As U.S. Treasury yields continued to rise, U.S. stocks opened lower on Thursday (25th) and then fluctuated in flat trading. The Dow Jones Industrial Average dropped 37 points or 0.1% at the opening, the Nasdaq Index fell 0.6%, and the S&P 500 Index fell. 0.3%, fee half fell 1.3%.

US Federal Reserve (Fed) Chairman Jerome Powell promised that the Fed will continue to support the economy during the recovery of the epidemic. He also said that it will take at least three years to reach the central bank’s inflation target and ease the market’s recent concerns about rising inflation.

Despite this, the yield on the 10-year US Treasury remained higher on Thursday. Report 1.454% before the deadline. Recently, some depressed technology stocks opened lower and fluctuated upward. Before the deadline, Apple (AAPL-US), Amazon (AMZN-US),Facebook (FB-US) All rose slightly.

On the other hand, GameStop(GME-US)、AMC(AMC-US), Gauss Electronics (KOSS-US) And other stocks favored by Reddit users soared at the opening of the market on Thursday, continuing the strong gains late yesterday.

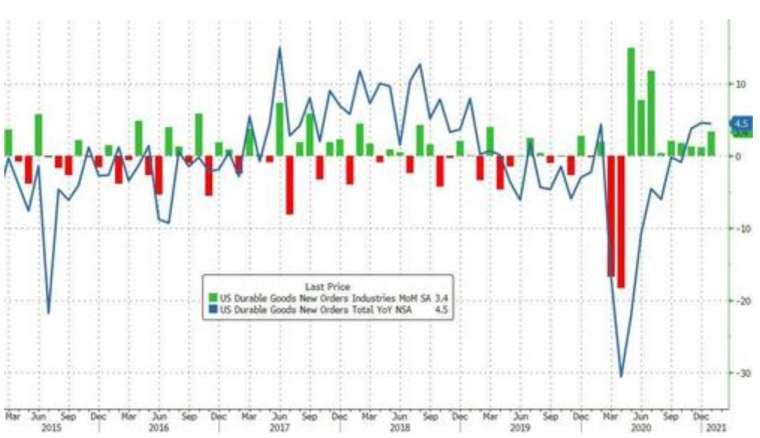

In terms of economic data, the number of people receiving unemployment benefits in the United States fell to 730,000 at the beginning of last week. As the manufacturing industry continued to rebound, durable goods orders increased for 9 consecutive months in January, with a monthly growth rate of 3.4%.

As of 22 o’clock on Thursday (25th) Taipei time:

- The Dow Jones Index fell 37.07 points or -0.12%, temporarily at 31924.79 points

- Nasdaq fell 81.69 points or -0.60%, temporarily reported at 13516.28 points

- The S&P 500 Index fell 13.44 points, or -0.34%, to 3,911.99 points temporarily

- Fees and a half fell by 41.89 points or-1.32%, to 3141.85 points temporarily

- TSMC ADR fell 0.75% to 131.31 per share USD

- The 10-year U.S. Treasury yield rose to 1.454%

- New York light crude oil fell 0.57% to 62.86 per barrel USD

- Brent crude oil fell 0.57% to 66.66 per barrel USD

- Gold fell 1.05% to 1,779.10 per ounce USD

- USDThe index fell 0.37% to 89.84 points

Focus stocks:

Nvidia(NVDA-US) Fell 1.34% in early trading to 572.20 USD。

Nvidia announced its latest financial report on Wednesday. Benefited from gaming and data center revenue, both Q4 revenue and EPS for fiscal 2021 were better than expected, and Q1 financial forecasts were also strong.

Best Buy (BBY-US) Fell 7.15% in early trading to 105.35 USD。

Best Buy announced its Q4 financial report for the 2021 fiscal year. Revenue fell slightly from the previous quarter and was lower than market expectations. The adjusted EPS was better than expected. Chief Financial Officer Matt Bilunas said that the company expects same-store sales to drop by the largest 2% this year, and the largest increase is 1%. In the future, online sales may account for about 40% of domestic sales.

Modern (MRNA-US) Rose 5.26% in early trading to 152.40 USD。

Moderna announced that Q4 revenue in 2020 was better than expected, but net loss reached 272 millionUSD, A loss of 69 cents per share, exceeding analyst expectations. Moderna expects new crown vaccine sales to reach 18.4 billion this yearUSD。

Daily key economic data:

- The United States reported 730,000 initial jobless claims last week (2/20), with an expected 825,000. The previous value was lowered from 861,000 to 841,000

- The United States last week (2/13) continued to report 4.419 million unemployment claims, which is expected to be 4.46 million. The previous value was raised from 4.494 million to 4.52 million

- The initial monthly growth rate of durable goods orders in the United States in January reported 3.4%, expected 1.3%, and 0.5% before

- The US Q4 core PCE quarterly growth rate revised value reported 1.4%, the previous value was revised up from 1.4% to 3.4%

- The revised value of the quarterly growth rate of real GDP in the United States in Q4 is 4.1%, which is expected to be 4.1% and the previous value is 4.0%

Wall Street analysis:

Sophie Chardon, cross-asset strategist at Lombard Odier, said that rising bond yields trigger stock rotations, and the market prefers value stocks to growth stocks. Rising yields are good for banks, and rising oil prices are good for energy stocks.

In the late trading of US stocks on Wednesday, stocks such as GameStop and AMC, which are popular with Reddit users, soared again. The high volatility recalled last month’s short squeeze frenzy.

Chardon believes that this move shows that speculative bets still exist and must be prepared to face this targeted bubble, but she believes it will not pose a threat to global stock markets.

–