Bitcoin (BTC) had a very turbulent development yesterday. At first, we were once again approaching the key level of around $ 47,000, but then came a small but very fast rinse. But then the course returned just as quickly. The whole financial market was simply quite affected by the newly published inflation for the month of January.

Turbulent development

To give you an idea, I’m attaching a 15-minute chart to make it clear to everyone what actually happened on the market yesterday. The exchange rate first expanded to $ 47,000, but then suddenly a rinse came. The decline itself was not large, but it was quite fast and especially the volumes were certainly not negligible.

It was an immediate response to the newly published inflation for January. Virtually the entire financial market reacted, not just bitcoin. But then the course returned quickly. Bitcoin reached almost $ 46,000. But then the price went down again to $ 42,000. The stock market had practically the same development.

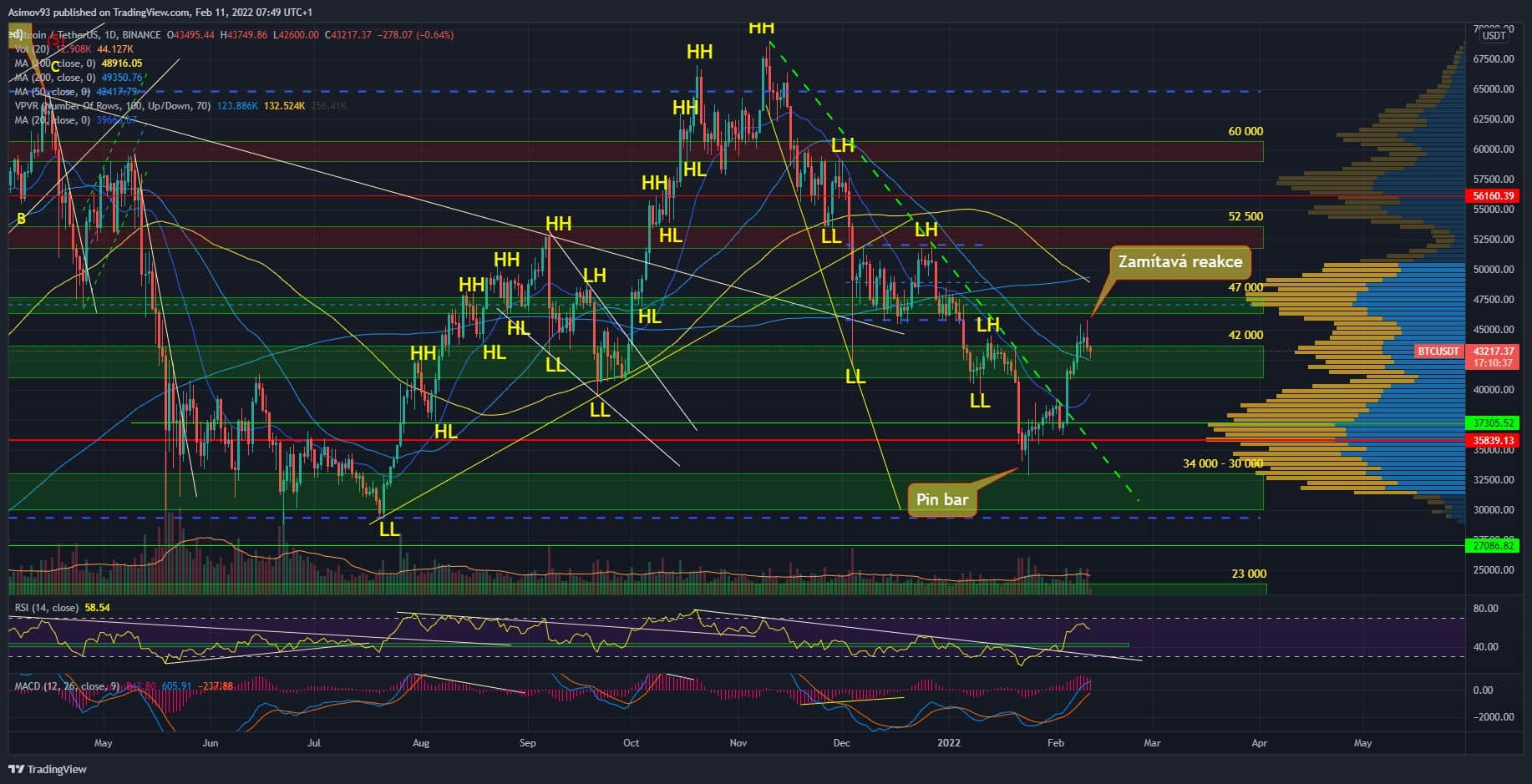

Current situation at 1D BTC / USD

Thursday candles are very important at the moment, because it shows us that the bulls were again beaten near $ 47,000. And this time it was much worse than on Tuesday. At that time, the shoppers showed some initiative and they managed to get the price at least to the daily starting line. However, now supply has not only absorbed all demand, but there have also been losses.

The course was captured again at 50 days moving average. Of course, the fact that it is in close proximity to the S / R level of 42,000 USD also helps. Nevertheless, Thursday’s rejection has not been decided. As long as he holds the $ 42,000, it’s better to assume that we’ll see a real S / R level test of $ 47,000. However, if close support fails, we will probably go back to the market minimum from the end of January.

In conclusion

That turbulent development, of course, tells us something. Markets are already quite nervous about accelerating inflation, which causes this volatility – you can find it in any literature that high inflation causes great emotion in the markets.

ATTENTION: No data in the video is an investment board. The analysis does not try to predict future price developments. It serves exclusively as educational content on how to approach the market. Before you invest, do your own research and analysis, you always trade at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

—