Amid controversy over the resumption of short selling ahead of the end of the short selling ban period, Finance Committee Chair Eun Seong-soo, who attended the Political Affairs Committee’s closed party discussions held at the National Assembly on the 29th, is leaving the meeting room while talking with the Political Affairs Committee Chairman Yoon Gwan-seok. Reporter Yoon Chang-won-The government and the ruling party are actively considering a proposal to resume after the introduction of the preliminary system in relation to the extension of the ban on temporary short selling through closed party-political consultations. Short selling will be extended in March as the system will not be complete, but this does not mean that short selling itself should be banned.

On the 29th, members of the National Assembly’s Political Affairs Committee and Democratic Party members received undisclosed business reports from six government departments under the jurisdiction of the Political Affairs Committee. Reports were made on the general pending issues of the Political Affairs Committee, as well as discussions on short selling, which is receiving great attention from the market. Although it has not been confirmed whether or when short selling will be extended, the market concerns over short selling were pointed out.

Rep. Kwan-Seok Yoon, Chairman of the National Assembly’s Political Affairs Committee, said, “It is necessary for the financial authorities to look at the capital market situation from a financial point of view, and to clarify the enforcement decree through the system improvement legislation.” It wasn’t reported today and the timing wasn’t set.

Rep. Kim Byeong-wook, a secretary of the ruling party of the Political Affairs Committee, said, “There was a concern about the spread of misinformation on short selling, and it was pointed out that the financial authorities need to respond appropriately. Some of the market is concerned that the stock market will collapse if short selling resumes. It is reported that the Financial Services Commission has announced that it will actively review the response.

Provide smart image-Consensus that the party government made many institutional improvements and preparations related to short selling that day, the discussion continued with an emphasis on how to settle them in the market. The core of these is the’computer system’.

Rep. Kim said, “Even though we announced the activation of private loans (shares), if there was no computerization, individuals could borrow stocks through a securities company. I said that I would be sure to monitor, but should there be no monitoring system?” If the improvement is settled well on the site, short selling can be resumed.”

In line with the party’s discussion, the Financial Services Commission and Korea Securities Finance are promoting a plan to increase the number of securities firms participating in the large stock market that lends short-selling stocks to individuals from the current six to ten. Currently, NH Investment & Securities, Shinhan Investment & Securities, Kiwoom Securities, Daishin Securities, Yuanta Securities, and SK Securities are participating.

In addition, it is reported that four major securities companies, including Mirae Asset Daewoo, Korea Investment & Securities, Samsung Securities, and KB Securities, have recently announced their intention to participate in the large stock market. It is interpreted that if up to four major securities companies participate in the large stock market, the supply of stocks that individuals use for short selling will increase from the present, and thus, it will be helpful in activating private short selling. However, an official at a large securities company who decided to participate said, “In fact, it is in the review stage,” and “It will take time because system development and related department agreements are required.”

The Korea Exchange is also preparing for the resumption of short selling by establishing a special supervision team, an organization dedicated to supervising short sales under the Supervision Department of the Market Supervision Headquarters in the recent reorganization. The special management team operates an illegal short sale detection system that the exchange is building, monitors short sale transactions in real time and manages them afterwards.

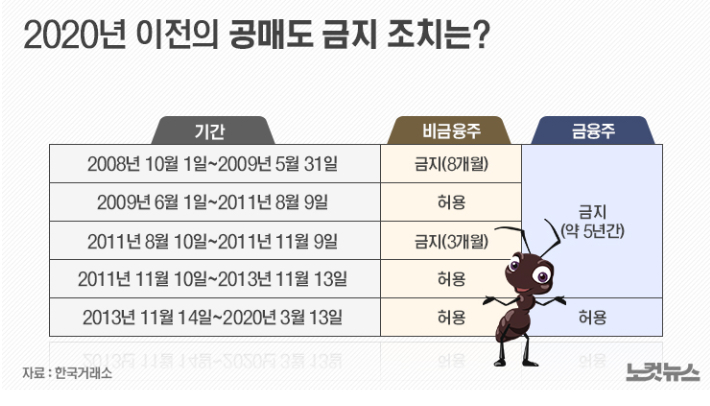

Graphic = Reporter Seongki Kim-Short selling is an investment method in which stocks that are expected to decline in share price are sold by borrowing from a securities company, and when the stock price actually goes down, it is bought again at a low price and paid off. In the domestic market, there is a strong perception that it is the main culprit in promoting the stock market decline because of the investment method that can make a profit if the stock price falls after short selling.

Individual investors argue that there is a limit to preventing illegal non-borrowing short selling with the system improvement proposed by the Financial Services Commission, and argue that short selling should not be resumed until the problem is resolved. The Blue House petition for the’permanent ban on short selling’ has exceeded 200,000 people.

On the other hand, the IMF announced its position on the Korean stock market the day before that “short selling is possible.” Andreas Bauer, deputy director of the IMF Asia-Pacific, pointed out that “the market equilibrium through a full ban on short selling is to respond with a non-sharp tool.” The final announcement on whether to extend the ban on short selling will be made through a resolution by the Financial Services Commission consisting of nine members including the chairman of the Financial Services Commission.

–

![[단독]”Short selling, resuming after system improvement”… Probable extension of the ban for 2-3 months [단독]”Short selling, resuming after system improvement”… Probable extension of the ban for 2-3 months](https://file2.nocutnews.co.kr/nocut/news/meta/20210130070520.jpg)

:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/2SBURHQ2TUANXDQIYKZWOVEJ44.jpg)

/i/1348220208.png?f=fpa)