(Tax Finance News = Doohan Song, visiting professor at Baekseok University of the Arts) Loan regulation for homeless people is to raise the standard LTV and DTI to ‘80%’ without conditions, and in the case of long-term housing mortgages, the standard must be raised to ‘90%’. do. Chronic jeonse crisis can be solved only by lowering the barriers to financial entry for homeless households, and it can contribute to the stabilization of supply and demand and prices in the rental market.

In addition, there is no reason to hesitate because deregulation of LTV and DTI for homeless people is in line with the basic direction of housing policy that promotes real demand and suppresses speculative demand.

Intensifying’housing polarization’ amid booming real estate market

It is necessary to widen the path of’preparing a home’ by easing financial regulations for the homeless.

In the reality of 9 million homeless households,’resolving the housing gap’ between classes is the same as the spirit of the times that the public and the public must solve together. However, the reality is that it is difficult to solve the housing supply and demand problem that arises because the supply cannot keep up with the demand with only the supply of rental housing led by the public. Even if public lease is sufficient, if the dream of obtaining a home cannot be loaded, the person will remain homeless forever or rely on the rental market provided by multi-homeowners. Housing policy in line with the spirit of the times is to drastically lower the barriers to market entry for the homeless, and at the center of this is real estate lending regulations such as LTV and DTI.

The LTV·DTI loan regulation, a key regulation in the housing market, is a measure of potential housing demand for homeless people. If the lending regulation establishes a barrier to entry into the market, homeless end users with weak capital will be pushed out of the trading market and will inevitably shift the cheonsei market. The reason why the housing market is suffering from speculative demand from multi-homeowners is that the current loan regulation loosens real demand regulations, and speculative demand does not correspond to the basic direction of real estate policy strengthening regulations.

In order to harmonize the publicity and marketability of housing supply and supply sufficient quantities, it is possible only when both the public and private sectors operate. The multi-household market is a source of speculative demand and a source of procurement that supplies most of the rentals to the market. 8.89 million homeless households are still bound to rely on the multi-home market. In this regard, the government’s real residence policy can be expected to be effective only when the following premise is established.

First, the LTV·DTI regulations are so complex and meticulous that even financial institution employees can hardly understand them, so it is difficult to understand what the policy aims to be. LTV and DTI regulations for homeless people are largely divided into homeless and low-income consumers, and then discriminatory standards are applied.

The ordinary consumer is a homeless person who satisfies the conditions of’combined annual income of 80 million won and housing price of 500 million won or less’. It is difficult to understand why the end users are regulated by dividing them in two.

Looking at the LTV and DTI regulations for homeless people, 50% of ordinary people’s unattended consumers and 40% of homeless people are applied in areas where speculation and speculation are overheated, and 60% of ordinary people’s unattended users and 50% of homeless people are applied in areas subject to adjustment. In the case of the metropolitan area and other areas, LTV 70%, which is the same standard for ordinary people and homeless, is applied, and DTI is 60% in the metropolitan area, and there are no restrictions in other areas.

The reality is that it is difficult to find places in the metropolitan area that are not in fact regulated areas. In summary, the current LTV·DTI regulation is like sending a message to end-users without homes to go out of the metropolitan area and go down to rural or rural areas to buy their homes. Of course, with current loan regulations, it is not easy to buy a house even in the provinces.

As such, LTV·DTI regulation is not only an underdeveloped policy that cannot keep up with the realities of the housing market, but also causes side effects of widening the “housing gap between classes”. This is why it is necessary to recognize harsh loan restrictions for 9 million homeless people as an issue of public welfare that is difficult to neglect any longer.

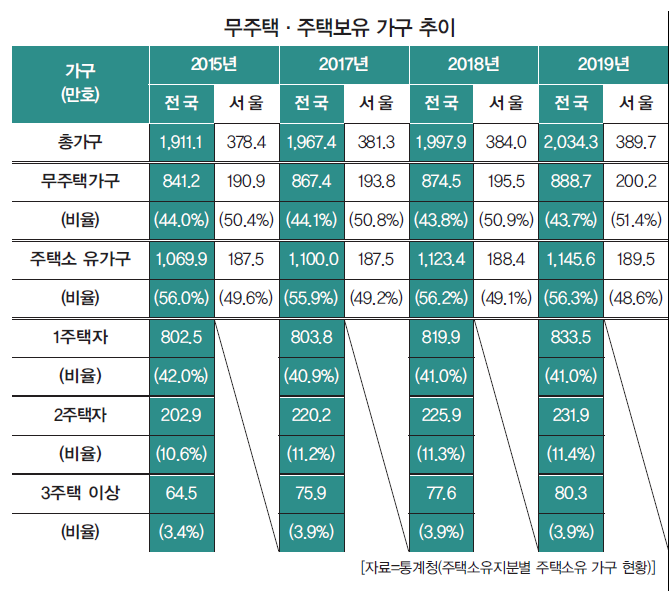

The first problem is that the more financial regulations are strengthened, the more the real demands of homeless people who lack capital power are suppressed, and the speculative demands of the multi-homed people are encouraged, resulting in consequences. The number of homeless households increased from 8.41 million in 2015 to 8.89 million in 2019, while households with two or more houses increased by 15% from 2.67 million to 3.12 million. It clearly shows that it may be difficult for homeless people to enter the market due to the LTV and DTI regulations.

Secondly, the problem of supply-demand and price imbalances facing the cheonsei market is strongly arising from the inability to shift the demand for jeonse by homeless people to the demand for purchase and sale. The supply and demand for jeonse was twisted as homeless people, who had difficulty finding a home due to loan restrictions, were rushing to the cheonsei market. A combination of factors is causing the jeonse crisis, but among them, the LTV·DTI regulation for homeless people is the policy tool that has the biggest impact on the housing market.

The third problem is that as housing loans to end users are blocked, the balloon effect of financing home purchases through credit loans or second financial sectors is evolving into a serious public welfare problem. If these side effects are left unattended for a long period of time, the quality of household debt can be deteriorated, and it can be transferred to household soundness problems or even insolvency of financial institutions. Looking at the credit loans of domestic banks, it surged more than 60 trillion won from 505 trillion won in 2019 to 566 trillion won in the third quarter of 2020.

As housing loans are blocked due to LTV and DTI regulations, end users are raising funds through unusual methods such as credit loans. Paradoxically, the LTV and DTI regulations are turning homeless people into multiple debtors borrowing money from multiple sources. Therefore, it is possible to reorganize the housing market where end-users can survive only when the LTV·DTI regulations for homeless people are drastically relaxed. If so, how should we fix the financial regulations on homeless people?

Increased LTV·DTI regulation for homeless people to 80%

Long-term mortgage up to 90%

First, financial regulations for homeless people should raise the standard LTV and DTI to ‘80%’ level, and in the case of long-term housing mortgages, the standard should be raised to ‘90%’. There is no reason to reinforce loan regulations by placing strict conditions on end-users without housing, although they are going to pay off their debts while living by buying a house by taking a loan.

Specifically, general housing loans for homeless people are allowed up to 80% of the house price regardless of conditions such as regulated areas, and housing mortgages can be allowed up to 90% of the house price as a condition of long-term loans. This is a very desirable policy direction in that it conforms to the basic purpose of the housing mortgage policy.

The reason the financial authorities are passive about deregulation on loans is due to concerns that financial soundness may deteriorate due to problems such as real estate speculation or excessive loans. However, this is just a one-sided argument that both logic and philosophy are poor. If the regulations on LTV and DTI for homeless people are relaxed, but only their’living requirements’ more clearly, the possibility of real estate speculation is close to zero.

Second, it is necessary to unify the LTV·DTI regulation, which acts as a discriminatory criterion according to regulatory designation areas or subdivision of the homeless class, and apply the relaxed standard without discrimination or conditions to all homeless people. In the case of end users, LTV and DTI regulations are applied discriminately according to the regulated area, but it is a wrong policy to extend and apply LTV and DTI regulations to end users.

In fact, considering the current situation in which the whole country is becoming a regulated area, homeless people are no different from going to rural or rural areas and disappearing homes. If the intrinsic purpose of the policy is to increase the number of real dwelling units and block speculative demand, the regulated area standard should not be applied to homeless people who are not speculative consumers.

The basic direction of housing policy is to reorganize the housing market, where real demand and speculative demand are mixed, centered on real demand. The current financial regulations should also strongly promote regulatory dualization within the framework of “deregulation of real users and reinforcement of regulations for multi-homeowners”. This is why the deregulation of LTV and DTI for end users should be taken as the starting point for policy change.

[프로필] Doohan Song, Visiting Professor, Baekseok University of the Arts

• Democratic Financial Development Network Policy Chairman

• KDI Economic Expert Advisory Committee

• Former) Adjunct Professor, Hankuk University of Foreign Studies

• 전) Visiting Assistant Professor (Otterbein University, Columbus, Ohio)

※ Writing: Subprime bubble diagnosis and future ripple effect diagnosis (2007), housing bubble cycle diagnosis and implications through analysis of household loan behavior (2012), etc.

[조세금융신문(tfmedia.co.kr), 무단전재 및 재배포 금지]

– .

![[경제칼럼⑱] Finding the answer in the relaxation of financial regulations for the homeless [경제칼럼⑱] Finding the answer in the relaxation of financial regulations for the homeless](https://www.tfmedia.co.kr/data/design/logo/default_image_share_20160726094110.png)