–

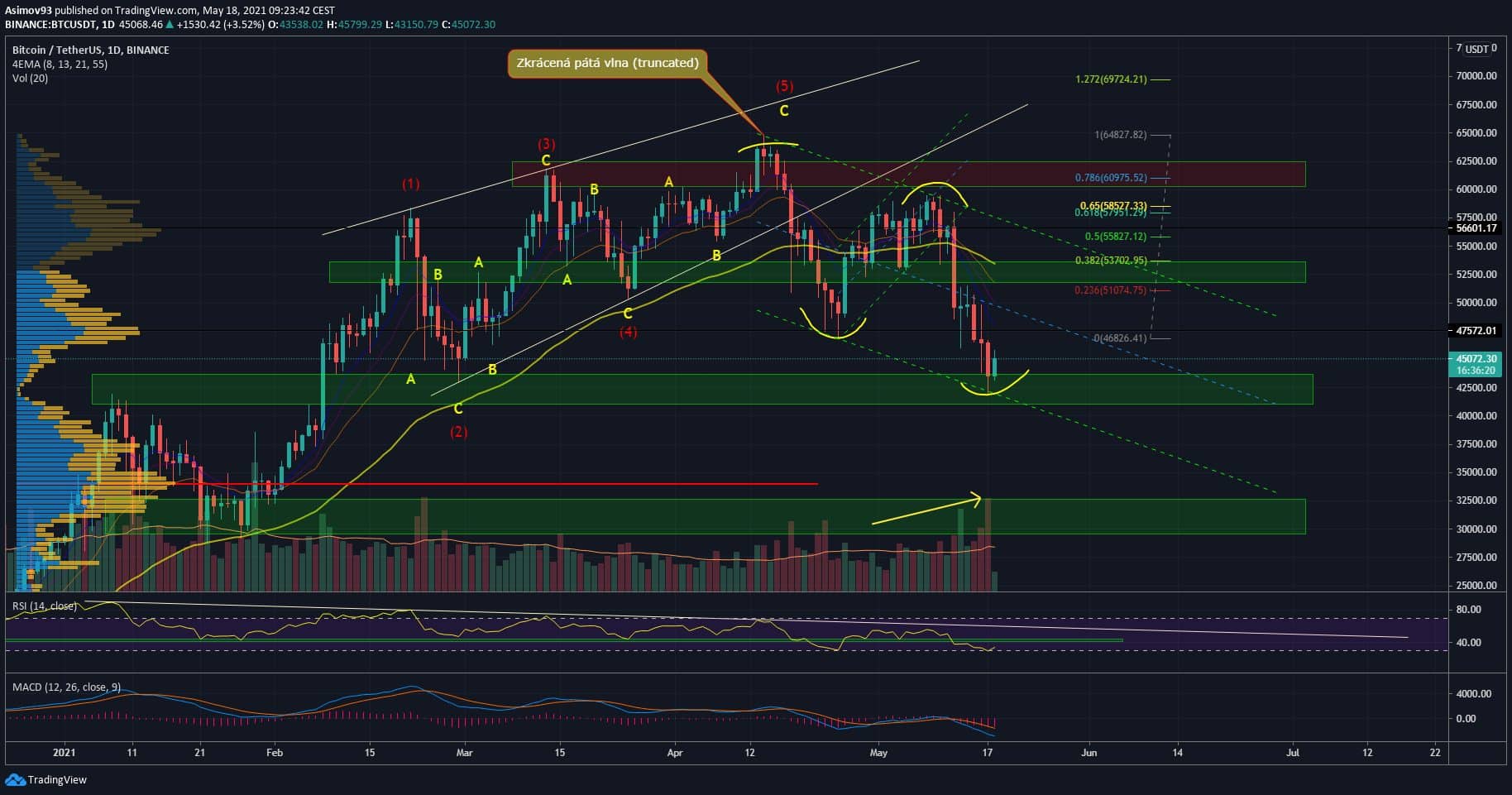

As we said in yesterday’s analysis on Bitcoin (BTC), it was time to at least wait for the daily close, which will tell us much more how strong the level is actually. I can say straight away that the daily close does not have any form, in fact it is quite a disappointment, because I assumed that the initial reaction will have much more power. In short, it was clear that shoppers were hesitant to support.

On the contrary, the sellers were quite aggressive at the support level, which of course is not good. Described may indicate that retail investors are starting to panic. No wonder we have the biggest drop ever during this bull trend. However, that panic can cause people to sell even relatively strong support. At such moments, logic simply doesn’t apply much.

Current situation at 1D TF BTC / USD

So, as has already been said, Monday’s candle doesn’t look very big. We have a reaction here, but it is clear from the bottom wick that the shoppers were not too aggressive. I was expecting something like February 28, when the candle closed like a Pin Bar. In any case, they are still struggling to see if Bitcoin falls below that level.

The course is still very close and it is therefore a question of whether there will be enough strength for expansion. Although the reaction itself is not strong, I would venture to say that in the end we will go up slowly. But I don’t expect much from that. Otherwise, I don’t know if I said that yesterday, but as the price goes down, our volumes go up.

We have Spike from yesterday, when Monday’s volumes are the largest in less than three months. Only on February 23, they were larger. Given that we have a kind of comparison, we can say that the market support certainly helped, although according to the result it was not so visible.

At that time, at almost the same volumes, the price drop was over 17%, now only about 10%. To put the whole thing right, the support we were following was definitely there enough limit orderswhich slowed down the slump. However for market, not many shoppers have rushed to the market and without that you simply won’t pump out the price.

Indicators

The interim bottom at RSI is 29.62 points, which means that we have crossed the 30-point mark for the first time in about 14 months. And there is still a good chance that we will cross again and this time we will go much deeper.

Current situation at 4H TF BTC / USD

On the 4H chart we have to show that the fresh development definitely doesn’t look very nice. Notice that we create again business zone, which could easily mean redistribution. That is why it is quite important for Bitcoin that we will soon see a breach of the upper limit of the band. Otherwise, the same fate can befall us as in the first plot drawn.

The chart also shows that a pile of BTC was traded for the $ 42,000. Therefore, something really happens with the support, some attempt at reacculation cannot be ruled out. If we have reacumulation in front of us, the process itself is quite gradual.

Indicators

There were divergences on the 4H RSI that had already taken place. The same is true for MACD. Otherwise, the MACD is full of spurious signals, where bullish crosses are repeatedly invalidated.

In conclusion

As the previous text showed, I expected a much more aggressive response to the $ 42,000 deal. This didn’t convince me much, so I think there is a chance for a breakthrough. But for Bitcoin, the option of gradual growth is certainly realistic, which would also make sense in connection with the declining channel. Of course, the decisive factor will be where the breakthrough from the current trading zone will lead.

–

:strip_icc():format(jpeg)/kly-media-production/medias/3393910/original/085446100_1614931005-redmi-note-10s.jpg)