Narat debt soared 9 trillion 9 trillion won with this addition

The combined fiscal deficit increased by 14 trillion and approached 90 trillion

Expert “It’s like spending money for future generations without consent”

Hong Nam-ki “The increase is important to the consensus of the people”

<a rel="nofollow" href="https://img.seoul.co.kr//img/upload/2021/03/02/SSI_20210302165626.jpg" title="홍남기 경제부총리 겸 기획재정부 장관이 2일 정부서울청사에서 4차 긴급재난지원급 지급을 위한 올해 첫 추가경정예산(추경)안 편성을 발표하면서 “다시 일어설 수 있는 든든한 버팀목이 되고, 또 일상으로 돌아갈 수 있다는 새 희망으로 다가가길 간절히 바란다”고 말했다. 왼쪽부터 이재갑 고용노동부 장관, 홍 부총리, 권덕철 보건복지부 장관, 권칠승 중소벤처기업부 장관.

Reporter Park Ji-hwan [email protected]” style=”padding:0px;margin:0px”>

–

–

–

▲ Hong Nam-ki, Deputy Prime Minister of Economy and Minister of Strategy and Finance, announced the formation of this year’s first supplementary budget for the 4th emergency disaster assistance payment at the government office in Seoul on the 2nd. I sincerely hope that I can approach it with a new hope that I can return to it.” From left, Minister of Employment and Labor Lee Jae-gap, Deputy Prime Minister Hong, Minister of Health and Welfare Kwon Deok-cheol, and Minister of Small and Medium Venture Businesses Kwon Chil-seung.

Reporter Park Ji-hwan [email protected]

–

–

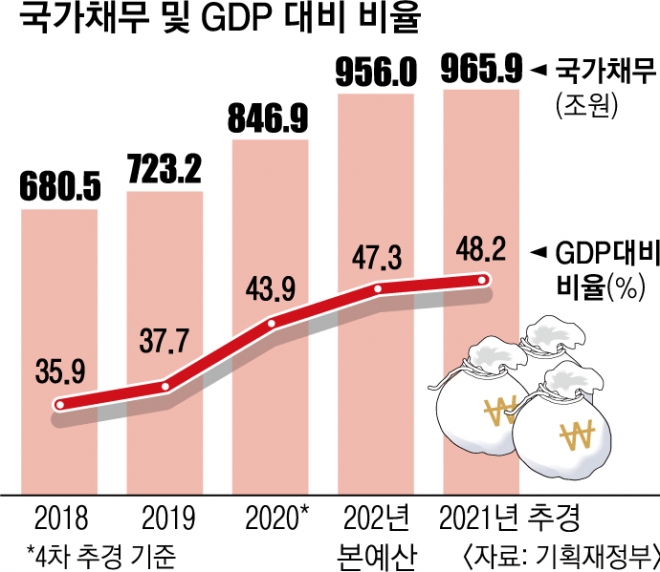

The government debt ratio has reached 50% with the establishment of an additional budget (additional budget) for the 4th disaster support payment. Narat debt also reaches 966 trillion won. There is even a forecast that the debt will exceed 1,000 trillion won after several additional supplementary accounts this year. There is also a growing voice that it is necessary to discuss’increased tax’ in earnest rather than increasing debt through repeated issuance of government bonds.

According to the Ministry of Strategy and Finance on the 2nd, due to the drafting of the supplementary bill, Narat debt was totaled to 965 trillion 900 billion won, an increase of 9.900 trillion won from the original budget (956 trillion won). It was analyzed that the ratio of national debt to gross domestic product (GDP) would increase by 0.9 percentage points from 47.3% to 48.2%. The national debt ratio increases by 0.5 percentage points when pure supplementation is taken, but the adjusted figure (0.4 percentage points) has been added as GDP is expected to be worse than expected.

The size of the integrated fiscal account deficit, which subtracts total expenditure from gross income, is expected to increase by 14 trillion 200 billion won to 89 trillion 600 billion won. The government has been using the managed fiscal balance as a representative fiscal balance index, but in this addition, the consolidated fiscal balance has been put ahead. “We decided to use the integrated fiscal balance as a representative indicator, considering the importance of international comparison and managing our finances in the mid- to long-term,” said Ando-geol Ando-geul, head of the budget department of the Ministry of Science and Technology.

–

–

–

–

–

The pace of debt growth has far exceeded expectations. The National Assembly’s Ministry of Budget and Policy predicted that the national debt ratio would reach 48.0% in 2023 in the report’Analyzing the 1st Supplementary Budget Proposal for 2020′ published earlier last year. However, over the past year, it has passed the 48% mark two years earlier than expected after going through four additional administrations.

Experts believe that the tax increase is inevitable as additional subsidies, such as the National Consolation Fund and the legalization of the loss compensation system, are announced in the future by the Blue House and the ruling party. Dankook University economics professor Kim Tae-gi said, “It is the time when it is necessary to increase taxation,” he pointed out, “It is not a debt that is used for future generations, but instead of taking money from future generations without consent to alleviate the suffering of the present generation.” He said, “I think the increase in VAT is reasonable in terms of universal taxation.” On the other hand, Seong Tae-yoon, professor of economics at Yonsei University, said, “It is an unreasonable decision due to the current economic situation.”

Hong Nam-ki, Deputy Prime Minister of Economy and Minister of Equipment, said in a briefing on the same day, “A national consensus agreement is very important on the issue of tax increases. In the short term, the government is doing as much as possible, such as strengthening the taxation of fugitive income and improving the non-taxation system to cover tax revenues.” He drew a line in the immediate tax increase discussion.

Reporter Sejong Na Sang-hyun [email protected]

–

![[서울신문] 966 trillion debt to debt ratio 48%… The financial burden seems to be inevitable [서울신문] 966 trillion debt to debt ratio 48%… The financial burden seems to be inevitable](https://img.seoul.co.kr/img/upload/2021/03/02/SSI_20210302165626.jpg)