Bitcoin (BTC) really got where we wanted to go – at least some of us. After a very long wait, bitcoin fully tested the S / R band, which rises around $ 30,000. And that’s great, because we have something to work with again. We have an initial course response to this level, so we have early and necessary data to build on.

But so far no big judgments can be made, because the data is scarce. Respectively, something big cannot be deduced from the initial touch. However, it can be said that the price action from the last 24 hours is expected.

By the way, I registered the crash on stablecoin terra on social networks by accident. To tell you the truth, the crash didn’t surprise me at all. On the contrary, I assumed that when the bigger panic started, stablecoins would catch it – that was quite normal in the previous bear market.

But this drop was really massive. Terra fell to $ 0.6. This must have been really crazy. Certainly some algorithms also helped. It’s a pity that it happened at night, because I haven’t experienced that stablecoin has returned to its original value. Otherwise terra is definitely not some no name stablecoin. According to the coin market, it holds the 4th place in stablecoins. However, it is true that, in contrast to tether, market capitalization is volatile.

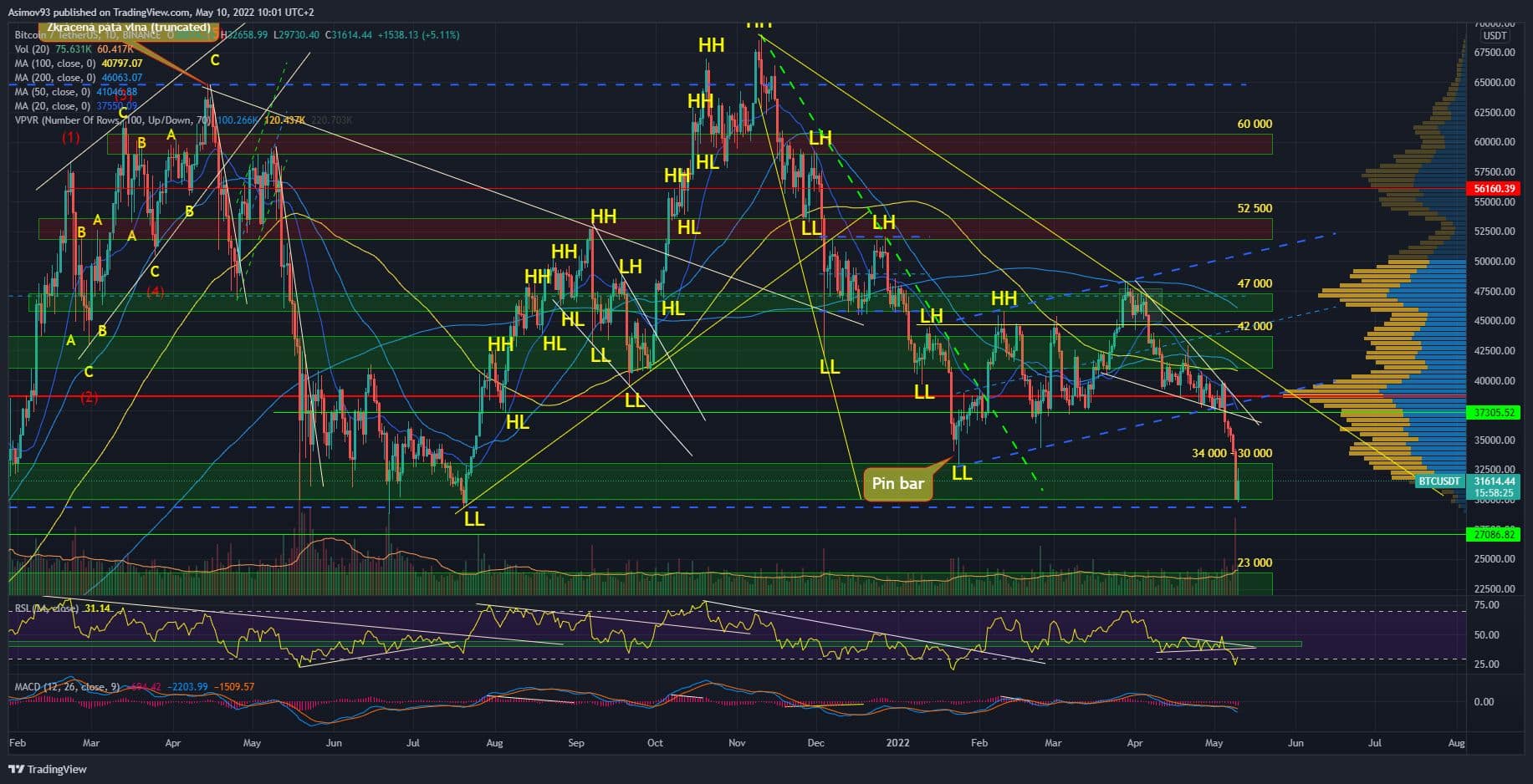

Current situation at 1D BTC / USD

So, as I said, bitcoin fully tested the $ 30,000 support band. Which was exactly what I wanted. Full testing will clearly show us how much liquidity is around the band – nothing complicated to understand.

I would say there was a lot of liquidity because the price went down really slow. In other words, there was a slow buyout of the offer. The shoppers were simply there, but without much initiative – I was just counting on this. I did not think that the reaction would be the same as in May 2021.

I admit, however, that I was hoping for a bottom wick. At least 30-40% of Monday’s candle could have been a wick. Then we could be satisfied. But Monday closed the red candle completely. In other words, the buying party got it through the papule. Respectively, the offer was terribly aggressive – but this is due to the panic and emotions.

Therefore, I would not inflict any catastrophe on the basis of one bad daily close. That retracement is rational to expect after a similar drop. Of course, nothing is certain. However, the market is already terribly oversold. Of course, this is not a bulletproof argument for reflection, but the imaginary spring is again quite compressed.

Indicators

The daily RSI has a bottom at 24.6 points. Quite a solid depth, where retracements usually start. Or at least an attempt at them begins.

In conclusion

Now there is nothing left but to wait for the market to deal with it. The offer was in full force, but I personally counted on it. I would rather guess that bitcoin is waiting for at least several days of consolidation in the support band. I can say for myself that I would welcome something similar. Therefore, remain patient. Especially if you sat down like me.

ATTENTION: No data in the video is an investment board. The analysis does not try to predict future price developments. It serves exclusively as educational content on how to approach the market. Before you invest, do your own research and analysis, you always trade at your own risk. The kryptomagazin.cz team strongly recommends individual risk considerations!

–