–

Today we will continue the text analysis on Bitcoin (BTC). We have a weekly close, so we will briefly analyze the weekly chart where it was generated signalwhich can be very relevant for the market. Therefore, it is good to know it and understand the possible consequences when the market decides to apply it.

In any case, I will also state that the dollar index (DXY) opens a new week in green, which means for us that the so-called risk-off environment in the markets clearly dominates. We’ll see what the bond ETF will do when the markets open in the afternoon. However, I would venture to say that they will also start a new week in terms of growth. That is, as long as the US dollar and the bond market strengthen, investor sentiment is gradually deteriorating.

Current situation at 1W TF BTC / USD

As promised, we will start with the weekly BTC chart. I would probably start first with the volumes and form of a freshly closed candle, which is visually definitely bearish in nature. However, this is not a significant loss. The volumes are almost the same as last week, so no change in this regard. The cucumber season simply continues.

However, the weekly graph generated one very important signal – we have the first ever close pod MA 50 in the last 15 months. This is certainly a fairly important signal, with the market threatening to react with another strong wash, most recently at the weekly close below MA 20 in May. Indeed, markets in the habit of MA 20, MA 50, MA 100 and others should not be left unanswered.

In May, Bitcoin reacted to the close below MA 20 almost immediately, so that’s why the current week deserves our careful attention. If there is a similar response as in May, it is good to calculate a drop of about 35-40%, which would lead to Bitcoin about 20,000 USD. Which is exactly the level that many of us are waiting for.

Current situation at 1D TF BTC / USD

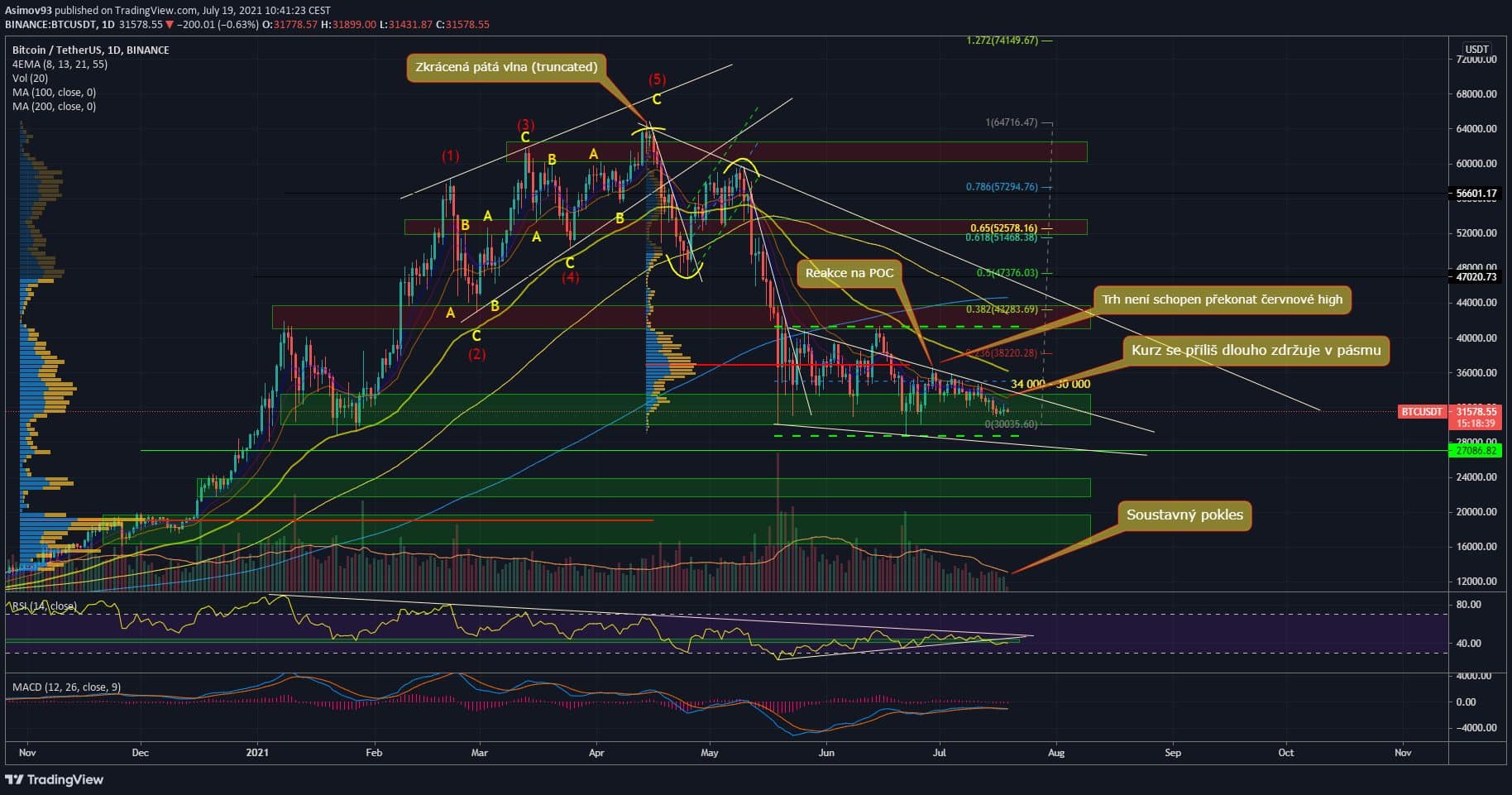

As for the daily chart, as I said in Sunday video analysis, I have noticed that a falling wedge is increasingly appearing in the graphs. Personally, I don’t agree with this pattern very much for the reasons I gave on Sunday. However, as it appears more and more in public space, I drew it there for completeness.

In any case, Bitcoin has been within the marked support zone for more than a week. I repeat, the market clearly changed the environment, because by the end of June, each penetration into the zone was quickly redeemed. At the beginning of June, this initiative on the part of shoppers began to disappear and the last seven days are completely gone.

The persistence of the exchange rate within the band is not logically exactly bullish, on the contrary. On the other hand, even the sellers do not use the situation much. Respectively, there is no greater move and effort to bring the exchange rate to a breakthrough of $ 30,000. In general, both sides of the barricades are now quite passive, but clearly in the range of $ 30,000 – $ 42,000 bears win.

As I said during the week, I am more in favor of more movement in the second half of July. And given the fresh signal in the form of a close under MA 50, there is a good chance that it will take place this week. That’s why it’s definitely worth watching Bitcoin actively this week.

Indicators

The RSI curve has definitely broken through the lower support trend, but Bitcoin has not yet responded. There was a fresh bearish cross on the MACD, also logically no response.

In conclusion

To sum it up today, after a few weeks we have again received a new signal that can be classified as significant. I would definitely not underestimate the weekly close under MA 50. Then we have other signals in the form of a bearish cross on the daily MACD and a breakthrough of the daily RSI curve through the support diagonal.

Those bear signals have been seriously the last few months. While there were not many bull signals, there are virtually none in the higher time frames. To explain this half-pathetically, there is no evidence yet that Bitcoin should bounce back. Of course, this scenario cannot be completely ruled out, but without evidence it cannot be calculated.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, you always trade only at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–