…). “These are the unfortunate prices of minimizing inflation. But failure to restore rate stability would indicate substantially better ache. “

The ache arrived swiftly, primarily hugely rated US tech stocks dropped sector cap. This is costing dearly to all those tremendous-abundant People who have considerable stakes in these providers, like Tesla’s Elon Musk. In truth, the US Federal Reserve led by Jerome Powell has now come to be an “enemy of the stock markets”. Because if stock markets get rid of market place capitalization, the so-termed “economical circumstances” shrink. This cuts down need, which in change reduces the source / need imbalance, which sales opportunities to inflation.

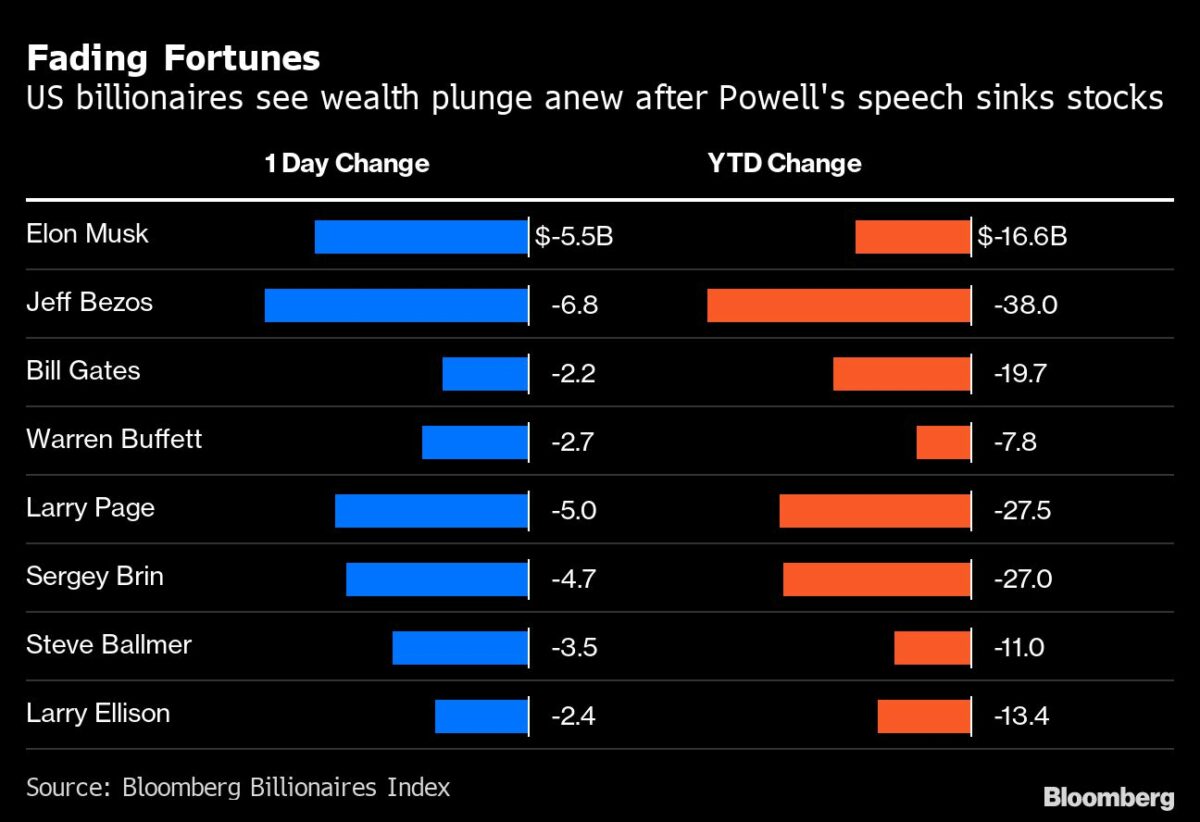

The decline of the tremendous prosperous from Powell’s speech

But how are the losses of the tremendous loaded in detail? Bloomberg writes:

In just eight minutes, Federal Reserve Chairman Jerome Powell triggered a stock industry crash that eroded the prosperity of the richest People in america by $ 78 billion.

Elon Musk dropped $ 5.5 billion of his fortune. Jeff Bezos missing $ 6.8 billion, far more than any individual else in the Bloomberg Billionaires Index. The fortunes of Monthly bill Gates and Warren Buffett fell by $ 2.2 and $ 2.7 billion, respectively, whilst that of Sergey Brin fell under $ 100 billion.

Powell utilised his speech at the Kansas Town Fed’s annual monetary coverage discussion board in Jackson Hole, Wyoming, to reiterate that the Federal Reserve will carry on to increase interest premiums to lessen inflation and will probable maintain them large for a even though. bit’. This was found as a reaction to the new rally in US fairness marketplaces, which had been fueled by speculation that intense monetary tightening could quickly be phased out.

The S&P 500 fell 3.4% on its worst day due to the fact mid-June. The substantial-tech Nasdaq 100, whose primary individual shares consist of Microsoft Corp., Amazon.com Inc., Tesla Inc., and Alphabet Inc., fell much more than 4%.

Couple of billion-dollar fortunes have been spared this 12 months. The 500 richest people today in the entire world dropped $ 1.4 trillion in the 1st fifty percent of 2022, the steepest fall in 6 months for the richest folks in the earth. In July, having said that, US equities recorded their strongest month to month rise because November 2020, leading traders to think the worst of the current market crisis was in excess of.

As a substitute, Powell’s speech served as a reminder that valuations for substantial tech firms are even now high by historical expectations. For the duration of the Covid-19 pandemic, when curiosity prices have been near to zero, they had risen at an unprecedented price.

FMW / Bloomberg

Examine and compose comments, click on listed here

–